Nokia 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

included in assumptions about the number of shares that the

employee will ultimately receive. On a regular basis, the Group

reviews the assumptions made and where necessary, revises

its estimates of the number of performance shares that are

expected to be settled. Share-based compensation is recog-

nized as an expense in the income statement over the relevant

service periods.

The Group has also issued certain stock options which are

accounted for as cash-settled. Related employee services re-

ceived, and the liability incurred, are measured at the fair value

of the liability. The fair value of stock options is estimated

based on the reporting date market value less the exercise

price of the stock options. The fair value of the liability is re-

measured at each reporting date and at the date of settlement

and related change in fair value is recognized in the consolidat-

ed income statements over the relevant service periods.

Treasury shares

The Group recognizes acquired treasury shares as a reduction

of equity at their acquisition cost. When cancelled, the acquisi-

tion cost of treasury shares is recognized in retained earnings.

Dividends

Dividends proposed by the Board of Directors are recorded

in the consolidated fi nancial statements when they have been

approved by the shareholders at the Annual General Meeting.

Earnings per share

Basic earnings per share is calculated by dividing the profi t

attributable to equity holders of the parent by the weighted

average number of shares outstanding during the year exclud-

ing shares purchased by the Group and held as treasury shares.

Diluted earnings per share is calculated by adjusting the net

profi t attributable to equity holders of the parent to eliminate

the interest expense of the convertible bonds and by adjusting

the weighted average number of the shares outstanding with

the dilutive eff ect of stock options, performance shares and

restricted shares outstanding during the year as well as the

assumed conversion of the convertible bonds.

Use of estimates and critical accounting

judgments

The preparation of fi nancial statements in conformity with

IFRS requires the application of judgment by management in

selecting appropriate assumptions for calculating fi nancial

estimates, which inherently contain some degree of uncer-

tainty. Management bases its estimates on historical experi-

ence, expected outcomes and various other assumptions

that are believed to be reasonable under the circumstances.

The related results form a basis for making judgments about

the reported carrying values of assets and liabilities and the

reported amounts of revenues and expenses that may not

be readily apparent from other sources. The Group will revise

material estimates if changes occur in the circumstances on

which an estimate was based or as a result of new informa-

tion or more experience. Actual results may diff er from these

estimates under diff erent assumptions or conditions.

Set forth below are areas requiring signifi cant judgment and

estimation that may have an impact on reported results and

the fi nancial position.

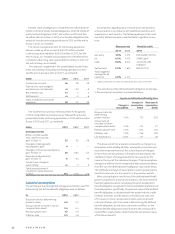

REVENUE RECOGNITION

The majority of the Group’s sales are recognized as revenue

when the signifi cant risks and rewards of ownership have trans-

ferred to the buyer, continuing managerial involvement usually

associated with ownership and eff ective control have ceased,

the amount of revenue can be measured reliably, it is probable

that economic benefi ts associated with the transaction will

fl ow to the Group and the costs incurred or to be incurred in re-

spect of the transaction can be measured reliably. Sales could

materially change if management’s assessment of such criteria

changes. The Group enters into transactions involving multiple

components consisting of any combination of hardware,

services and software. The consideration received from these

transactions is allocated to each separately identifi able compo-

nent. The NSN allocation method is based on relative fair value,

while the allocation of revenue for multiple component ar-

rangements within the Devices & Services business reported as

discontinued operations is based on the residual value method.

The consideration allocated to each component is recognized

as revenue when the revenue recognition criteria for that com-

ponent have been met. Determination of the fair value for each

component requires the use of estimates and judgment taking

into consideration factors which may have a signifi cant impact

on the timing and amount of revenue recognition. Examples

of such factors include price when the component is sold

separately by the Group or the price when a similar component

is sold separately by the Group or a third party.

Revenue from contracts involving solutions achieved

through modifi cation of complex telecommunications equip-

ment is recognized on the percentage of completion basis

when the outcome of the contract can be estimated reliably.

Recognized revenues and profi ts are subject to revisions

during the project in the event that the assumptions regard-

ing the overall project outcome are revised. Current sales and

profi t estimates for projects may materially change due to the

early stage of a long-term project, new technology, changes in

the project scope, changes in costs, changes in timing, chang-

es in customers’ plans, realization of penalties, and other

corresponding factors, which may have a signifi cant impact on

the timing and amount of revenue recognition.

CUSTOMER FINANCING

The Group has provided a limited number of customer fi nanc-

ing arrangements and agreed extended payment terms with

selected customers. Should the actual fi nancial position of

the customers or general economic conditions diff er from

assumptions, the ultimate collectability of such fi nancings and

trade credits may be required to be re-assessed, which could

result in a write-down of these balances and thus negatively