Nokia 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

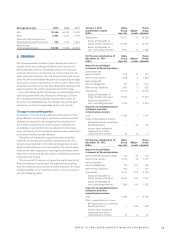

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

hedges of the foreign exchange rate risk of future forecast

foreign currency denominated sales and purchases that meet

the following requirements: the cash fl ow being hedged must

be “highly probable” and must present an exposure to vari-

ations in cash fl ows that could ultimately aff ect profi t or loss,

and the hedge must be highly eff ective both prospectively and

retrospectively.

For qualifying foreign exchange forwards, the change in

fair value that refl ects the change in spot exchange rates is

deferred in fair value and other reserves to the extent that the

hedge is eff ective. For qualifying foreign exchange options, or

option strategies, the change in intrinsic value is deferred in

fair value and other reserves to the extent that the hedge is

eff ective. In all cases, the ineff ective portion is recognized im-

mediately in profi t and loss. Hedging costs, expressed either

as the change in fair value that refl ects the change in forward

exchange rates less the change in spot exchange rates for for-

ward foreign exchange contracts, or change in the time value

for options, or options strategies, are recognized in other

operating income or expenses.

Accumulated changes in fair value from qualifying hedges

are released from fair value and other reserves to profi t

and loss as adjustments to sales and cost of sales when the

hedged cash fl ow aff ects profi t and loss. Forecast foreign

currency sales and purchases aff ect profi t and loss at various

dates up to approximately year from the balance sheet date.

If the hedged cash fl ow is no longer expected to occur, all

deferred gains or losses are released immediately to profi t and

loss. If the hedged cash fl ow ceases to be highly probable, but

is still expected to occur, accumulated gains and losses remain

in equity until the hedged cash fl ow aff ects profi t and loss.

CASH FLOW HEDGES: HEDGING OF FOREIGN CURRENCY RISK

OF HIGHLY PROBABLE BUSINESS ACQUISITIONS AND OTHER

TRANSACTIONS

From time to time the Group hedges the cash fl ow variability

due to foreign currency risk inherent in highly probable busi-

ness acquisitions and other future transactions that result in

the recognition of non-fi nancial assets. When those non-fi nan-

cial assets are recognized in the consolidated statements of

fi nancial position, the gains and losses previously deferred are

transferred from fair value and other reserves and included in

the initial acquisition cost of the asset. The deferred amounts

are ultimately recognized in profi t and loss as a result of good-

will assessments in case of business acquisitions and through

depreciation in case of other assets. In order to apply for

hedge accounting, the forecast transactions must be highly

probable and the hedges must be highly eff ective prospec-

tively and retrospectively.

CASH FLOW HEDGES: HEDGING OF CASH FLOW VARIABILITY

ON VARIABLE RATE LIABILITIES

The Group applies cash fl ow hedge accounting for hedging cash

fl ow variability on certain variable rate liabilities. The eff ective

portion of the gain or loss relating to interest rate swaps hedg-

ing variable rate borrowings is deferred in fair value and other

reserves. The gain or loss related to the ineff ective portion is

recognized immediately in profi t and loss. For hedging instru-

ments closed before the maturity date of the related liability,

hedge accounting will immediately discontinue from that date

onwards, with all the cumulative gains and losses on the hedg-

ing instruments recycled gradually to profi t and loss when the

hedged variable interest cash fl ows aff ect profi t and loss.

FAIR VALUE HEDGES

The Group applies fair value hedge accounting with the objec-

tive to reduce the exposure to fl uctuations in the fair value of

interest-bearing liabilities due to changes in interest rates and

foreign exchange rates. Changes in the fair value of derivatives

designated and qualifying as fair value hedges, together with

any changes in the fair value of the hedged liabilities attrib-

utable to the hedged risk, are recorded in profi t and loss in

fi nancial income and expenses.

If a hedge no longer meets the criteria for hedge accounting,

hedge accounting ceases and any fair value adjustments made

to the carrying amount of the hedged item while the hedge was

eff ective are amortized to profi t and loss in fi nancial income

and expenses based on the eff ective interest method.

HEDGES OF NET INVESTMENTS IN FOREIGN OPERATIONS

The Group also applies hedge accounting for its foreign cur-

rency hedging on net investments. Qualifying hedges are

those properly documented hedges of the foreign exchange

rate risk of foreign currency denominated net investments

that are eff ective both prospectively and retrospectively.

For qualifying foreign exchange forwards, the change in

fair value that refl ects the change in spot exchange rates

is deferred in translation diff erences within consolidated

shareholder’s equity. The change in fair value that refl ects

the change in forward exchange rates less the change in spot

exchange rates is recognized in fi nancial income and expenses.

For qualifying foreign exchange options, the change in intrinsic

value is deferred in translation diff erences within consolidated

shareholder’s equity. Changes in the time value are at all times

recognized directly in profi t and loss as fi nancial income and

expenses. If a foreign currency denominated loan is used as a

hedge, all foreign exchange gains and losses arising from the

transaction are recognized in translation diff erences within

consolidated shareholder’s equity. In all cases, the ineff ective

portion is recognized immediately in profi t and loss.

Accumulated changes in fair value from qualifying hedges

are released from translation diff erences on the disposal of

all or part of a foreign Group company by sale, liquidation,

repayment of share capital or abandonment. The cumulative

amount or proportionate share of the changes in the fair value

from qualifying hedges deferred in translation diff erences is

recognized as income or as expense when the gain or loss on

disposal is recognized.