Nokia 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

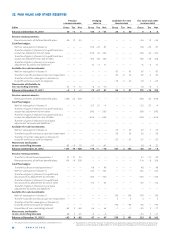

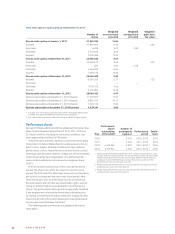

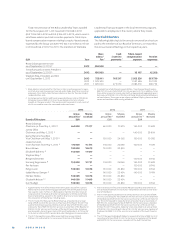

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

tiff s’ motion for leave to amend their complaint a second time

and entered judgment in favor of Nokia. On October , ,

the plaintiff s fi led an appeal of the District Court’s order grant-

ing judgment in favor of Nokia. On June , , the Second

Circuit upheld the earlier decision of the US District Court for

the Southern District of New York from September , to

dismiss all claims made in the ERISA claim fi led against defend-

ants including Nokia Inc. and the Nokia Inc. Retirement Plan by

Javad Majad and Ryan Sharif. The Plaintiff had until September

, to appeal the Second Circuit decision by fi ling a cert

petition to the US Supreme Court. The Plaintiff did not appeal

and the case is closed.

On September , , a class action based on the US

Employee Retirement Income Security Act (“ERISA”) entitled

Romero v. Nokia was fi led in the United States District Court

for the Southern District of New York. The complaint named

Nokia Corporation, certain Nokia Corporation Board members,

Fidelity Management Trust Co., The Nokia Retirement Savings

& Investment Plan Committee and Linda Fonteneaux as well

as certain individuals from the Nokia Retirement Savings &

Investment Plan Committee whose identity is not known to the

plaintiff s as defendants. The complaint claimed to represent

all persons who were participants in or benefi ciaries of the

Nokia Retirement Savings and Investment Plan (the “Plan”)

who participated in the Plan between January , and the

present and whose accounts invested in the Nokia Stock Fund

(“the Fund”). The complaint alleged that the named individu-

als breached their fi duciary duties by, among other things,

permitting the plan to off er the Fund as an investment option,

permitting the plan to invest in the Fund and permitting the

Fund to invest in and remain invested in American Depository

Receipts of Nokia Corporation when the defendants allegedly

knew the Fund and Nokia’s shares were extremely risky invest-

ments. Plaintiff was provided plan documents and informed

that it had incorrectly identifi ed the proper defendants in its

complaint. On December , Plaintiff fi led a motion to

dismiss the complaint against all defendants, without preju-

dice and indicated it would refi le in California where the Nokia

Retirement Savings and Investment Plan is currently adminis-

tered.

Romero fi led a new complaint on December , in

the United States District Court for the Northern District

of California, naming as defendants Nokia Inc., the Nokia

Retirement Savings and Investment Plan Committee, and sev-

eral individuals alleged to be plan fi duciaries, claiming to rep-

resent all persons who were participants in or benefi ciaries of

the Nokia Retirement Savings and Investment Plan (the “Plan”)

who participated in the Plan between January , and

the present and whose accounts invested in the Nokia Stock

Fund (“the Fund”). The complaint alleges that named individu-

als breached their fi duciary duties by, among other things,

permitting the plan to off er the Fund as an investment option,

permitting the plan to invest in the Fund and permitting the

Fund to invest in and remain invested in American Depository

Receipts of Nokia Corporation when the defendants allegedly

knew the Fund and Nokia’s shares were extremely risky invest-

ments. On May , , Nokia and the Named Defendants fi led

a motion to dismiss all claims against the defendants and are

awaiting the Court’s decision. On October , the court

granted Nokia and the Named Defendants motion to dismiss

all claims with prejudice. Plaintiff did not appeal and this mat-

ter is closed.

Antitrust Litigation

LCD AND CRT CARTEL CLAIMS

In November , Nokia Corporation fi led two lawsuits, one

in the United Kingdom’s High Court of Justice and the other in

the United States District Court for the Northern District of

California, joined by Nokia Inc., against certain manufactur-

ers of liquid crystal displays (“LCDs”). Both suits concerned

the same underlying allegations: namely, that the defendants

violated the relevant antitrust or competition laws by entering

into a worldwide conspiracy to raise and/or stabilize the prices

of LCDs, among other anticompetitive conduct, from approxi-

mately January to December (the “Cartel Period”).

Defendants Sharp Corporation, LG Display Co. Ltd., Chunghwa

Picture Tubes, Ltd., Hitachi Displays Ltd. and Epson Imaging

Devices Corporation, as well as non-defendant Chi Mei Opto-

electronics, and Hannstar Display Corporation, have pleaded

guilty in the United States to participating in a conspiracy to

fi x certain LCD prices and have agreed to pay fi nes totaling

approximately USD million. Further, the United States De-

partment of Justice has indicted AU Optronics Corporation and

its American subsidiary, AU Optronics Corporation America,

for participation in the conspiracy to fi x the prices of TFT-LCD

panels sold worldwide from September , to December

, .

Also in November , Nokia Corporation fi led a lawsuit

in the United Kingdom’s High Court of Justice against certain

manufacturers of cathode rays tubes (“CRTs”). In this law-

suit, Nokia alleges that the defendants violated the relevant

antitrust or competition laws by entering into a worldwide

conspiracy to raise and/or stabilize the prices of CRTs, among

other anticompetitive conduct, from no later than March

to around November .

All of the defendants have now settled Nokia’s claims

against them on confi dential terms.

We are also party to other routine litigation, as well as

indemnity claims involving customers or suppliers, which are

incidental to the normal conduct of our business. Based upon

the information currently available, our management does not

believe that liabilities related to those proceedings are likely to

be material to our fi nancial condition or results of operations.