Nokia 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

68

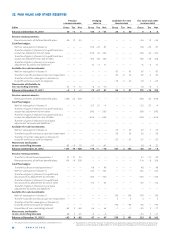

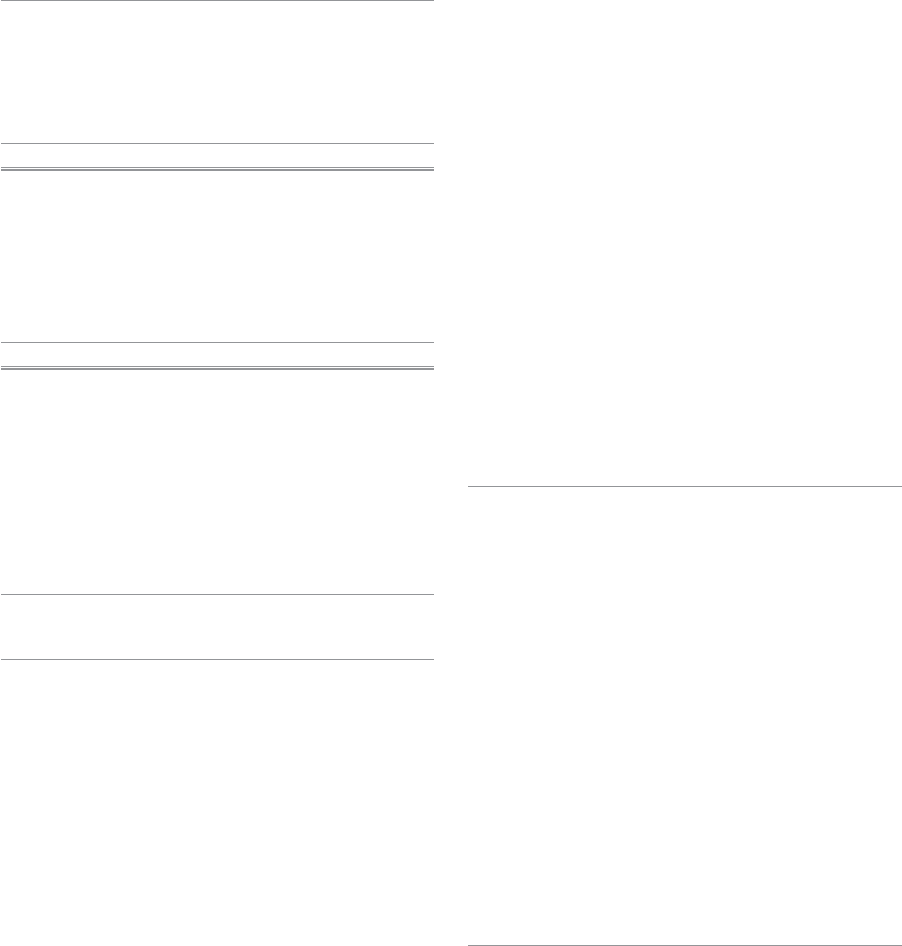

29. EARNINGS PER SHARE

2013 2012 2011

Numerator/EURm

Basic:

Profi t attributable to equity

holders of the parent

Continuing operations 186 – 771 – 1 272

Discontinued operations – 801 – 2 334 109

Total Group – 615 – 3 105 – 1 163

Diluted:

Elimination of interest expense,

net of tax, on convertible

bonds, where dilutive — — —

Profi t used to determine

diluted earnings per share

Continuing operations 186 – 771 – 1 272

Discontinued operations – 801 – 2 334 109

Total Group – 615 – 3 105 – 1 163

Denominator/1 000 shares

Basic:

Weighted average

number of shares

in issue 3 712 079 3 710 845 3 709 947

Eff ect of dilutive securities:

Stock options 1 978 — 473

Performance shares — — —

Restricted shares

and other 19 307 — 6 614

21 285 7 087

Assumed conversion

of convertible bonds — — —

—

Diluted:

Adjusted weighted average

number of shares and

assumed conversions

Continuing

operations 3 733 364 3 710 845 3 709 947

Discontinued

operations 3 712 079 3 710 845 3 717 034

Total Group 3712079 3710845 3709947

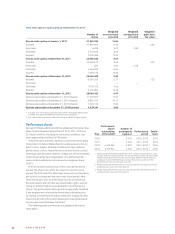

Basic earnings per share is calculated by dividing the profi t

attributable to equity holders of the parent by the weighted

average number of shares outstanding during the year exclud-

ing shares purchased by the Group and held as treasury shares.

Diluted earnings per share is calculated by adjusting the profi t

attributable to equity holders of the parent to eliminate

the interest expense of the dilutive convertible bond and by

adjusting the weighted average number of shares outstanding

with the dilutive eff ect of stock options, restricted shares and

performance shares outstanding during the period as well as

the assumed conversion of convertible bonds.

In , stock options equivalent to million shares (

million in and million in ) were excluded from the

calculation of diluted earnings per share because they were

determined to be anti-dilutive.

In addition, million of performance shares ( million in

and million in ) were excluded from the calculation of dilu-

tive shares because contingency conditions have not been met.

As at December , , there were million ( million in

and million in ) of restricted shares outstanding

that could potentially have a dilutive impact in the future but

were excluded from the calculation as they were determined

anti-dilutive.

Convertible bonds issued to Microsoft in September,

were excluded from the calculation of diluted shares in

because they were determined to be antidilutive. These

potential shares, if fully converted, would result in an issuance

of million shares. As a result of the closing of the sale of

Device & Services business the bonds have been redeemed.

The convertible bond includes a voluntary conver-

sion option. Based on the initial conversion price, voluntary

conversion of the entire bond would result in the issue of

million shares. These potential shares were excluded from the

calculation of diluted shares in and because they

were determined to be antidilutive at December , and

, respectively.

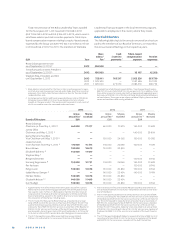

30. COMMITMENTS AND CONTINGENCIES

EURm 2013 1 2012 2

Collateral for own commitments

Assets pledged 38 38

Contingent liabilities on behalf

of Group companies

Other guarantees 778 937

Contingent liabilities on behalf

of associated companies

Financial guarantees on behalf

of associated companies 16 11

Contingent liabilities on behalf

of other companies

Financial guarantees on behalf

of third parties 3 12 12

Other guarantees 103 68

Financing commitments

Customer fi nance commitments 3 25 34

Venture fund commitments 215 282

Continuing operations

Nokia Group

See also Note Risk Management.

The amounts above represent the maximum principal amount

of commitments and contingencies.

Other guarantees on behalf of Group Companies include

commercial guarantees of EUR million in (EUR

million in ) provided to certain NSN customers in the form

of bank guarantees or corporate guarantees issued by NSN’s

Group entity. These instruments entitle the customer to claim

payment as compensation for non-performance by NSN of its

obligations under network infrastructure supply agreements.

Depending on the nature of the guarantee, compensation is

payable on demand or subject to verifi cation of non-perfor-