Nokia 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

80

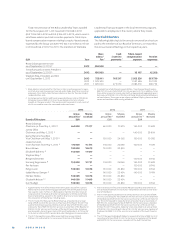

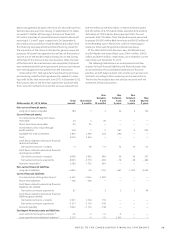

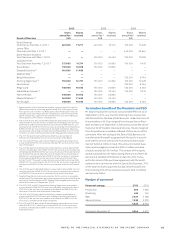

Due Due Due

between between between Due

Total Duewithin 3 and 1 and 3 and beyond

At December 31, 2012, EURm amount 3months 12months 3years 5years 5 years

Non-current fi nancial assets

Long-term loans receivable 217 1 2 46 37 131

Current fi nancial assets

Current portion of long-term loans

receivable 40 12 28 — — —

Short-term loans receivable 1 1 — — — —

Investments at fair value through

profi t and loss 493 1 5 11 260 216

Available-for-sale investment 6 008 5 782 119 82 25 —

Cash 3 504 3 504 — — — —

Cash fl ows related to derivative fi nancial

assets net settled:

Derivative contracts – receipts 240 78 – 30 86 25 81

Cash fl ows related to derivative fi nancial

assets gross settled:

Derivative contracts – receipts 13 864 10 299 3 072 41 41 411

Derivative contracts – payments – 13596 – 10212 – 2959 – 17 – 17 – 391

Accounts receivable

1 4 579 3 952 615 12 — —

Non-current fi nancial liabilities

Long-term liabilities – 6 642 – 111 – 163 – 2933 – 1123 – 2312

Current fi nancial liabilities

Current portion of long-term loans – 216 – 83 – 133 — — —

Short-term liabilities – 262 – 207 – 55 — — —

Cash fl ows related to derivative fi nancial

liabilities net settled:

Derivative contracts – payments – 99 – 2 – 3 – 7 – 7 – 80

Cash fl ows related to derivative fi nancial

liabilities gross settled:

Derivative contracts – receipts 7 966 6 964 889 113 — —

Derivative contracts – payments – 8 016 – 6 999 – 903 – 114 — —

Accounts payable – 4 394 – 4 241 – 136 – 17 — —

Contingent fi nancial assets and liabilities

Loan commitments given undrawn 3 – 34 – 28 – 6 — — —

Loan commitments obtained undrawn 4 2 261 46 – 11 727 1 499 —

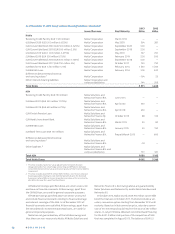

Accounts receivable maturity analysis does not include receivables ac-

counted for based on the percentage of completion method of EUR

million (EUR million in ).

The maturity bucket presented for EUR Convertible Bonds (total of EUR

million maturing – ) is based on the bonds being redeemed

at par plus accrued interest at the close of Sale of the D&S business.

Loan commitments given undrawn have been included in the earliest

period in which they could be drawn or called.

Loan commitments obtained undrawn have been included based on the

period in which they expire. These amounts include related commitment

fees.

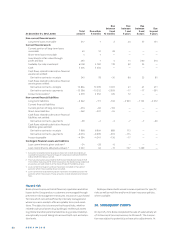

Hazard risk

Nokia strives to ensure that all fi nancial, reputation and other

losses to the Group and our customers are managed through

preventive risk management measures. Insurance is purchased

for risks which cannot be effi ciently internally managed and

where insurance markets off er acceptable terms and condi-

tions. The objective is to ensure that hazard risks, whether

related to physical assets (e.g. buildings), intellectual assets

(e.g. Nokia brand) or potential liabilities (e.g. product liability),

are optimally insured taking into account both cost and reten-

tion levels.

Nokia purchases both annual insurance policies for specifi c

risks as well as multiline and/or multiyear insurance policies,

where available.

36. SUBSEQUENT EVENTS

On April , Nokia completed the sale of substantially all

of its Devices & Services business to Microsoft. The transac-

tion was subject to potential purchase price adjustments. At