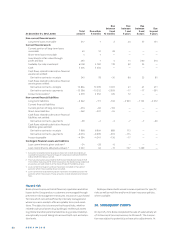

Nokia 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2013

74

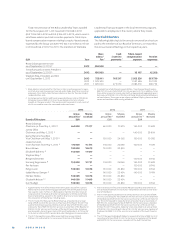

2013, EURm USD JPY CNY INR

FX derivatives used as

cashfl ow hedges

(net amount) 1 – 409 – 232 — —

FX derivatives used as

net investment hedges

(net amount) 2 – 724 – 14 – 358 – 157

FX exposure from

balance sheet items

(net amount) 3 – 217 36 – 47 – 141

FX derivatives not

designated in a hedge

relationship and carried

at fair value through

profi t and loss

(net amount) 3 – 367 – 116 81 57

Cross currency / interest

rate hedges 390 — — —

2012, EURm USD JPY CNY INR

FX derivatives used as

cashfl ow hedges

(net amount) 1 550 – 281 — —

FX derivatives used as

net investment hedges

(net amount) 2 – 281 – 16 – 1043 – 763

FX exposure from

balance sheet items

(net amount) 3 1 156 38 263 – 539

FX derivatives not

designated in a hedge

relationship and carried

at fair value through

profi t and loss

(net amount) 3 – 1439 106 – 114 420

Cross currency / interest

rate hedges 428 — — —

The FX derivatives are used to hedge the foreign exchange risk from fore-

cast highly probable cashflows related to sales, purchases and business

acquisition activities. In some of the currencies, especially in US dollar,

Nokia has substantial foreign exchange risks in both estimated cash

inflows and outflows, which have been netted in the table. The underlying

exposures for which these hedges are entered into are not presented in

the table, as they are not financial instruments.

The FX derivatives are used to hedge the Group’s net investment expo-

sure. The underlying exposures for which these hedges are entered into

are not presented in the table, as they are not financial instruments.

The balance sheet items and some probable forecast cash flows which

are denominated in foreign currencies are hedged by a portion of FX

derivatives not designated in a hedge relationship and carried at fair value

through profit and loss.

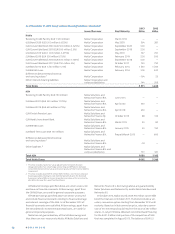

The VaR fi gures for the Group’s fi nancial instruments which

are sensitive to foreign exchange risks are presented in the

table below. The VaR calculation includes foreign currency

denominated monetary fi nancial instruments such as:

■ Available-for-sale investments, loans and accounts receiv-

able, investments at fair value through profi t and loss, cash,

loans and accounts payable.

■ FX derivatives carried at fair value through profi t and loss

which are not in a hedge relationship and are mostly used

for hedging balance sheet foreign exchange exposure.

■ FX derivatives designated as forecasted cash fl ow hedges

and net investment hedges. Most of the VaR is caused by

these derivatives as forecasted cash fl ow and net invest-

ment exposures are not fi nancial instruments as defi ned

under IFRS and thus not included in the VaR calculation.

VaR from fi nancial instruments, EURm 2013 2012

At December 31 42 67

Average for the year 114 128

Range for the year 42 – 188 67 – 192

Interest rate risk

The Group is exposed to interest rate risk either through

market value fl uctuations of balance sheet items (i.e. price risk)

or through changes in interest income or expenses (i.e. refi -

nancing or reinvestment risk). Interest rate risk mainly arises

through interest bearing liabilities and assets. Estimated

future changes in cash fl ows and balance sheet structure also

expose the Group to interest rate risk.

The objective of interest rate risk management is to balance

uncertainty caused by fl uctuations in interest rates and net

long-term funding costs.

At the reporting date, the interest rate profi le of the

Group’s interest-bearing assets and liabilities is presented in

the table below:

2013 2012

Fixed Floating Fixed Floating

EURm rate rate rate rate

Assets 4 400 4 739 3 488 6 627

Liabilities – 5947 – 630 – 4191 – 1312

Assets and liabilities

before derivatives – 1547 4109 – 703 5315

Interest rate

derivatives 954 – 926 1880 – 1784

Assets and liabilities

after derivatives – 593 3183 1177 3531

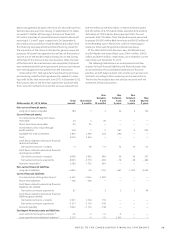

The interest rate exposure of the Group is monitored and

managed centrally. Nokia uses the VaR methodology com-

plemented by selective shock sensitivity analyses to assess

and measure the interest rate risk of interest-bearing assets,

interest-bearing liabilities and related derivatives, which

together create the Group’s interest rate exposure. The VaR

for the Group interest rate exposure in the investment and

debt portfolios is presented in the table below. Sensitivities to

credit spreads are not refl ected in the below numbers.

‘

EURm 2013 2012

At December31 42 22

Average for the year 45 19

Range for the year 20 – 84 9 – 44

Equity price risk

Nokia’s exposure to equity price risk is related to certain pub-

licly listed equity shares.

The fair value of these investments at December ,

was EUR million (EUR million in ). The VaR for the

Group equity investment in publicly traded companies is insig-

nifi cant. The private funds where the Group has investments