Nokia 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

50

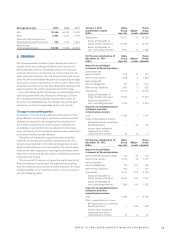

(renamed Nokia Solutions and Networks) for a consideration

of EUR million. Cash of EUR million was paid at the

closing of the transaction. The remaining EUR million was

fi nanced through a secured loan from Siemens, which was

repaid in September . Transaction related costs amounted

to EUR million.

Upon closing, the parent entity of NSN business, Nokia

Siemens Networks B.V., became wholly owned subsidiary of

Nokia. Nokia continues to control and consolidate NSN’s results

and fi nancial position and the acquisition of Siemens’ non-

controlling interest is accounted for as an equity transaction.

The transaction reduced the Group’s equity by EUR million,

representing the diff erence between the carrying amount of

Siemens’ non-controlling interest on the date of the acquisi-

tion of EUR million and the total consideration paid of EUR

million. The impact to individual shareholder’s equity line

items is presented in “Acquisition of non-controlling interest”

line item in the consolidated statement of changes in share-

holder’s equity and in the accompanying notes.

The transaction resulted in changes in the reporting struc-

ture of the NSN business, for further information refer to

Note.

Acquisitions completed in 2012

During , the Group completed minor acquisitions that

did not have a material impact on the consolidated fi nancial

statements. The purchase consideration paid and the total of

goodwill arising from these acquisitions amounted to EUR

million and EUR million, respectively. The goodwill arising

from these acquisitions is attributable to assembled workforce

and post-acquisition synergies.

■ Scalado AB, based in Lund, Sweden, provides and develops

imaging software and experiences. The Group acquired im-

aging specialists, all technologies and intellectual property

from Scalado AB on July , .

■ earthmine Inc., based in California, USA, develops systems

to collect and process D imagery. The Group acquired a

% ownership interest in earthmine on November ,

.

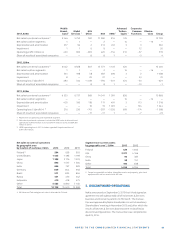

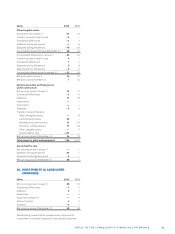

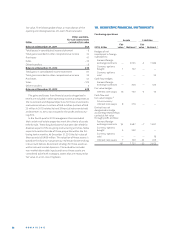

11. DEPRECIATION AND AMORTIZATION

EURm 2013 2012 2011

Depreciation and amortization

by function

Cost of sales 88 119 151

Research and development 1 293 525 586

Selling and marketing 2 95 334 435

Administrative and general 84 110 146

Total 560 1088 1318

In , depreciation and amortization allocated to research and develop-

ment included amortization of acquired intangible assets of EUR

million (EUR million in and EUR million in ).

In , depreciation and amortization allocated to selling and marketing

included amortization of acquired intangible assets of EUR million

(EUR million in and EUR million in ).

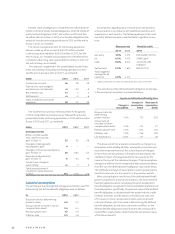

fees and advertising, will grow in the future as more custom-

ers demand complete, end-to-end location solutions and as

cloud computing and cloud-based services garner greater

market acceptance. Actual short and long-term performance

could vary from management’s forecasts and impact future

estimates of recoverable value. Since the recoverable amount

exceeds the carrying amount only by a small margin, any mate-

rial adverse changes such as market deterioration or changes

in the competitive landscape could impact management’s

estimates of the main drivers and result in impairment loss.

Other than as disclosed for the HERE CGU above, manage-

ment believes that no reasonably possible change in any of the

above key assumptions would cause the carrying value of any

cash generating unit to exceed its recoverable amount.

Other intangible assets

There were no impairment charges recognized during .

During , a charge of EUR million was recorded on

intangible assets attributable to the decision to transition

certain operations into maintenance mode within NSN. These

charges were recorded in other operating expenses.

Property, plant and equipment

During Nokia Solutions and Networks recorded an impair-

ment charge of EUR million (EUR million in ) on prop-

erty, plant and equipment as a result of the remeasurement

of the Optical Networks disposal group at fair value less cost

of disposal. Furthermore, the Group recognized impairment

losses of EUR million related to certain properties attribut-

able to Corporate Common Functions.

Investments in associated companies

No material impairment charges were recognized during .

After application of the equity method, including recogni-

tion of the Group’s share of results of associated companies,

the Group determined that recognition of impairment losses

of EUR million in (EUR million in ) was necessary

to adjust the Group’s investment in associated companies to

its recoverable amount. The charges were recorded in other

operating expense and are included in Corporate Common

Functions.

Available-for-sale investments

The Group’s investment in certain equity and interest-bearing

securities held as available-for-sale suff ered a signifi cant

or prolonged decline in fair value resulting in an impairment

charge of EUR million (EUR million in , EUR million

in ). These impairment losses are included within fi nancial

income and expenses and other operating expenses in the

consolidated income statement. See also Note .

10. ACQUISITIONS

Acquisitions completed in 2013

ACQUISITION OF SIEMENS’ NON-CONTROLLING

INTEREST IN NSN

On August , Nokia completed its acquisition of Siemens’

% interest in their joint venture, Nokia Siemens Networks