Nokia 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

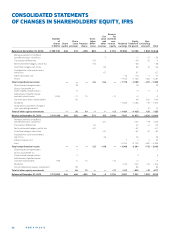

NOKIA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS

OF CASH FLOWS, IFRS

2012 * 2011 *

2013

FinancialyearendedDecember31 Notes EURm EURm EURm

Cash fl ow from operating activities

Loss attributable to equity holders of the parent – 615 – 3105 – 1163

Adjustments, total 33 1789 3841 3488

Change in net working capital 33 – 945 119 – 641

Cash generated from operations 229 855 1684

Interest received 92 130 190

Interest paid – 208 – 277 – 283

Other fi nancial income and expenses, net 345 – 584 264

Income taxes paid, net – 386 – 478 – 718

Net cash from/used in operating activities 72 – 354 1137

Cash fl ow from investing activities

Acquisition of businesses, net of acquired cash — 13 – 817

Purchase of current available-for-sale investments, liquid assets – 1021 – 1668 – 3676

Purchase of investments at fair value through profi t and loss, liquid assets — – 40 – 607

Purchase of non-current available-for-sale investments – 53 – 55 – 111

Purchase of shares in associated companies – 8 – 1 – 2

Payment of other long-term receivables – 1 — – 14

Proceeds from (+)/payment of (–) short-term loans receivable 4 24 – 31

Capital expenditures – 407 – 461 – 597

Proceeds from disposal of businesses, net of disposed cash – 63 – 15 – 2

Proceeds from disposal of shares in associated companies — 5 4

Proceeds from maturities and sale of current available-for-sale investments,

liquid assets 586 2355 6090

Proceeds from maturities and sale of investments at fair value

through profi t and loss, liquid assets — 86 1156

Proceeds from sale of non-current available-for-sale investments 129 37 57

Proceeds from sale of fi xed assets 138 279 48

Dividends received 5 3 1

Net cash used in/from investing activities – 691 562 1499

Cash fl ow from fi nancing activities

Other contributions from shareholders — — 546

Purchase of a subsidiary’s equity instruments – 1707 — —

Proceeds from long-term borrowings 2291 752 1

Repayment of long-term borrowings – 862 – 266 – 51

Repayment of short-term borrowings – 128 – 196 – 59

Dividends paid – 71 – 755 – 1536

Net cash used in fi nancing activities – 477 – 465 – 1099

Foreign exchange adjustment – 223 – 27 107

Net decrease (–)/increase (+) in cash and cash equivalents – 1319 – 284 1644

Cash and cash equivalents at beginning of period 8 952 9236 7592

Cash and cash equivalents at end of period 7633 8952 9236

Cash and cash equivalents comprise of:

Bank and cash 3676 3504 1957

Current available-for-sale investments, cash equivalents 17,35 3 957 5 448 7 279

7 633 8 952 9 236

The figures in the consolidated statement of cash flows combine cash flows relating to both continuing and discontinued operations.

Note includes information about discontinued operations cash flows.

The figures in the consolidated statement cash flows cannot be directly traced from the balance sheet without additional information as a result

of acquisitions and disposals of subsidiaries and net foreign exchange differences arising on consolidation.

* Full years and reflect the retrospective application of Revised IAS , Employee Benefits.

See Notes to Consolidated Financial Statements.