Nokia 2013 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

128

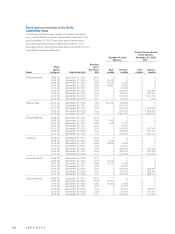

Equity grants in

Option awards Stock awards

Number of Grant Performance Performance Grant

shares Grant date sharesat sharesat Restricted date

Name and principal Grant underlying price fairvalue 3 threshold maximum shares fair value 4

position 2 Year date options EUR EUR (number) (number) (number) EUR

Stephen Elop, 2013 May 15 1 800 000 2.71 2197 692 562 500 2 250 000

EVP Devices & Services, 2013 March 13 785 000 5385 660

former President and CEO

Risto Siilasmaa, 2013 — 0 0 0 0 0 0 0

Chairman of the Board of

Directors. Interim CEO

Timo Ihamuotila, 2013 May 15 370 000 2.71 451 748 110 000 440 000

EVP, Chief Financial Offi cer, 2013 March 13 130 000 990 280

Interim President 2013 November 13 25 000 146 125

Louise Pentland, 2013 May 15 350 000 2.71 427 329 100 000 400 000

EVP, Chief Legal Offi cer 2013 March 13 120 000 905 120

Michael Halbherr, 2013 May 15 370 000 2.71 451 748 110 000 440 000

EVP, HERE 2013 March 13 130 000 990 280

Jo Harlow, 2013 May 15 370 000 2.71 451 748 110 000 440 000

EVP, Smart Devices 2013 March 13 130 000 990 280

Including all equity awards made during . Awards were made under

the Nokia Stock Option Plan , the Nokia Performance Share Plan

and the Nokia Restricted Share Plan .

The positions set forth in this table are the positions of the named execu-

tive officers as of December , .

The fair value of stock options equals the estimated fair value on the

grant date, calculated using the Black-Scholes model. The stock option

exercise price was EUR . on May , . NASDAQ OMX Helsinki closing

market price was EUR . at grant date on May , .

For information with respect to the Nokia shares and equity

awards held by the members of the Nokia Leadership Team as

at December , , please see “Share ownership”.

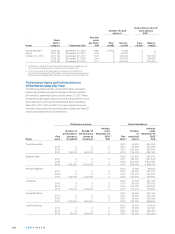

EQUITY-BASED INCENTIVE PROGRAMS

General

The Board of Directors approved on February , Nokia

equity based incentive programme for the year . The pro-

gramme for will be explained in more detail under “Nokia

eguity based incentive programme ”.

During the year ended December , , we administered

two global stock option plans, four global performance share

plans, four global restricted share plans and an employee

share purchase plan. Both executives and employees partici-

pate in these plans. Our compensation programs promote

long-term value creation and sustainability of the company

and are designed to ensure that compensation is based on

performance. Performance shares have been the main ele-

ment of the company’s broad-based equity compensation

program for several years to emphasize the performance ele-

ment in employees’ long-term incentives.

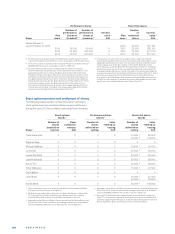

The primary equity instruments for the executive employ-

ees were performance shares and stock options. Restricted

shares have also been used for executives for retention pur-

poses. The portfolio approach has been designed to build an

optimal and balanced combination of long-term equity-based

incentives and to help focus recipients on long term fi nancial

performance as well as on share price appreciation, thus align-

ing recipients’ interests with those of shareholders. For direc-

tors below the executive level, the primary equity instruments

have been performance shares and restricted shares. Below

The fair value of performance shares and restricted shares equals the

estimated fair value on the grant date. The estimated fair value is based

on the grant date market price of the Nokia share less the present value

of dividends expected to be paid during the vesting period. The value

of performance shares is presented on the basis of a number of shares,

which is two times the number at threshold.

the director level, performance shares and restricted shares

have been used on a selective basis to ensure retention and

recruitment of individuals with functional mastery and other

employees deemed critical to Nokia’s future success.

The equity-based incentive grants are conditioned upon

continued employment with Nokia, as well as the fulfi llment

of performance and other conditions, as determined in the

relevant plan rules.

The participant group for the equity-based incentive

program continued to include employees from many levels

of the organization. As at December , , the aggregate

number of participants in all of our active equity-based pro-

grams was approximately and approximately as at

December , .

Stock option, performance share and restricted share

grants to the President and CEO are made upon recom-

mendation by the Personnel Committee and approved by

the Board of Directors and confi rmed by the independent

directors of the Board. The interim CEO was not eligible to

receive any equity-based incentive grants and did not receive

any grants during . The interim President’s stock option

and restricted share grants in recognition of his additional

responsibilities as the interim President were made upon

recommendation by the Personnel Committee and approved

by the Board of Directors in accordance with the terms and

conditions of the plans. Stock option, performance share and

restricted share grants to the other Nokia Group Leadership

Team members and other direct reports of the President and

CEO are approved by the Personnel Committee. Stock op-

tion, performance share and restricted share grants to other

eligible employees are approved by the President and CEO on a

quarterly basis, based on an authorization given by the Board

of Directors.