Nokia 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

48

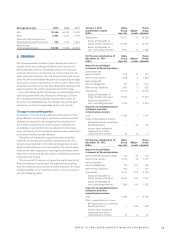

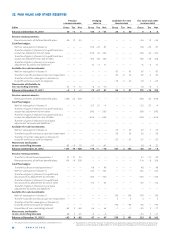

9. IMPAIRMENT

EURm 2013 2012 2011

Goodwill — — 1090

Other intangible assets — 8 2

Property, plant and equipment 12 23 10

Inventories — — 7

Investments in associated

companies — 8 41

Available-for-sale investments 8 31 94

Continued operations, net 20 70 1 244

Discontinued operations, net — 39 94

Goodwill

Goodwill is allocated to the Group’s cash-generating units

(“CGUs”) or groups of cash-generating units for the purpose of

impairment testing. The allocation is made to those CGUs that

are expected to benefi t from the synergies of the business

combination in which the goodwill arose. As a result of the Sale

of the D&S business to Microsoft, as well as Nokia’s acquisition

of the Siemens’ stake in NSN, the Group reviewed the structure

of its CGUs.

In consequence of the Purchase Agreement with Microsoft,

the Smart Devices and Mobile Phones CGUs have been com-

bined to a single Devices & Services CGU and aligned with the

scope of the business being sold. The goodwill previously allo-

cated to the two separate CGUs was allocated to the combined

CGU for impairment testing purposes in . No goodwill was

allocated to the new Advanced Technologies CGU.

In previous years, the Group had defi ned the NSN operating

segment as a single CGU. As a consequence of Nokia’s acquisi-

tion of the Siemens minority stake in NSN and the resulting

change in reportable segments, the Group has identifi ed two

NSN related groups of CGUs to which goodwill has been al-

located: Radio Access Networks within the Mobile Broadband

operating segment and Global Services.

IAS requires goodwill to be assessed annually for im-

pairment unless triggering events are identifi ed prior to the

annual testing date that indicate a potential impairment, in

which case an interim assessment is required. The annual im-

pairment testing for the Devices & Services and HERE CGUs is

performed as of October . The annual impairment testing for

the Nokia Solutions and Networks related groups of CGUs has

been performed as of September . An additional impairment

analysis specifi c to NSN CGUs was performed subsequently at

November , to align the annual testing date with NSN’s

annual fi nancial planning cycle. Management determined that

the signing of the agreement with Microsoft for the Sale of the

D&S business constituted a triggering event requiring an inter-

im impairment test for the Devices & Services and HERE CGUs.

Accordingly, an interim review was performed in September

. No impairment charges were recorded for any of the

CGUs as a result of either the interim or annual tests.

The Group allocated goodwill to the CGUs at each of the

respective years’ impairment testing date, as presented in the

table below:

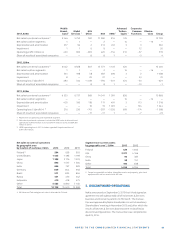

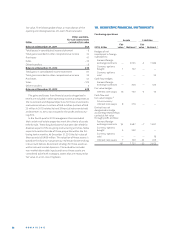

8. OTHER INCOME AND EXPENSES

Continuing operations

EURm 2013 2012 2011

Other income

Distributions from unlisted

venture funds 97 22 26

FX gain on hedging forecasted

sales and purchases 36 26 2

Rental income 25 20 30

Profi t on sale of other fi xed assets 26 28 18

Gain on sale of real estate 6 79 9

Interest income from customer

receivables and overdue payments 27 10 11

Pension curtailments — 12 —

Other miscellaneous income 55 79 55

Other income, total 272 276 151

Other expenses

Restructuring and associated

charges – 395 – 1 174 – 169

Country and contract exits – 52 – 42 —

Divestment of businesses – 157 – 50 – 19

Loss on sale of property,

plant and equipment – 20 – 40 – 9

Impairment of shares in

associated companies — – 8 – 41

Other impairments – 13 – 29 – 66

Sale of receivables transactions – 53 – 44 – 33

Valuation allowances for

doubtful accounts – 30 – 34 33

FX loss on hedging forecasted

sales and purchases – 24 – 18 8

VAT and other indirect tax

write-off s and provisions – 37 – 25 – 35

Transaction costs related to

the Sale of D&S Business – 18 — —

Other miscellaneous expenses – 9 – 49 – 1

Other expenses, total – 808 – 1 513 – 332

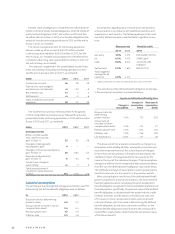

In , other expenses from continuing operations included

restructuring and related charges of EUR million, which

consists primarily of employee termination benefi ts. Restruc-

turing and related charges included EUR million related to

NSN, recorded within NSN, other, EUR million related to HERE,

EUR million related to Advanced Technologies and EUR mil-

lion related to Corporate Common Functions, respectively.

In , other expenses included restructuring and re-

lated charges of EUR million, which consists primairily

of employee termination benefi ts. Restructuring and related

charges included EUR million related to NSN, EUR mil-

lion to HERE, EUR million to Advanced Technologies and EUR

million related to Corporate Common Functions, respectively.

In , other expenses included restructuring charges of

EUR million. Restructuring charges inlcuded EUR mil-

lion related to NSN, recorded within NSN Other, EUR million

related to HERE, EUR million to Advanced Technologies and

EUR million to Corporate Common Functions, respectively.