Nokia 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

detailed analysis to assess any potential impact on the fi nal

amount to be recognized.

At December , , Nokia’s continuing operations in

Finland had approximately EUR . billion (calculated at the

Finnish corporate tax rate of %) of net deferred tax assets

that have not been recognized in the fi nancial statements.

Asignifi cant portion of Nokia’s Finnish deferred tax assets

are indefi nite in nature and available against future Finnish

taxable income. The Group will continue closely monitoring the

realizability of these deferred tax assets, including assessing

future fi nancial performance of continuing activities in Finland.

Should the recent improvements in the continuing fi nancial

results be sustained, all or part of the unrecognized deferred

tax assets may be recognized in the future.

In the Netherlands and in certain other jurisdictions, the uti-

lization of deferred tax assets is dependent on future taxable

profi t in excess of the profi ts arising from reversal of existing

taxable temporary diff erences. The recognition of deferred tax

assets is based upon whether it is more likely than not that suf-

fi cient taxable profi ts will be available in the future from which

the reversal of temporary diff erences and tax losses can be de-

ducted. Recognition therefore involves judgment with regard

to future fi nancial performance of a particular legal entity or

tax group in which the deferred tax asset has been recognized.

Liabilities for uncertain tax positions are recorded based on

estimates and assumptions when, despite management’s be-

lief that tax return positions are supportable, it is more likely

than not that certain positions will be challenged and may not

be fully sustained upon review by tax authorities. Furthermore,

the Group has ongoing tax investigations in multiple jurisdic-

tions, including India. If the fi nal outcome of these matters

diff ers from the amounts initially recorded, diff erences may

impact the income tax expense in the period in which such

determination is made.

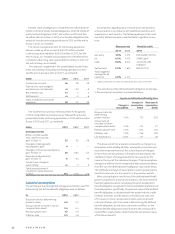

PENSIONS AND OTHER LONG-TERM EMPLOYEE BENEFITS

The determination of pension benefi t obligation and ex-

pense for defi ned benefi t pension plans and other long-term

employee benefi ts is dependent on the Group’s selection of

certain assumptions which are used by actuaries in calculating

such amounts. Those assumptions include, among others, the

discount rate and annual rate of increase in future compensa-

tion levels. A portion of plan assets is invested in equity securi-

ties, which are subject to equity market volatility. Changes in

assumptions and actuarial conditions may materially aff ect the

pension benefi t obligation and future expense. See also Note .

New accounting pronouncements under IFRS

The Group will adopt the following new and revised standards,

amendments and interpretations to existing standards issued

by the IASB that are expected to be relevant to its operations

and fi nancial position:

IFRS Financial Instruments refl ects the fi rst phase of the

IASB’s work on the replacement of IAS Financial Instruments:

Recognition and Measurement and will change the classifi ca-

tion and measurement of the Group’s fi nancial assets and

introduced a new hedge accounting model. The Group is plan-

ning to adopt the standard on the revised eff ective date of

not earlier than January , . The Group will assess IFRS ’s

full impact when all phases have been completed and the fi nal

standard is issued.

The amendments described below will be adopted on

January , and they are not expected to have a material

impact on the fi nancial condition and the results of operations

of the Group.

Amendment to IAS Off setting Financial Assets and

Financial Liabilities clarifi es the meaning of “currently has a

legally enforceable right to set-off ”.

Recoverable Amount Disclosures for Non-Financial Assets

(Amendments to IAS ) adds guidance to IAS Impairment

of Assets on disclosure of recoverable amounts and discount

rates.

Novation of Derivatives and Continuation of Hedge

Accounting (Amendments to IAS ) makes it clear that IAS

Financial Instruments: Recognition and Measurement does not

require discontinuing hedge accounting if a hedging derivative

is novated, provided certain criteria are met.

Defi ned Benefi t Plans: Employee Contributions (Amend-

ments to IAS ) clarifi es IAS Employee Benefi ts require-

ments that relate to how contributions from employees or

third parties that are linked to service should be attributed to

periods of service.

IFRIC Levies, an interpretation of IAS Provisions,

Contingent Liabilities and Contingent Assets clarifi es that the

obligating event giving rise to a liability to pay a levy to a gov-

ernment agency is the activity that triggers the payment.

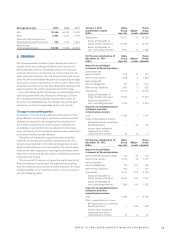

2. SEGMENT INFORMATION

Nokia has three continuing businesses: NSN, HERE and Ad-

vanced Technologies, and four operating and reportable seg-

ments for fi nancial reporting purposes: Mobile Broadband and

Global Services within the NSN, HERE and Advanced Technolo-

gies. Also, Devices & Services business, which is presented as

discontinued operations, forms an operating and reportable

segment.

Nokia adopted its current operational and reporting struc-

ture during in response to the following events:

■ On August , Nokia announced that it had completed

the acquisition of Siemens’ stake in Nokia Siemens Networks

also referred to as NSN. Until then, NSN was reported as a

single reportable segment. Following the completion of the

transaction Nokia Solutions and Networks also referred to

as NSN (formerly Nokia Siemens Networks) became a wholly

owned subsidiary of Nokia and the chief operating decision

maker started to evaluate the business more from a product

perspective. As a result, NSN business has two operating

and reportable segments, Mobile Broadband and Global

Services.