Nokia 2013 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

126

Nokia Group Leadership Team member may be entitled to

compensation during the non-competition period or a part

of it. Such compensation amounts to the annual base salary

and annual management incentive at target for the respective

period during which no severance payment is paid.

The Nokia Group Leadership Team members have change of

control agreements with Nokia, which serve as an addendum

to their executive agreements. These change of control agree-

ments are based on a double trigger structure, which means

that both the change of control event and the termination of

the individual’s employment must take place for any change of

control based severance payment to materialize. More specifi -

cally, if a change of control event, as defi ned in the agreement,

has occurred in the company, and the individual’s employment

with the company is terminated either by Nokia or its succes-

sor without cause, or by the individual for “good reason” (for

example, material reduction of duties and responsibilities),

in either case within months from such change of control

event, the individual will be entitled to his or her notice period

compensation (including base salary, benefi ts, and target

incentive) and cash payment (or payments) for the pro-rated

value of the individual’s outstanding unvested equity, includ-

ing restricted shares, performance shares, stock options and

equity awards under NSN Equity Incentive Plan, payable pursu-

ant to the terms of the agreement. The Board of Directors

has the full discretion to terminate or amend the change of

control agreements at any time.

PENSION ARRANGEMENTS FOR THE MEMBERS OF THE NOKIA

GROUP LEADERSHIP TEAM

The members of the Nokia Group Leadership Team participate

in the local retirement programs applicable to employees in

the country where they reside. This applies also to Mr. Elop, the

former President and CEO, and Mr. Suri, the President and CEO

as from May , , who are not entitled to any extraordinary

pension arrangements. Executives in Finland, including Mr.

Elop and Mr. Suri participate in the Finnish TyEL pension sys-

tem, which provides for a retirement benefi t based on years of

service and earnings according to prescribed statutory rules.

Under the Finnish TyEL pension system, base pay, incentives

and other taxable fringe benefi ts are included in the defi ni-

tion of earnings, although gains realized from equity are not.

Retirement benefi ts are available from age to , according

to an increasing scale. The Nokia Group Leadership Team mem-

bers in the United States participate in Nokia’s US Retirement

Savings and Investment Plan. Under this (k) plan, partici-

pants elect to make voluntary pre-tax contributions that are

% matched by Nokia up to % of eligible earnings. % of

the employer’s match vests for the participants during each

year of the fi rst four years of their employment. The Nokia

Group Leadership Team members in Germany participate in

the Nokia German Pension Plan that is % company funded.

Contributions are based on pensionable earnings, the pension

table and retirement age. For the Nokia Group Leadership

Team members in UK, the pension accrued in the UK Pension

Scheme is a Money Purchase benefi t. Contributions are paid

into the UK Pension Scheme by both the member and employ-

er. These contributions are held within the UK Pension Scheme

and are invested in funds selected by the member.

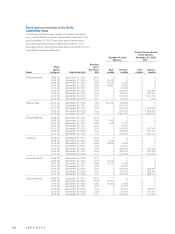

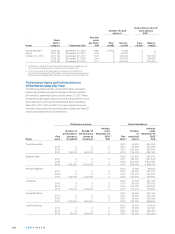

ACTUAL COMPENSATION FOR THE MEMBERS OF THE NOKIA

LEADERSHIP TEAM IN 2013

At December , , The Nokia Leadership Team consisted of

members. Changes in the composition of the Nokia Leader-

ship Team during and subsequently are explained above

in “Nokia Group Leadership Team”.

The following tables summarize the aggregate cash com-

pensation paid and the long-term equity-based incentives

granted to the members of the Nokia Leadership Team under

our equity plans in .

Gains realized upon exercise of stock options and share-

based incentive grants vested for the members of the Nokia

Leadership Team during are included in “Stock option

exercises and settlement of shares”.

Aggregate cash compensation to the Nokia Leadership

Team for ,

Number of Cash

members on Base incentive

December31, salaries payments

Year 2013 EUR EUR

2013 11 6 305 269 2855 579

Includes base salary and short-term cash incentives paid or payable by

Nokia for fiscal year . The short-term cash incentives include annual

short-term cash incentives that are paid as a percentage of annual base

salary and/or variable spot compensation paid for specific achievements

during the year.

Includes Marko Ahtisaari for the period until October ,

EUR for annual base salary as a Nokia Leadership Team member

and zero short-term cash incentive payment.

Long-term equity-based incentives granted in

Nokia Total

Leadership number of

Team 3, 4 Total participants

Performance shares

at threshold 2 1 537 500 6 696 241 3 580

Stock options 5 150 000 8 334 200 140

Restricted shares 1 970 000 12 347 931 3 600

The equity-based incentive grants are generally forfeited if the employ-

ment relationship terminates with Nokia prior to vesting. The settlement

is conditional upon performance and/or service conditions, as deter-

mined in the relevant plan rules. For a description of our equity plans,

see Note to our consolidated financial statements.

For performance shares granted under Nokia Performance Share Plans,

at maximum performance, the settlement amounts to four times the

number at threshold.

Includes Marko Ahtisaari for the period until October , .

For the Nokia Leadership Team member whose employment terminated

during , the long-term equity-based Incentives were forfeited follow-

ing termination of employment in accordance with plan rules.