Nokia 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

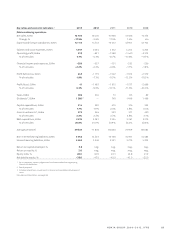

CRITICAL ACCOUNTING POLICIES

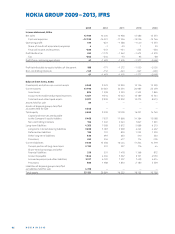

Cashgeneratingunits

Radio Access

Networks group

of CGUs in Global Services

HERE Mobile Broadband 1 group of CGUs 1 NSN

% % % %

2013 2012 2013 2012 2013 2012 2013 2012

Terminalgrowthrate 1.7 1.7 1.5 — 0.5 — — 0.7

Post-taxdiscountrate 10.6 9.9 10.8 — 10.1 — — 10.3

NSN CGU is divided into two groups of CGUs in : Radio Access Networks group of CGUs

within Mobile Broadband operating segment and the Global Service group of CGUs.

CGU (EUR million), NSN Mobile Broadband group of CGUs

(EUR million) and NSN Global Services group of CGUs (EUR

million).

IAS requires goodwill to be assessed annually for im-

pairment unless triggering events are identifi ed prior to the

annual testing date that indicate a potential impairment in

which case an interim assessment is required. The annual

impairment testing for the Devices & Services and HERE CGUs

is performed as of October . The annual impairment testing

for the Nokia Solutions and Networks related groups of CGUs

has been performed as of September . An additional impair-

ment analysis specifi c to NSN CGUs was performed subse-

quently at November , to align the annual testing date

with the NSN’s annual fi nancial planning cycle. Management

determined that the signing of the agreement with Microsoft

for the Sale of D&S Business constituted a triggering event re-

quiring an interim impairment test for the Devices & Services

and HERE CGUs. Accordingly, an interim review was performed

in September . No impairment charges were recorded for

any of the CGUs as a result of either the interim or annual tests.

The recoverable values of the Smart Devices and Mobile

Phones CGUs, that are now combined to form the Devices &

Services CGU and are classifi ed as discontinued operations in

, were previously valued using a value in use basis. During

, the Devices & Services CGU recoverable value was de-

termined using a fair value less cost of disposal model based

on the agreed purchase price defi ned for the Sale of D&S

Business, excluding any consideration attributable to patents

or patent applications.

During , the recoverable amounts of the HERE CGU,

Radio Access Networks and Global Services Group of CGUs

have been determined using a fair value less cost of disposal

model. Fair value less cost of disposal was estimated using

discounted cash fl ow calculations. The cash fl ow projections

employed in the discounted cash fl ow calculations have been

determined by management based on the information avail-

able, to refl ect the amount that an entity could obtain from

separate disposal of each of the CGUs in an orderly transaction

between market participants at the measurement date after

deducting the estimated cost of disposal. The estimates of

fair value less cost of disposal are categorized as level of the

fair value hierarchy.

Discounted cash fl ows for the Nokia Solutions and Networks

groups of CGUs and HERE CGU were modeled over ten an-

nual periods. The growth rates used in transition to terminal

year refl ect estimated long term stable growth which do not

exceed long-term average growth rates for the industry and

economies in which the CGUs operate. All cash fl ow projections

are consistent with external sources of information, wherever

possible.

The key assumptions applied in the impairment testing for

each CGU in the annual goodwill impairment testing for each

year indicated are presented in the table below. No informa-

tion has been included for the Devices & Services CGU as the

recoverable amount was not determined using a discounted

cash fl ow analysis and the CGU is attributable to discontinued

operations: