Nokia 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

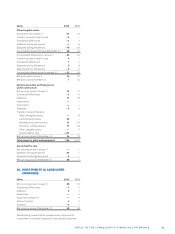

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Assets Liabilities

Fair Fair

2012, EURm value 1 Notional 2 value 1 Notional 2

Hedges of net

investment in foreign

subsidiaries:

Forward foreign

exchange contracts 24 2 164 – 11 1 182

Cash fl ow hedges:

Forward foreign

exchange contracts 7 2 968 – 6 3 158

Fair value hedges

Interest rate swaps 174 1 626 — —

Cash fl ow and

fair value hedges: 3

Cross currency

interest rate swaps 42 378 — —

Derivatives not

designated in hedge

accounting relationships

carried at fair value

through profi t and loss:

Forward foreign

exchange contracts 185 7 111 – 18 3 337

Currency options

bought 16 1 107 — —

Currency options

sold — — – 6 289

Interest rate swaps — 150 – 48 513

Other derivatives — — – 1 9

448 15504 – 90 8488

In the consolidated statement of financial position the fair value of

derivative financial instruments is included in Other financial assets and

in Other financial liabilities.

Includes the gross amount of all notional values for contracts that have

not yet been settled or cancelled. The amount of notional value out-

standing is not necessarily a measure or indication of market risk, as the

exposure of certain contracts may be offset by that of other contracts.

These cross-currency interest rate swaps have been designated partly as

fair value hedges and partly as cash flow hedges.

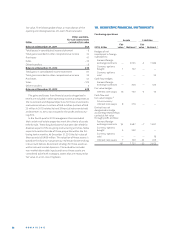

Balanceat Transfer to Chargedto Balance

EURm beginning discontinued costs and at end

Allowances on assets to which they apply: of year operations expenses Deductions 1 of year

2013

Allowance for doubtful accounts 248 – 120 40 – 44 124

Excess and obsolete inventory 471 – 192 39 – 140 178

2012

Allowance for doubtful accounts 284 — 53 – 89 248

Excess and obsolete inventory 457 — 403 – 389 471

2011

Allowance for doubtful accounts 363 — 131 – 210 284

Excess and obsolete inventory 301 — 345 – 189 457

Deductions include utilization and releases of the allowances.

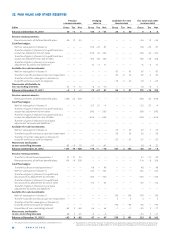

19. INVENTORIES

EURm 2013 2012

Raw materials, supplies and other 147 409

Work in progress 136 352

Finished goods 521 777

Total 804 1538

The total amount of inventories included within Assets of

disposal groups classifi ed as held for sale at December ,

, net of write-downs to the net realizable value, is EUR

million.

During the Group recognized an expense of EUR

million (EUR million in ) to write-down the inventories to

net realizable value. The write-down relates to discontinued

operations inventories.

20. PREPAID EXPENSES AND ACCRUED

INCOME

EURm 2013 2012

Social security, VAT and other indirect taxes 286 875

Deposits 43 71

Interest income 33 45

Deferred cost of sales 14 145

Rents 15 34

Other prepaid expenses and accrued income 269 1512

Total 660 2 682

Prepaid expenses and accrued income also include various

other prepaid expenses and accrued income, but no amounts

which are individually signifi cant.

Total amount of prepaid expenses and accrued income

included within Assets of disposal groups classifi ed as held for

sale at December , , is EUR million, of which EUR

million relates to the Qualcomm advance payment.

Prepaid expenses and accrued income regarding current tax

are included in Current income tax assets in the consolidated

statement of fi nancial position in , and have also been

reclassifi ed for comparability purposes in .

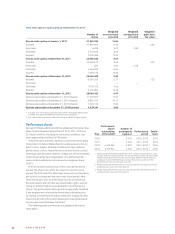

21. VALUATION AND QUALIFYING ACCOUNTS