Nokia 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

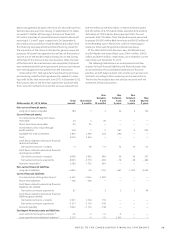

Stephen Elop did not receive remuneration for his services as a member

of the Board. This table does not include remuneration paid to Mr. Elop for

services as the President and CEO. Stephen Elop stepped down from the

board of directors as of September , .

The , and fees paid to Henning Kagermann amounted to

an annual total of EUR each year indicated, consisting of a fee of

EUR for services as a member of the Board and EUR for

services as Chairman of the Personnel Committee.

The and fees paid to Isabel Marey-Semper amounted to an

annual total of EUR each year indicated, consisting of a fee of

EUR for services as a member of the Board and EUR for

services as a member of the Audit Committee.

The and fees paid to Elizabeth Nelson amounted to an annual

total of EUR , consisting of a fee of EUR for services as

a member of the Board and EUR for services as a member of the

Audit Committee.

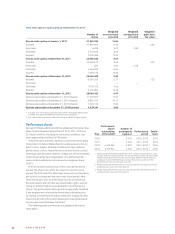

Termination benefi ts of the President and CEO

Mr. Elop’s employment contract was amended eff ective as of

September , , as a result of entering into a transaction

with Microsoft for the Sale of D&S Business. Under the terms

of the amendment, Mr. Elop resigned from his position as

President and CEO as of September , and assumed

the role of Executive Vice President, Devices & Services. He

also resigned from his position as a member of Board of

Directors as of the same date. After the closing of the Sale

of D&S Business, he transferred to Microsoft as agreed with

Microsoft. In accordance with his service contract he received

a severance payment of EUR . million in total. This amount

included: base salary and management incentive EUR .

million and value of equity awards EUR . million. The

amount of the equity awards was based on the Nokia closing

share price of EUR . per share at NASDAQ OMX Helsinki

on April , . Pursuant to the terms of the purchase

agreement with Microsoft entered into in connection with the

Sale of D&S Business, % of the total severance payment

was borne by Microsoft and the remaining % of the

severance amount (EUR . million) was borne by Nokia.

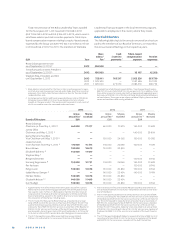

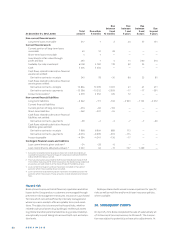

33. NOTES TO THE CONSOLIDATED

STATEMENTS OF CASH FLOW

EURm 2013 2012 2011

Adjustments for: 1

Depreciation and amortization 728 1326 1 562

Loss (+)/profi t (–) on sale

of property, plant and

equipment and

available-for-sale investments 40 – 131 – 49

Income taxes 401 1 145 291

Share of results of

associated companies (Note 16) – 4 1 23

Non-controlling interest – 124 – 681 – 323

Financial income and expenses 264 333 49

Transfer from hedging reserve

to sales and cost of sales – 87 – 16 – 4

Impairment charges (Note 9) 20 109 1 338

Asset retirements 24 31 13

Share-based compensation 56 13 18

Restructuring related charges 2 446 1 659 565

Other income and expenses 25 52 5

Adjustments, total 1789 3 841 3 488

Change in net working capital

Decrease in short-term

receivables 1 655 2 118 218

Decrease in inventories 193 707 289

(Decrease) in interest-free

short-term borrowings – 2793 – 2706 – 1148

Change in net working capital – 945 119 – 641

Combines adjustments relating to both continuing and discontinued

operations.

The adjustments for restructuring related charges represent the non-

cash portion of the restructuring related charges recognized in the

consolidated income statement.

The Group did not engage in any material non-cash investing

activities in , and .