Nokia 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

24

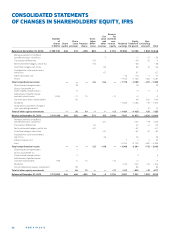

CONSOLIDATED STATEMENTS

OF FINANCIAL POSITION, IFRS

2013

December 31 Notes EURm EURm

ASSETS

Non-current assets

Goodwill 14 3295 4876

Other intangible assets 14 296 647

Property, plant and equipment 15 566 1 431

Investments in associated companies 16 65 58

Available-for-sale investments 17 741 689

Deferred tax assets 26 890 1 279

Long-term loans receivable 17,35 96 125

Other non-current assets 99 218

6048 9323

Current assets

Inventories 19, 21 804 1 538

Accounts receivable, net of allowances for doubtful accounts

(2013: EUR 124million, 2012:EUR 248 million) 17, 21, 35 2901 5 551

Prepaid expenses and accrued income 20 660 2 682

Current income tax assets 146 495

Current portion of long-term loans receivable 17, 35 29 35

Other fi nancial assets 17,18,35 285 451

Investments at fair value through profi t and loss, liquid assets 17, 35 382 415

Available-for-sale investments, liquid assets 17, 35 956 542

Available-for-sale investments, cash equivalents 17, 35 3957 5 448

Bank and cash 35 3676 3 504

13796 20661

Assets held for sale 15, 17 89 —

Assets of disposal groups classifi ed as held for sale 3 5258 —

Total assets 25 191 29 984

SHAREHOLDERS’ EQUITY AND LIABILITIES

Capital and reserves attributable to equity holders of the parent

Share capital 24 246 246

Share issue premium 615 446

Treasury shares, at cost – 603 – 629

Translation diff erences 23 434 746

Fair value and other reserves 22 80 – 5

Reserve for invested non-restricted equity 3 115 3136

Retained earnings 2 581 3997

6 468 7937

Non-controlling interests 192 1302

Total equity 6 660 9239

Non-current liabilities

Long-term interest-bearing liabilities 17, 35 3 286 5 087

Deferred tax liabilities 26 195 701

Other long-term liabilities 630 997

Provisions 28 242 304

4 353 7089

Current liabilities

Current portion of long-term loans 17, 35 3 192 201

Short-term borrowings 17, 35 184 261

Other fi nancial liabilities 17, 18, 35 35 90

Current income tax liabilities 13 484 499

Accounts payable 17,35 1842 4394

Accrued expenses and other liabilities 27 3033 6223

Provisions 28 680 1988

9 450 13 656

Liabilities of disposal groups classifi ed as held for sale 3 4 728 —

Total shareholders’ equity and liabilities 25 191 29 984

* December , reflects the retrospective application of Revised IAS , Employee Benefits.

See Notes to Consolidated Financial Statements.

2012 *