Nokia 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.REVIEW BY THE BOARD OF DIRECTORS 13

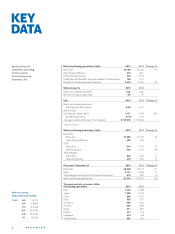

margin. The increase in Smart Devices gross margin was

primarily due to lower inventory related allowances, which

negatively aff ected Smart Devices gross margin in .

OPERATING EXPENSES

Discontinued operations operating expenses were approxi-

mately EUR million in , compared to approximately

EUR million in . The % decrease in was due to

lower Mobile Phones and Smart Devices operating expenses,

primarily due to structural cost savings, as well as overall cost

controls.

OPERATING PROFIT (LOSS)

Discontinued operations operating margin improved to

negative .% in compared to negative .% in . The

improvement was primarily due to structural cost savings, as

well as overall cost controls, and a higher gross margin.

MAIN EVENTS IN 2013

Nokia

■ Nokia completed the acquisition of Siemens’ stake in Nokia

Siemens Networks on August , , making it wholly

owned subsidiary of Nokia. The acquisition was initially

announced on July , . In accordance with this transac-

tion, the Siemens name was phased out from Nokia Siemens

Networks’ company name and branding. The new name and

brand was announced to be Nokia Solutions and Networks,

also referred to as NSN, which was also used for fi nancial

reporting purposes.

■ On September , , Nokia announced that it had signed

an agreement to enter into a transaction whereby Nokia

would sell substantially all of its Devices & Services business

and license its patents to Microsoft.

■ Nokia’s Extraordinary General Meeting held on November ,

confi rmed and approved the Sale of the D&S Business

to Microsoft in line with the proposal and recommendation

of the Nokia Board of Directors. The transaction was com-

pleted on April , .

■ Nokia also announced changes to its leadership as a result

of the announcement of the transaction with Microsoft in

September. To avoid the perception of any potential confl ict

of interest between the announcement and the consum-

mation of the transaction, Stephen Elop stepped aside as

President and CEO of Nokia Corporation, resigned from the

Board of Directors, and became Executive Vice President,

Devices & Services. Risto Siilasmaa assumed an interim CEO

role while continuing to serve in his role as Chairman of the

Nokia Board of Directors and Timo Ihamuotila assumed an

interim President role while also continuing to serve as CFO.

Mr. Ihamuotila also assumed the responsibility of chairing

the Nokia Leadership Team during this interim period. The

interim governance ended on May , after the an-

nouncement of the new strategy and management, includ-

ing the new President and CEO, Rajeev Suri.

■ As a result of the announcement of the Sale of D&S Business,

Nokia Board conducted a strategy evaluation for Nokia

Group, results of which were announced on April , .

Nokia plans to focus on three established businesses:

Networks, a leader in network infrastructure and ser-

vices; HERE, a leader in mapping and location services; and

Technologies, which will build on several of Nokia’s current

CTO and intellectual property rights activities.

Networks operating highlights

■ We won LTE contracts for China Mobile’s and China Telecom’s

nationwide TD-LTE networks; with Chunghwa Telecom in

Taiwan; Celcom in Malaysia; Sprint in the USA; US Cellular’s

second wave of LTE services; with TIM Brasil and Oi Brasil;

Movistar and Claro in Chile; MTS in the Moscow and Central

Russia regions; SFR in Paris; Tele in the Netherland;

Vodafone in New Zealand, and Ooredoo in Qatar.

■ We continued to stay at the forefront of mobile broadband,

further enhancing the Radio Base Station Smart Scheduler

and launching a powerful TD-LTE Base Station radio module;

and introducing new (FlexiZone) microcell and picocell base

stations.

■ Networks and China Mobile enabled the world’s fi rst live TV

broadcast via TD-LTE; NSN and the Singapore-based opera-

tor StarHub completed Southeast Asia’s fi rst GPP standard

Voice over LTE call in a live network. Networks and Panasonic

Mobile Communications were selected by NTT DOCOMO in

Japan to develop for LTE-Advanced next-generation mobile

broadband network architecture; Networks also helped

all three major Korean operators – SK Telecom, LG U+ and

Korea Telecom – to become the world’s fi rst to launch LTE-

Advanced services commercially.

■ Networks and SK Telecom of South Korea completed world’s

fi rst proof-of-concept of Liquid Applications over LTE, and

Networks successfully demonstrated its telco cloud capa-

bilities in a joint proof-of-concept for Evolved Packet Core

(EPC) virtualization with SK Telecom.

■ The Lebanese telecommunications operator, touch, chose

our operations support systems (OSS) portfolio and related

integration services; Zain Kuwait deployed our Customer

Experience Management (CEM) solution, and our CEM con-

tract with Beijing Mobile was extended.