Nokia 2013 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

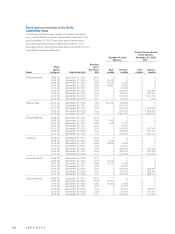

COMPENSATION OF THE BOARD OF DIRECTORS AND THE NOKIA GROUP LEADERSHIP TEAM

Performance criterion for the Nokia Group employees (excluding HERE employees):

Threshold Maximum

Performance criterion Weighting performance performance Potential range of settlement*

Nokia average annual non-IFRS net sales

during Jan. 1, 2014 – Dec. 31, 2015 50% EUR 11.135 billion EUR 15.065 billion Threshold number up to maximum

level (4 x threshold number)

Nokia average annual non-IFRS EPS

during Jan. 1, 2014 – Dec. 31, 2015 50% EUR 0.11 EUR 0.38 Threshold number up to maximum

level (4 x threshold number)

Performance criterion for the HERE employees:

Threshold Maximum

Performance criterion Weighting performance performance Potential range of settlement*

Nokia average annual non-IFRS EPS

during Jan. 1, 2014 – Dec. 31, 2015 25% EUR 0.11 EUR 0.38 Threshold number up to maximum

level (4 x threshold number)

HERE non-IFRS average annual

operating profi t

during Jan. 1, 2014 – Dec. 31, 2015 25% EUR 0 million EUR 130 million Threshold number up to maximum

level (4 x threshold number)

HERE average annual non-IFRS

net sales

during Jan. 1, 2014 – Dec. 31, 2015 50% EUR 950 million EUR 1.150 billion Threshold number up to maximum

level (4 x threshold number)

* The minimum payout of % of the grant amount will be payable only

in the event that the calculated payout (based on Nokia’s performance

against the performance criteria) is beneath % achievement against the

performance criteria.

We believe the performance criteria set above are challeng-

ing, yet realistic and within reach. The awards at the threshold

are signifi cantly reduced from grant level and achievement of

maximum award would serve as an indication that Nokia’s per-

formance signifi cantly exceeded current market expectations

of our long-term execution.

Achievement of the maximum performance for all criteria

would result in the vesting of a maximum of . million Nokia

shares. Performance exceeding the maximum criteria does

not increase the number of performance shares that will vest.

Achievement of the threshold performance for all criteria will

result in the vesting of approximately . million shares and will

be the minimum payout under the plan. Minimum payout un-

der the plan, even if threshold performance is not achieved, is

. million shares due to the % minimum payout. The vesting

will occur after . Until Nokia shares are delivered, the par-

ticipants will not have any shareholder rights, such as voting or

dividend rights associated with these performance shares.

RESTRICTED SHARES

Restricted shares under the Nokia Restricted Share Plan

approved by the Board of Directors are used as described

above on a selective basis to ensure extraordinary retention

and recruitment of individuals with functional mastery and

other employees deemed critical to Nokia’s future success

and will only be used in limited and exceptional circumstances.

This is a change to the earlier practice when restricted shares

were included as part of the annual compensation reviews. The

restricted shares under the Nokia Restricted Share Plan

have a three-year restriction period. The restricted shares will

vest and the resulting Nokia shares will be delivered in ,

and early , dependent on the fulfi llment of the criteria of

continued employment during the restriction period. Until the

shares are delivered, the participants will not have any share-

holder rights, such as voting or dividend rights associated with

these restricted shares.

EMPLOYEE SHARE PURCHASE PLAN

Under the Employee Share Purchase Plan, eligible Nokia

employees can elect to make monthly contributions from

their salary to purchase Nokia shares. The contribution per

employee cannot exceed EUR per year. The share pur-

chases will be made at market value on pre-determined dates

on a monthly basis during a -month savings period. Nokia

will off er one matching share for every two purchased shares

the employee still holds after the last monthly purchase has

been made following the end of the -month savings period.

Participation in the plan is voluntary to the employees.

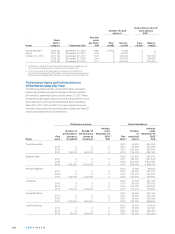

MAXIMUM PLANNED GRANTS UNDER THE NOKIA EQUITY-

BASED INCENTIVE PROGRAM 2014 IN YEAR 2014

The approximate maximum numbers of planned grants under

the Nokia Equity Program (i.e., performance shares,

restricted shares as well as matching share awards under the

Employee Share Purchase Plan) in are set forth in the

table below.