Nokia 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

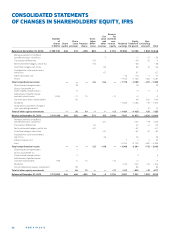

NOKIA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS

OF CHANGES IN SHAREHOLDERS’ EQUITY, IFRS (continued)

Reserve

Fair for

Number Trans- value invested

of Share lation and non- Equity Non-

shares Share issue Treasury diff er- other restrict. Retained holders of controlling

(1 000’s) capital premium shares ences reserves equity earnings the parent interests Total

Balance at December31, 2012 3710985 246 446 – 629 746 – 5 3136 3997 7937 1302 9239

Remeasurement on defi ned

benefi t pensions, net of tax 55 55 25 80

Translation diff erences – 468 – 468 – 28 – 496

Net investment hedges, net of tax 114 114 114

Cash fl ow hedges, net of tax – 3 – 3 7 4

Available-for-sale investments,

net of tax 49 49 — 49

Other increase, net 5 5 — 5

Loss – 615 – 615 – 124 – 739

Total comprehensive income — — — – 354 101 — – 610 – 863 – 120 – 983

Share-based compensation 25 25 25

Settlement of performance

and restricted shares 1 404 – 7 26 – 21 – 2 – 2

Dividend — — – 37 – 37

Acquisition of non-controlling

interest – 3 42 – 16 – 806 – 783 – 924 – 1707

Other change in non-controlling

interest — – 29 – 29

Convertible bond – equity

component 154 154 154

Convertible bond – conversion

to equity 38 — — —

Total of other equity movements — 169 26 42 – 16 – 21 – 806 – 606 – 990 – 1596

Balance at December31, 2013 3712427 246 615 – 603 434 80 3115 2581 6468 192 6660

Dividends declared per share were EUR . for (EUR . for and EUR . for ), subject to shareholders’ approval.

See Notes to Consolidated Financial Statements.