Nokia 2013 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

22

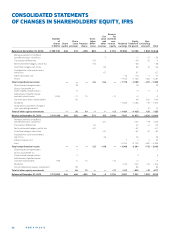

CONSOLIDATED INCOME STATEMENTS, IFRS

2013

FinancialyearendedDecember31 Notes EURm EURm EURm

Continuing operations

Net sales 12 709 15 400 15 968

Cost of sales – 7 364 – 9 841 – 10 408

Gross profi t 5 345 5 559 5 560

Research and development expenses – 2 619 – 3 081 – 3 334

Selling and marketing expenses – 974 – 1 372 – 1 608

Administrative and general expenses – 697 – 690 – 735

Impairment of goodwill 9 — — – 1 090

Other income 8 272 276 151

Other expenses 8,9 – 808 – 1 513 – 332

Operating profi t (+)/loss (–) 2 – 11,25 519 – 821 – 1 388

Share of results of associated companies 16,32 4 – 1 – 23

Financial income and expenses 9,12 – 280 – 357 – 131

Profi t (+)/loss (–) before tax 243 – 1 179 – 1 542

Income tax 13 – 202 – 304 – 73

Profi t (+)/loss (–) from continuing operations 41 – 1 483 – 1 615

Profi t (+)/loss (–) from continuing operations

attributable to equity holders of the parent 186 – 771 – 1 272

Loss from continuing operations attributable to non-controlling interests – 145 – 712 – 343

41 – 1 483 – 1 615

Loss (–)/profi t (+) from discontinued operations 3 – 780 – 2 303 128

Loss (–)/profi t (+) from discontinued operations

attributable to equity holders of the parent – 801 – 2 334 109

Profi t from discontinued operations attributable to non-controlling interests 21 31 19

– 780 – 2 303 128

Loss for the year – 739 – 3 786 – 1 487

Loss attributable to equity holders of the parent – 615 – 3 105 – 1 163

Loss attributable to non-controlling interests – 124 – 681 – 324

– 739 – 3 786 – 1 487

Earnings per share from continuing and discontinued operations 2013 2012 2011

(for profi t (+)/loss (–) attributable to the equity holders of the parent) 29 EUR EUR EUR

Basic earnings per share

From continuing operations 0.05 – 0.21 – 0.34

From discontinued operations – 0.22 – 0.63 0.03

From the profi t of the year – 0.17 – 0.84 – 0.31

Diluted earnings per share

From continuing operations 0.05 – 0.21 – 0.34

From discontinued operations – 0.22 – 0.63 0.03

From the profi t of the year – 0.17 – 0.84 – 0.31

Average number of shares (000’s shares) 29

Basic

From continuing operations 3 712 079 3 710 845 3 709 947

From discontinued operations 3 712 079 3 710 845 3709947

From the profi t of the year 3 712 079 3 710 845 3 709 947

Diluted

From continuing operations 3 733 364 3 710 845 3 709 947

From discontinued operations 3 712 079 3710845 3 717 034

From the profi t of the year 3712079 3 710 845 3 709 947

* Full years and reflect the retrospective application of Revised IAS , Employee Benefits.

See Notes to Consolidated Financial Statements.

2012 * 2011 *