Nokia 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

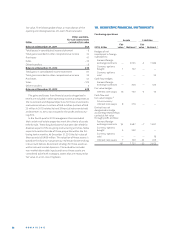

28. PROVISIONS

Project Material IPR

EURm Restructuring losses Warranty liability infringements Other Total

At January1, 2012 483 205 688 125 431 396 2328

Exchange diff erences — — — – —

Additional provisions

Changes in estimates – – – – – – –

Charged to profi t and loss account – –

Utilized during year – – – – – – –

At December31, 2012 747 149 407 242 388 359 2292

Transfer to liabilities of disposal

groups held for sale – — – – – – –

Exchange diff erences – — – — — – –

Additional provisions —

Changes in estimates – – – – – – –

Charged to profi t and loss account — –

Utilized during year – – – – – – –

At December31, 2013 443 152 94 19 15 199 922

Provision balances before movements during the year.

EURm 2013 2012

Analysis of total provisions at December 31:

Non-current 242 304

Current 680 1988

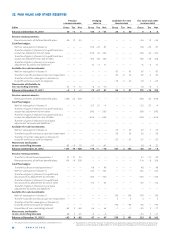

The restructuring provision in is mainly related to re-

structuring activities in NSN. In , the remaining balance of

NSN’s restructuring provision is EUR million (EUR million

in ). The majority of outfl ows related to the restructuring

is expected to occur over the next two years.

Restructuring and other associated expenses incurred in

NSN in , including mainly personnel related expenses as

well as expenses arising from the country and contract exits

based on NSN’s strategy that focuses on key markets and

product segments and costs incurred in connection with the

divestments of businesses, totaled EUR million (EUR

million in ).

In , the remaining balance of HERE’s restructuring provi-

sion is EUR million. In addition to the plans announced in

and , HERE announced during further plans to reduce

its workforce in the map data collection and processing areas

of its business.

Provisions for losses on projects in progress are related to

NSN’s onerous contracts. Utilization of provisions for project

losses is generally expected to occur in the next months.

Outfl ows for the warranty provision are generally expected

to occur within the next months.

Material liability provision relates to non-cancellable pur-

chase commitments with suppliers. The outfl ows are expected

to occur over the next months.

The IPR provision is based on estimated potential future

settlements for asserted past IPR infringements. Final resolu-

tion of IPR claims generally occurs over several periods.

Other provisions include provisions for various contractual

obligations and litigations. Outfl ows for other provisions

are generally expected to occur over the next two years.

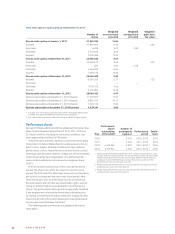

Provisions for project losses and other provisions include

amounts recorded for claims and related to the exit from

various customer contracts in line with the NSN’s strategic

focus or due to challenging political or business environments.

Such provisions are estimated based on the information cur-

rently available and are subject to change as negotiations with

customers, trade sanctions environment, or other related

circumstances evolve.

Uncertain income tax positions regarding current tax are

included in Current income tax liabilities in the consolidated

statement of fi nancial position in and have also been

reclassifi ed for comparability purposes in .

Provisions included in Liabilities of disposal groups classifi ed

as held for sale at December , were EUR million.

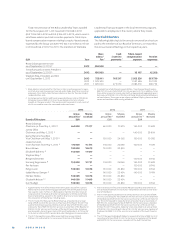

Legal Matters

A number of Nokia companies are, and will likely continue to

be, subject to various legal proceedings and investigations

that arise from time to time, including proceedings regarding

intellectual property, product liability, sales and marketing

practices, commercial disputes, employment, and wrongful

discharge, antitrust, securities, health and safety, environ-

mental, tax, international trade and privacy matters. As a

result, the Group may become subject to substantial liabilities

that may not be covered by insurance and could aff ect our

business and reputation. While Nokia does not believe that any

of these legal proceedings will a have a material adverse eff ect

on its fi nancial position, litigation is inherently unpredictable

and large judgments sometimes occur. As a consequence,

Nokia may in the future incur judgments or enter into settle-

ments of claims that could have a material adverse eff ect on its

results of operations and cash fl ow.