Nokia 2013 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

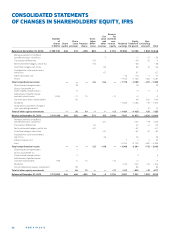

NOKIA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME, IFRS

2013

FinancialyearendedDecember31 Notes EURm EURm EURm

Loss – 739 – 3786 – 1487

Other comprehensive income (+)/expence (–)

Items that will not be reclassifi ed to profi t or loss

Remeasurements on defi ned benefi t pensions 6 83 – 228 – 36

Items that may be reclassifi ed subsequently to profi t or loss

Translation diff erences 23 – 496 41 9

Net investment hedges 23 114 – 58 – 37

Cash fl ow hedges 22 3 – 41 116

Available-for-sale investments 22 49 35 70

Other increase (+)/decrease (–), net 5 10 – 17

Income tax related to components of other

comprehensive expense (–)/income (+) 22,23 – 2 34 – 4

Other comprehensive expense (–)/income (+), net of tax – 244 – 207 101

Total comprehensive expense – 983 – 3993 – 1386

Total comprehensive expense

attributable to

equity holders of the parent – 863 – 3281 – 1089

non-controlling interests – 120 – 712 – 297

– 983 – 3993 – 1386

Total comprehensive income(+)/expense (–) attributable

to equity holders of the parent arises from:

Continuing operations 34 – 831 – 1 200

Discontinued operations – 897 – 2 450 111

– 863 – 3 281 – 1 089

* Full years and reflect the retrospective application of Revised IAS , Employee Benefits.

See Notes to Consolidated Financial Statements.

2012 * 2011 *