Nokia 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

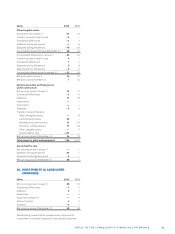

Translation Net investment Translation

diff erences hedging diff erencestotal

EURm Gross Tax Net Gross Tax Net Gross Tax Net

Balance at December31, 2010 944 4 948 – 174 51 – 123 770 55 825

Translation diff erences:

Currency translation diff erences 17 — 17 — — — 17 — 17

Transfer to profi t and loss (fi nancial income and expense) – 8 — – 8 — — — – 8 — – 8

Net investment hedging:

Net investment hedging gains (+)/losses (–) — — — – 37 9 – 28 – 37 9 – 28

Transfer to profi t and loss (fi nancial income and expense) — — — — — — — — —

Movements attributable to non-controlling interests – 35 — – 35 — — — – 35 — – 35

Balance at December31, 2011 918 4 922 – 211 60 – 151 707 64 771

Translation diff erences:

Currency translation diff erences 42 – 1 41 — — — 42 – 1 41

Transfer to profi t and loss (fi nancial income and expense) – 1 — – 1 — — — – 1 — – 1

Net investment hedging:

Net investment hedging gains (+)/losses (–) — — — – 58 – 9 – 67 – 58 – 9 – 67

Transfer to profi t and loss (fi nancial income and expense) — — — — — — — — —

Movements attributable to non-controlling interests 2 — 2 — — — 2 — 2

Balance at December31, 2012 961 3 964 – 269 51 – 218 692 54 746

Translation diff erences:

Currency translation diff erences – 496 — – 496 — — — – 496 — – 496

Transfer to profi t and loss (fi nancial income and expense) — — — — — — — — —

Net investment hedging:

Net investment hedging gains (+)/losses (–) — — — 114 — 114 114 — 114

Transfer to profi t and loss (fi nancial income and expense) — — — — — — — — —

Acquisition of non-controlling interest 42 — 42 — — — 42 — 42

Movements attributable to non-controlling interests 28 — 28 — — — 28 — 28

Balance at December31, 2013 535 3 538 – 155 51 – 104 380 54 434

23. TRANSLATION DIFFERENCES

24. THE SHARES OF THE PARENT COMPANY

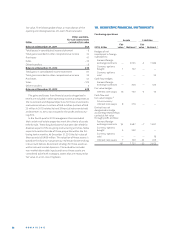

Nokia shares and shareholders

SHARES AND SHARE CAPITAL

Nokia has one class of shares. Each Nokia share entitles the

holder to one vote at General Meetings of Nokia.

On December , , the share capital of Nokia Corpora-

tion was EUR . and the total number of shares

issued was .

On December , , the total number of shares included

shares owned by Group companies representing

approximately .% of the share capital and the total voting

rights.

Under the Articles of Association of Nokia, Nokia Corpora-

tion does not have minimum or maximum share capital or a par

value of a share.

Authorizations

AUTHORIZATION TO INCREASE THE SHARE CAPITAL

At the Annual General Meeting held on May , , Nokia

shareholders authorized the Board of Directors to issue a

maximum of million shares through one or more issues

of shares or special rights entitling to shares, including stock

options. The Board of Directors may issue either new shares

or shares held by the Parent Company. The authorization

includes the right for the Board to resolve on all the terms

and conditions of such issuances of shares and special rights,

including to whom the shares and the special rights may be

issued. The authorization may be used to develop the Parent

Company’s capital structure, diversify the shareholder base,

fi nance or carry out acquisitions or other arrangements, settle

the Parent Company’s equity-based incentive plans, or for

other purposes resolved by the Board. This authorization

would have been eff ective until June, as per the reso-

lution of the Annual General Meeting on May , , but it was