Nokia 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

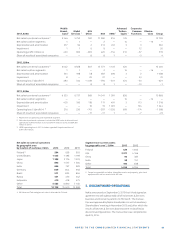

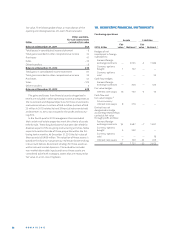

12. FINANCIAL INCOME AND EXPENSES

EURm 2013 2012 2011

Continuing operations

Dividend income on available-for-sale

fi nancial investments 1 3 1

Interest income on available-for-sale

fi nancial investments 1 95 119 169

Interest income on loans receivables

carried at amortized cost 7 3 1

Interest income on investments at

fair value through profi t and loss 6 8 18

Net interest expense on derivatives

not under hedge accounting – 4 – 4 – 12

Interest expense on fi nancial

liabilities carried at amortized cost 1 – 319 – 263 – 255

Net realised gains (+)/losses (–) on

disposal of fi xed income

available-for-sale fi nancial investments 2 – 1 – 4

Net fair value gains (+)/losses (–) on

investments at fair value through

profi t and loss – 29 27 102

Net gains (+)/losses (–) on other

derivatives designated at fair value

through profi t and loss 32 – 11 – 121

Net fair value gains (+)/losses (–) on

hedged items under fair value

hedge accounting 69 – 15 – 82

Net fair value gains (+)/losses (–) on

hedging instruments under fair value

hedge accounting – 63 23 72

Net foreign exchange gains (+)/losses (–) 2

From foreign exchange derivatives

designated at fair value through

profi t and loss – 28 – 42 100

From balance sheet

items revaluation – 74 – 223 – 90

Other fi nancial income 3 48 51 48

Other fi nancial expenses 4 – 23 – 32 – 78

Total – 280 – 357 – 131

During , interest income decreased mainly as a result of lower cash

levels than in and lower interest rates in certain currencies where

the Group has investments. Interest expense increased due to higher

levels of borrowing as well as expenses related to funding the purchase of

NSN non-controlling interest from Siemens. During , interest income

decreased mainly as a result of lower cash levels than in and lower

interest rates in certain currencies where the Group has investments.

During foreign exchange gains (or losses) were positively impacted

by lower hedging costs than in as well as lower volatility of certain

emerging market currencies. During foreign exchange gains (or

losses) were negatively impacted by higher hedging costs than in as

well as significant weakening of certain emerging market currencies.

Other financial income includes distributions of EUR million in

(EUR million in and EUR million in ) from a private fund held

as non-current available-for-sale investments.

Other financial expenses include an impairment loss of EUR million

in (EUR million in and EUR million in ) in the Group’s

investment in the above mentioned private fund due to changes in esti-

mated future cash flows resulting from distributions received as well as

other factors. The Group did not recognize any impairment losses related

to Asset Backed Securities in or in other financial expenses,

whereas impairments for these securities amounted to EUR million in

. Additional information can be found in Note and Note .

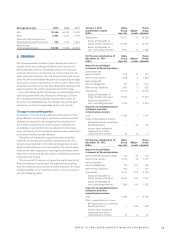

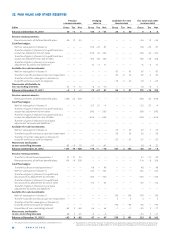

13. INCOME TAXES

EURm 2013 2012 2011

Continuing operations

Income tax

Current – 354 – 329 – 340

Deferred 152 25 267

Total – 202 – 304 – 73

Finnish entities – 87 – 147 – 102

Other countries – 115 – 157 29

Total – 202 – 304 – 73

The diff erences between the income tax expense computed

at statutory rate of .% in and in Finland (% in

) and income taxes recognized in the consolidated income

statement is reconciled as follows:

EURm 2013 2012 2011

Income tax expense (+)/benefi t (–)

at statutory rate 60 – 289 – 401

Permanent diff erences – 22 67 – 98

Non tax deductible impairment

of goodwill (Note9) — — 283

Income taxes for prior years – 22 – 78 – 16

Income taxes on foreign subsidiaries’

profi ts in excess of (lower than)

income taxes at statutory rates 5 15 – 22

Realizability of deferred tax assets 1 138 609 279

Net increase (+)/decrease (–)

in uncertain tax positions 14 – 14 3

Change in income tax rates 7 4 11

Income taxes on undistributed

earnings – 21 – 24 9

Other 43 14 25

Income tax expense 202 304 73

This item primarily relates to NSN’s Finnish tax losses, unused tax credits

and temporary differences for which no deferred tax was recognized. In

this item also relates to NSN’s German tax losses and temporary dif-

ferences for which no deferred tax was recognized.

Current income tax liabilities at December , include

EUR million (EUR million in ) related to uncertain

tax positions. The timing of outfl ows related to these matters

is inherently uncertain.

Certain of the Group companies’ income tax returns for

prior periods are under examination by tax authorities. Our

business and investments especially in emerging market coun-

tries may be subject to uncertainties, including unfavorable

or unpredictable taxation treatment. Management judgment

and a degree of estimation are required in determining tax

expense. Even though the Group does not believe that any

signifi cant additional taxes in excess of those already provided

for will arise as a result of the examinations, fi nal resolutions

of open items may substantially diff er from the amounts

initially recorded.