Nokia 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REVIEW BY THE BOARD OF DIRECTORS 11

price accounting items, by more than EUR . billion by the end

of , compared to the end of .

During , NSN recognized restructuring charges and

other associated items of EUR million related to this

restructuring program, resulting in cumulative charges of

approximately EUR million. By the end of , NSN had

cumulative restructuring related cash outfl ows of approxi-

mately EUR million relating to this restructuring program.

NSN expects restructuring related cash outfl ows to be ap-

proximately EUR million for the full year relating to

this restructuring program.

HERE

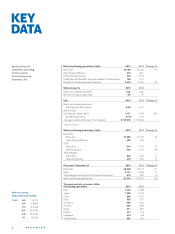

The following table sets forth selective line items for the fi scal

years and .

YoY

EURm 2013 2012 Change

Net sales 914 1 103 – 17%

Cost of sales – 208 – 228 – 9%

Gross profi t 706 875 – 19%

Research and development

expenses – 648 – 883 – 27%

Selling and marketing expenses – 119 – 186 – 36%

Administrative and general

expenses – 69 – 77 – 10%

Other operating income and

expenses – 24 – 30 – 20%

Operating profi t (loss) – 154 – 301

NET SALES

HERE net sales decreased % to EUR million in ,

compared to EUR million in . HERE internal net sales

decreased % to EUR million in , compared to EUR

million in . HERE external net sales increased % to EUR

million in , compared to EUR million in . The

year-on-year decline in HERE internal net sales was due to low-

er recognition of deferred revenue related to our smartphone

sales. The year-on-year increase in HERE external net sales in

was primarily due to higher sales to vehicle customers,

partially off set by lower sales to personal navigation devices

customers. Additionally, HERE net sales were negatively af-

fected by foreign currency fl uctuations.

The following table sets forth the distribution by geographi-

cal area of our net sales for the fi scal years and .

HERE net sales by geographic area

YoY

EURm 2013 2012 Change

Europe 384 477 – 19%

Middle East & Africa 57 74 – 23%

Greater China 17 63 – 73%

Asia-Pacifi c 75 82 – 9%

North America 322 335 – 4%

Latin America 59 72 – 18%

Total 914 1 103 – 17%

GROSS MARGIN

On a year-on-year basis, the decrease in HERE gross margin,

.% in compared to .% in , was primarily due to

proportionally higher sales of update units to vehicle custom-

ers which generally carry a lower gross margin, partially off set

by lower costs related to service delivery.

OPERATING EXPENSES

HERE research and development expenses decreased % to

EUR million in compared to EUR million in ,

primarily due to a decrease in purchase price accounting

related items, EUR million in compared to EUR mil-

lion in , and cost reduction actions.

HERE sales and marketing expenses decreased % to EUR

million in compared to EUR million in , primar-

ily driven by a decrease in purchase price accounting items,

EUR million in compared to EUR million in , cost

reduction actions and lower marketing spending.

HERE administrative and general expenses decreased %

to EUR million in compared to EUR million in ,

primarily due cost reduction actions.

In , HERE other income and expense had a slightly

positive year-on-year impact on profi tability, decreasing from

EUR million in to EUR million in . In , we

recognized restructuring charges of EUR million in HERE,

compared to EUR million in .

OPERATING PROFIT (LOSS)

HERE operating loss decreased to EUR million in ,

compared with a loss of EUR million in . HERE operating

margin in was negative .%, compared with negative

.% in . The year-on-year improvement in operating

margin in was driven primarily by the absence of signifi -

cant purchase price accounting related items arising from the

purchase of NAVTEQ, the vast majority of which had been fully

amortized as of the end of the second quarter of .

Advanced Technologies

The following table sets forth selective line items for the fi scal

years and .