Nokia 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

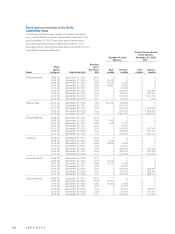

COMPENSATION OF THE BOARD OF DIRECTORS AND THE NOKIA GROUP LEADERSHIP TEAM

Summary compensation table

Change in

pension value

and

nonqualifi ed

Variable deferred

compen- Stock Option compensation All other

Name andprincipal Salary sation 2 awards 3 awards 3 earnings 4 compensation Total

position 1 Year EUR EUR EUR EUR EUR EUR EUR

Stephen Elop, 2013 1 105 171 769 217 5 385 660 2 197 691 75 554 121 765 5 9 655 059

EVP Devices & Services, 2012 1 079 500 0 2 631 400 497 350 56 776 69 395 4 334 421

former President and CEO 2011 1 020 000 473 070 3752 396 539 443 73 956 2 085 948 7 944 813

Risto Siilasmaa 2013 0 0 0 0 500 000 6 500 000

Chairman of the Board

of Directors, Interim CEO

Timo Ihamuotila 2013 578 899 628 909 1 136 530 547 748 160 630 314 066 7 3 366 782

EVP, Chief Financial Offi cer, 2012 570690 57750 539300 106575 262183 40146 1 576644

Interim President 2011 550 000 173 924 479 493 185 448 150 311 8 743 1 547 919

Louise Pentland 8 2013 441 499 476 027 905 120 427 329 9 324 9, 10 2 259 299

EVP, Chief Legal Offi cer 2012 466 653 46 321 407 730 81 708 22 761 1 025 173

Michael Halbherr 2013 440 375 206 426 990 280 451 748 89 849 11 2 178 678

EVP, HERE 2012 411 531 44 038 539 300 106 575 61 477 1 162 921

Jo Harlow 8 2013 533 436 0 990 280 451 748 62 415 12 2 037 879

EVP, Smart Devices 2012 555296 55494 539300 106575 58 732 1 315397

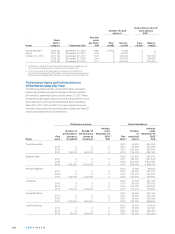

The positions set forth in this table are the positions of the named execu-

tive officers as of December , .

The amount consists of the annual short term variable compensation and/

or other incentives earned and paid or payable by Nokia for the respective

fiscal year. The amount above is inclusive of any discretionary variable

spot compensation earned by active Nokia Leadership Team members for

specific contributions during the year.

Amounts shown represent the grant date fair value of equity grants

awarded for the respective fiscal year. The fair value of stock options

equals the estimated fair value on the grant date, calculated using the

Black-Scholes model.

The fair value of performance shares and restricted shares equals the

estimated fair value on grant date. The estimated fair value is based on

the grant date market price of a Nokia share less the present value of

dividends expected to be paid during the vesting period. The value of

the performance shares is presented on the basis of granted number of

shares, which is two times the number of shares at threshold.

The value of the stock awards with performance shares valued at

maximum (four times the number of shares at threshold), for each of the

named executive officers, is as follows: Mr. Elop EUR ;

Mr. Ihamuotila EUR ; and Ms. Pentland EUR ; Mr. Halbherr

EUR and Ms. Harlow EUR .

The change in pension value represents the proportionate change in the

liability related to the individual executives. These executives are covered

by the Finnish State employees’ pension act (“TyEL”) that provides for a

retirement benefit based on years of service and earnings according to

the prescribed statutory system. The TyEL system is a partly funded and

a partly pooled “pay as you go” system. Effective March , , Nokia

transferred its TyEL pension liability and assets to an external Finnish

insurance company and no longer carries the liability on its financial

statements. The figures shown represent only the change in liability for

the funded portion. The method used to derive the actuarial IFRS valua-

tion is based upon available salary information at the respective year end.

Actuarial assumptions including salary increases and inflation have been

determined to arrive at the valuation at the respective year end.

All other compensation for Mr. Elop in includes: EUR for tax

services for fiscal years , and ; housing of EUR ; EUR

for participation in a health assessment and leadership perfor-

mance program; home security EUR ; and EUR taxable benefit

for premiums paid under supplemental medical and disability insurance

and for mobile phone and driver.

All other compensation for Mr. Siilasmaa in includes: EUR as

compensation for his additional responsibilities as Interim CEO, % of

this amount was delivered to him in shares bought on the open market.

The remaining % was paid in cash, most of which was used to cover the

estimated associated taxes. The table does not include the compensation

he is paid for his role as Chairman of the Board of Directors.

All other compensation for Mr. Ihamuotila in includes: EUR

for car allowance; EUR for security and EUR taxable benefit

for premiums paid under supplemental medical and disability insurance

and for mobile phone and driver; EUR for participation in a health

assessment and leadership performance program. In recognition of

additional responsibilities for his role as acting President, Mr. Ihamuotila

received EUR cash paid in installments starting in October ,

resulting in EUR being paid in and EUR being paid in

. Additionally, he received an equity grant value EUR (included

in the stock award and stock options columns) which will vest in accord-

ance with normal plan rules.

Salaries, benefits and perquisites for Ms. Harlow and Ms. Pentland were

paid and denominated in GBP and USD, respectively. Amounts were

converted using year-end USD/EUR exchange rate of . and GPB/

EUR rate of .. For year disclosure, amounts were converted using

year-end USD/EUR exchange rate of . and GPB/EUR exchange rate

of .. For year disclosure, amounts were converted using year-end

USD/EUR and GPB/EUR exchange rate of . and ., respectively.

Ms. Pentland participated in Nokia’s U.S Retirement Savings and Invest-

ment Plan. Under this (k) plan, participants elect to make voluntary

pre-tax contributions that are % matched by Nokia up to % of eligible

earnings. % of the employer’s match vests for the participants during

each of the first four years of their employment. Participants earning in

excess of the Internal Revenue Service (IRS) eligible earning limits may

participate in the Nokia Restoration and deferral Plan, which allows em-

ployees to defer up to % of their salary and % of their short-term

variable incentive. Contributions to the Restoration and Deferral Plan

are matched % up to % of eligible earnings, less contributions made

to the (k) plan. The company’s contributions to the plan are included

under “All Other Compensation Column” and noted hereafter.

All other compensation for Ms. Pentland in includes: EUR com-

pany contributions to the (k) Plan and EUR provided under Nokia’s

international assignment policy in the UK.

All other compensation for Mr. Halbherr in includes: EUR

company contributions to the German Pension Plan and EUR for car,

fuel, account maintenance and health insurance and EUR for partici-

pation in a health assessment and leadership performance program.

All other compensation for Ms. Harlow in includes: EUR

company’s contributions to the UK Pension Plan; EUR for car and fuel

and EUR for health insurance; EUR service award and EUR

for participation in a health assessment and leadership performance

program.

A signifi cant portion of equity grants presented in the below

Summary compensation table to the named executive offi cers

are tied to the performance of the company and aligned with

the value delivered to shareholders. Therefore, the amounts

shown are not representative of the amounts that will actually

be earned and paid out to each named executive offi cer (but

rather the accounting grant date fair value of each applica-

ble grant, which is required to be reported in the Summary

compensation table). In fact, for each of the years reported,

the compensation “realized” by each named executive of-

fi cer is lower than the amount required to be reported in the

Summary compensation table.