Nokia 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

54

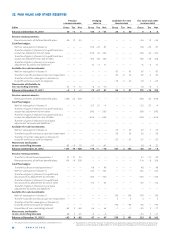

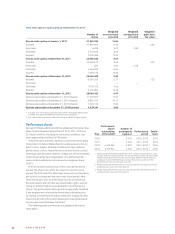

17. FAIR VALUE OF FINANCIAL INSTRUMENTS

Carrying amounts

Financial

instruments

Current Non-current at fair Loans and Financial

available- available- value receivables liabilities

for-sale for-sale through measuredat measuredat Total

fi nancial fi nancial profi t amortized amortized carrying Fair

Continuing operations assets assets or loss cost cost amounts value 1

At December31, 2013, EURm

Available-for-sale investments,

publicly quoted equity shares — 11 — — — 11 11

Available-for-sale investments, carried at fair value — 503 — — — 503 503

Available-for-sale investments,

carried at cost less impairment — 227 — — — 227 227

Long-term loans receivable — — — 96 — 96 85

Accounts receivable — — — 2901 — 2 901 2 901

Current portion of long-term loans receivable — — — 29 — 29 29

Other current fi nancial assets, derivatives — — 191 — — 191 191

Other current fi nancial assets, other — — — 94 — 94 94

Investments at fair value through profi t and loss,

liquid assets — — 382 — — 382 382

Available-for-sale investments,

liquid assets carried at fair value 956 — — — — 956 956

Available-for-sale investments,

cash equivalents carried at fair value 3957 — — — — 3 957 3 957

Total fi nancial assets 4 913 741 573 3120 — 9347 9336

Long-term interest-bearing liabilities 2 — — — — 3 286 3 286 4 521

Current portion of long-term loans payable 2 — — — — 3 192 3 192 3 385

Short-term borrowing — — — — 184 184 184

Other fi nancial liabilities — — 35 — — 35 35

Accounts payable — — — — 1 842 1 842 1 842

Total fi nancial liabilities — — 35 — 8504 8539 9967

At December31, 2012, EURm

Available-for-sale investments,

publicly quoted equity shares — 11 — — — 11 11

Available-for-sale investments, carried at fair value — 447 — — — 447 447

Available-for-sale investments,

carried at cost less impairment — 231 — — — 231 231

Long-term loans receivable — — — 125 — 125 113

Accounts receivable — — — 5 551 — 5 551 5 551

Current portion of long-term loans receivable — — — 35 — 35 35

Other current fi nancial assets, derivatives — — 448 — — 448 448

Other current fi nancial assets, other — — — 3 — 3 3

Investments at fair value through profi t and loss,

liquid assets — — 415 — — 415 415

Available-for-sale investments,

liquid assets carried at fair value 542 — — — — 542 542

Available for-sale investments,

cash equivalents carried at fair value 5 448 — — — — 5 448 5 448

Total fi nancial assets 5990 689 863 5714 — 13 256 13 244

Long-term interest-bearing liabilities 2 — — — — 5 087 5 087 5 298

Current portion of long-term loans payable 2 — — — — 201 201 201

Short-term borrowing — — — — 261 261 261

Other fi nancial liabilities — — 90 — — 90 90

Accounts payable — — — — 4 394 4 394 4 394

Total fi nancial liabilities — — 90 — 9943 10033 10244