Nokia 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8NOKIA IN 2012

In , other income and expenses included restructur-

ing charges of EUR million, as well as transaction related

costs of EUR million related to the Sale of the D&S Business.

In , other income and expenses included restructuring

charges of EUR million, including EUR million related

to country and contract exits, impairments of assets of EUR

million, a negative adjustment of EUR million to purchase

price allocations related to the fi nal payment from Motorola

as well as amortization of acquired intangible assets of EUR

million and a net gain on sale of real estate of EUR million.

OPERATING PROFIT (LOSS)

Our operating profi t was EUR million, compared with

an operating loss of EUR million in . The increased

operating profi t resulted primarily from lower restructuring

charges and purchase price accounting items in general and

an increase in the operating performance of our NSN busi-

ness, which was partially off set by a decrease in the operating

performance of HERE. Our operating profi t in included

purchase price accounting items, restructuring charges and

other special items of net negative EUR million compared

to net negative EUR million in . Our operating

margin was positive .% compared to negative .% in .

The improvement was primarily due to an increase in our gross

margin and lower expenses in other income and expenses.

CORPORATE COMMON

Corporate common functions’ operating loss totalled EUR

million in , compared to EUR million in . In cor-

porate common included restructuring charges and associated

impairments of EUR million, as well as transaction related

costs of EUR million related to the Sale of the D&S Business.

In corporate common benefi tted from a net gain from

sale of real estate of EUR million and included restructuring

charges of EUR million.

NET FINANCIAL INCOME AND EXPENSES

Financial income and expenses, net, was an expense of EUR

million in compared to an expense of EUR million

in . The lower net expense in was primarily driven by

lower foreign exchange losses.

Our net debt to equity ratio was negative % at December

, , compared with a net debt to equity ratio of negative

% at December , .

PROFIT (LOSS) BEFORE TAXES

Continuing operations profi t before tax was EUR million

in , compared to a loss of EUR million in . Taxes

amounted to EUR million in and EUR million in

.

NON-CONTROLLING INTERESTS

Loss attributable to non-controlling interests from continuing

operations totalled EUR million in , compared with a

loss attributable to non-controlling interests of EUR million

in . This change was primarily due to an improvement in

NSN’s results and our acquisition of Siemens’ stake in NSN.

PROFIT ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT

AND EARNINGS PER SHARE

Nokia Group’s total loss attributable to equity holders of the

parent in amounted to EUR million, compared with a

loss of EUR million in . Continuing operations gener-

ated a profi t attributable to equity holders of the parent in

, amounting to EUR million, compared with a loss of

EUR million in . Nokia Group’s total earnings per share

in increased to EUR – . (basic) and EUR – . (diluted),

compared with EUR – . (basic) and EUR – . (diluted) in

. From continuing operations, earnings per share in

increased to EUR . (basic) and EUR . (diluted), compared

with EUR – . (basic) and EUR – . (diluted) in .

CASH FLOW AND FINANCIAL POSITION

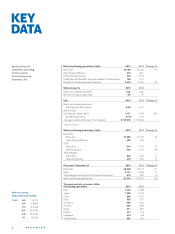

The following chart sets out Nokia’s continuing operations

cash fl ow for the fi scal years and , as well as the year-

on-year growth rates.

YoY

EURm 2013 2012 Change

Net cash from operating

activities 72 – 354

Total cash and other

liquid assets 8 971 9 909 – 9%

Net cash and other

liquid assets 1 2 309 4 360 – 47%

Total cash and other liquid assets minus interest-bearing liabilities.

The items below are the primary drivers of the decrease in

Nokia’s continuing operations net cash and other liquid assets

in of EUR . billion:

■ Nokia’s continuing operations net profi t adjusted for non-

cash items of positive EUR . billion;

■ Nokia’s continuing operations outfl ow related to the

acquisition of Siemens’ stake in Nokia Siemens Networks of

EUR . billion;

■ Nokia’s continuing operations net working capital-related

cash outfl ows of approximately EUR million, which

included approximately EUR million of restructuring

related cash outfl ows;

▪ NSN net working capital-related outfl ows of approximately

EUR million, which included approximately EUR

million of restructuring-related cash outfl ows. Excluding