Nokia 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

64

reporting date. The total carrying amount for liabilities arising

from share-based payment transactions is EUR million at

December , (EUR million in ) and is included in

accrued expenses and other liabilities in the consolidated

statement of fi nancial position.

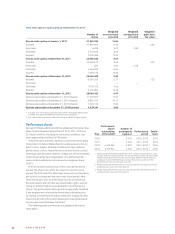

In , Nokia introduced a voluntary Employee Share

Purchase Plan, which was off ered in to Nokia employees

working for Devices & Services business, HERE, Advanced

Technologies and Corporate Common Functions. Under the

plan employees make monthly contributions from their sal-

ary to purchase Nokia shares on a monthly basis during a

-month savings period. Nokia off ers one matching share

for every two purchased shares the employee still holds

after the last monthly purchase has been made in June .

Employees who have transferred to Microsoft following the

Sale of Devices & Services business will receive a cash settle-

ment under the plan.

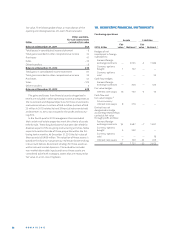

26. DEFERRED TAXES

EURm 2013 2012

Deferred tax assets:

Intercompany profi t in inventory 48 58

Tax losses carried forward

and unused tax credits 446 564

Warranty provision 6 47

Other provisions 120 261

Depreciation diff erences 660 893

Other temporary diff erences 102 145

Reclassifi cation due to netting

of deferred taxes – 492 – 689

Total deferred tax assets 890 1279

Deferred tax liabilities:

Depreciation diff erences

and untaxed reserves – 609 – 893

Undistributed earnings – 68 – 313

Other temporary diff erences – 10 – 184

Reclassifi cation due to netting

of deferred taxes 492 689

Total deferred tax liabilities – 195 – 701

Net deferred tax asset 695 578

Tax charged to equity 6 3

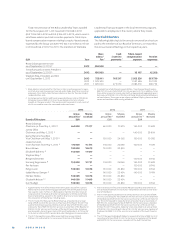

At December , the Group had tax losses carry forward

of EUR million (EUR million in ) of which EUR

million will expire within years (EUR million in ).

At December , the Group had tax losses carry

forward, temporary diff erences and tax credits of EUR

million (EUR million in ) for which no deferred tax

asset was recognized due to uncertainty of utilization of these

items. EUR million of those will expire within years

(EUR million in ).

The recognition of the remaining deferred tax assets is sup-

ported by off setting deferred tax liabilities, earnings history

and profi t projections in the relevant jurisdictions.

At December , the Group had undistributed earn-

ings of EUR million (EUR million in ) on which no

deferred tax liability has been formed as these will not reverse

in the foreseeable future.

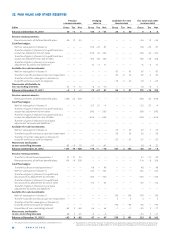

27. ACCRUED EXPENSES AND

OTHER LIABILITIES

EURm 2013 2012

Advance payments and deferred revenue 1163 1747

Wages and salaries 710 1031

Social security, VAT and other indirect taxes 312 555

NSN customer project related 234 378

Other 614 2512

Total 3033 6223

Other accruals include accrued discounts, royalties, research

and development expenses, marketing expenses and interest

expenses as well as various amounts which are individually

insignifi cant.

Accrued expenses and other liabilities of disposal groups

classifi ed as held for sale at December , were EUR

million.

Accrued current tax liabilities are presented separately in

the consolidated statement of fi nancial position in and

have also been reclassifi ed for comparability purposes in .