Nokia 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REVIEW BY THE BOARD OF DIRECTORS 9

the restructuring-related cash outfl ows, NSN net working

capital-related infl ows of approximately EUR million is

primarily due to a decrease in receivables and inventories,

partially off set by a decrease in interest free short term

liabilities.

▪ HERE net working capital-related infl ows of approximately

EUR million;

▪ Advanced Technologies net working capital-related in-

fl ows of approximately EUR million.

■ Nokia’s continuing operations net fi nancial income and

expense-related cash infl ow of approximately EUR

million,

■ Nokia’s continuing operations cash tax net outfl ows of

approximately EUR million;

■ Nokia’s continuing operations net proceeds related to

unlisted funds of approximately EUR million;

■ Nokia’s continuing operations capital expenditure of

approximately EUR million;

■ Nokia’s continuing operations net outfl ows of approximately

EUR million related to business divestments;

■ Nokia’s continuing operations infl ow related to the proceeds

from the sale of fi xed assets of approximately EUR

million;

■ Nokia’s continuing operations proceeds related to the

equity component of the Microsoft convertible bond of

approximately EUR million;

■ Nokia’s continuing operations negative foreign exchange

impact from translation of opening net cash of

approximately EUR million; and

■ Discontinued operations cash outfl ow of approximately EUR

. billion.

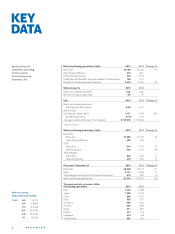

RESULTS BY SEGMENTS

Nokia Solutions and Networks

The following table sets forth selective line items for the fi scal

years and .

YoY

EURm 2013 2012 Change

Net sales 11 282 13 779 – 18%

Cost of sales – 7 148 – 9 610 – 26%

Gross profi t 4 134 4 169 – 1%

Research and development

expenses – 1 822 – 2 046 – 11%

Selling and marketing expenses – 821 – 1 158 – 29%

Administrative and general

expenses – 489 – 470 4%

Other operating income and

expenses – 582 – 1 290 – 55%

Operating profi t/loss 420 – 795

Segment information

Mobile Global NSN

Broadband Services Other NSN

2013

Net sales 5 347 5 753 182 11 282

Operating profi t (loss) 420 693 – 693 420

2012

Net sales 6 043 6 929 807 13 779

Operating profi t (loss) 490 334 – 1 619 – 795

NSN Other includes net sales and related cost of sales and operating

expenses of non-core businesses, as well as Optical Networks business until

May , when its divestment was completed. It also includes restructur-

ing and associated charges for the NSN business.

NET SALES

NSN’s net sales decreased % to EUR million in ,

compared to EUR million in . The year-on-year

decline in NSN’s net sales was primarily due to reduced wire-

less infrastructure deployment activity aff ecting both Mobile

Broadband and Global Services, as well as the divestments

of businesses not consistent with its strategic focus, foreign

currency fl uctuations, and the exiting of certain customer

contracts and countries.

Mobile Broadband net sales declined % to EUR mil-

lion in , compared to EUR million in , as declines

in WCDMA, CDMA and GSM were partially off set by growth in

both FD-LTE and TD-LTE, refl ecting the industry shift to G

technology. Core network sales declined as a result of the

customer focus on radio technologies.

Global Services net sales declined % to EUR million

in , compared to EUR million in primarily due