Nokia 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

58

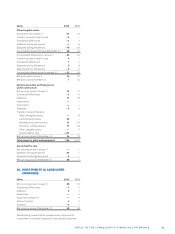

22. FAIR VALUE AND OTHER RESERVES

Pension Hedging Available-for-sale Fairvalueandother

remeasurements reserve investments reservestotal

EURm Gross Tax Net Gross Tax Net Gross Tax Net Gross Tax Net

Balance at December31, 2010 10 – 4 6 – 30 3 – 27 26 4 30 6 3 9

Pension remeasurements:

Remeasurements of defi ned benefi t plans – 36 12 – 24 — — — — — — – 36 12 – 24

Cash fl ow hedges:

Net fair value gains (+)/losses (–) — — — 106 – 25 81 — — — 106 – 25 81

Transfer of gains (–)/losses (+) to profi t and loss

account as adjustment to net sales — — — – 166 42 – 124 — — — – 166 42 – 124

Transfer of gains (–)/losses (+) to profi t and loss

account as adjustment to cost of sales — — — 162 – 36 126 — — — 162 – 36 126

Transfer of gains (–)/losses (+) as a basis

adjustment to assets and liabilities 1 — — — 14 – 3 11 — — — 14 – 3 11

Available-for-sale investments:

Net fair value gains (+)/losses (–) — — — — — — 67 — 67 67 — 67

Transfer to profi t and loss account on impairment — — — — — — 22 – 2 20 22 – 2 20

Transfer of net fair value gains (–)/losses (+)

to profi t and loss account on disposal — — — — — — – 19 – 1 – 20 – 19 – 1 – 20

Movements attributable to

non-controlling interests 24 – 7 17 – 8 – 2 – 10 — — — 16 – 9 7

Balance at December31, 2011 – 2 1 – 1 78 – 21 57 96 1 97 172 – 19 153

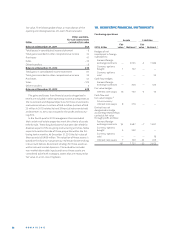

Pension remeasurements:

Remeasurements of defi ned benefi t plans – 228 22 – 206 — — — — — — – 228 22 – 206

Cash fl ow hedges:

Net fair value gains (+)/losses (–) — — — – 25 21 – 4 — — — – 25 21 – 4

Transfer of gains (–)/losses (+) to profi t and loss

account as adjustment to net sales — — — 390 — 390 — — — 390 — 390

Transfer of gains (–)/losses (+) to profi t and loss

account as adjustment to cost of sales — — — – 406 — – 406 — — — – 406 — – 406

Transfer of gains (–)/losses (+) as a basis

adjustment to assets and liabilities 1 — — — — — — — — — — — —

Available-for-sale investments:

Net fair value gains (+)/losses (–) — — — — — — 32 1 33 32 1 33

Transfer to profi t and loss account on impairment — — — — — — 24 — 24 24 — 24

Transfer of net fair value gains (–)/losses (+)

to profi t and loss account on disposal — — — — — — – 21 — – 21 – 21 — – 21

Movements attributable

to non-controlling interests 83 – 4 79 – 47 — – 47 — — — 36 – 4 32

Balance at December31, 2012 – 147 19 – 128 – 10 — – 10 131 2 133 – 26 21 – 5

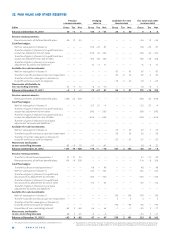

Pension remeasurements:

Transfer to discontinued operations 2 31 – 11 20 — — — — — — 31 – 11 20

Remeasurements of defi ned benefi t plans 114 – 6 108 — — — — — — 114 – 6 108

Cash fl ow hedges:

Transfer to discontinued operations 2 — — — 48 — 48 — — — 48 — 48

Net fair value gains (+)/losses (–) — — — 124 — 124 — — — 124 — 124

Transfer of gains (–)/losses (+) to profi t and

loss account as adjustment to net sales — — — – 130 — – 130 — — — – 130 — – 130

Transfer of gains (–)/losses (+) to profi t and

loss account as adjustment to cost of sales — — — – 23 — – 23 — — — – 23 — – 23

Transfer of gains (–)/losses (+) as a basis

adjustment to assets and liabilities 1 — — — — — — — — — — — —

Available-for-sale investments:

Net fair value gains (+)/losses (–) — — — — — — 139 — 139 139 — 139

Transfer to profi t and loss account on impairment — — — — — — 5 — 5 5 — 5

Transfer of net fair value gains (–)/losses (+)

to profi t and loss account on disposal — — — — — — – 95 — – 95 – 95 — – 95

Acquisition of non-controlling interest – 63 3 – 60 44 — 44 – 1 — – 1 – 20 3 – 17

Movements attributable

to non-controlling interests – 28 3 – 25 – 6 — – 6 — — — – 34 3 – 31

Balance at December31, 2013 2 – 93 8 – 85 47 — 47 179 2 181 133 10 143

The adjustments relate to acquisitions completed in . Movements in after transfer to discontinued operations represents movements of continuing

operations and the balance at December , represents the balance of continuing operations.