Nokia 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA

IN 2013

Table of contents

-

Page 1

NOKIA IN 2013 -

Page 2

-

Page 3

... of the Annual Accounts 2013 and proposal for distribution of proï¬t ...99 Auditors' report ...100 ADDITIONAL INFORMATION Critical accounting policies ...102 Corporate governance statement Corporate governance ...108 Board of Directors ...114 Nokia Group Leadership Team ...117 Compensation of the... -

Page 4

...FOR NOKIA 7.8. 3.6. Nokia's new manufacturing facility in Hanoi, Vietnam starts customer shipments. 9.7. HERE introduces HERE Drive + for all Windows Phone 8 smartphones. Nokia completes the acquisition of Siemens' stake in Nokia Siemens Networks and renames the business Nokia Solutions and Networks... -

Page 5

... network. Other major deals won by NSN in 2013 include e.g. China Mobile and China Telecommunications Corporation. 30.8. HERE introduces the Connected Driving solution. 3.9. Nokia announces the sale of substantially all of its Devices & Services business to Microsoft and changes in its leadership... -

Page 6

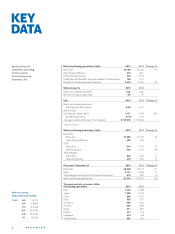

... Reporting Standards, IFRS. Nokia continuing operations, EURm Net sales Operating proï¬t/loss Proï¬t/loss before tax Proï¬t/loss attributable to equity holders' of the parent Research and development expenses Nokia Group, % Return on capital employed Net debt to equity (gearing) EUR 2013... -

Page 7

... the Mobile Phones and Smart Devices business units as well as an industry-leading design team, operations including Nokia Devices & Services production facilities, Devices & Services-related sales and marketing activities, and related support functions. Also, in conjunction with the closing of... -

Page 8

... the businesses and reportable segments as they were named at December , . However, the terms "Networks" and "Nokia Solutions and Networks, or "NSN " and the terms "Technologies" and "Advanced Technologies" may be used interchangeably in this annual report. Board work The Nokia Board of Directors... -

Page 9

...HERE had to our Discontinued operations (formerly Devices & Services business) that used certain HERE services in its mobile devices. After the closing of the Sale of the D&S Business HERE no longer generates such internal sales, however it will continue to recognize deferred revenue related to this... -

Page 10

...and EUR - . (diluted) in . CASH FLOW AND FINANCIAL POSITION The following chart sets out Nokia's continuing operations cash ï¬,ow for the ï¬scal years and , as well as the yearon-year growth rates. YoY EUR m 2013 2012 Change Net cash from operating activities Total cash and other liquid assets Net... -

Page 11

... cash out ï¬,ow of approximately EUR . billion. RESULTS BY SEGMENTS Nokia Solutions and Networks The following table sets forth selective line items for the ï¬scal years and . YoY EUR m 2013 2012 Change Net sales Cost of sales Gross proï¬t Research and development expenses Selling and marketing... -

Page 12

... with NSN 's focused strategy, most notably LTE . NSN 's sales and marketing expenses decreased ï ‰% yearon-year in to EUR million from EUR million in , primarily due to structural cost savings from NSN 's restructuring program and a decrease in purchase price accounting related items arising from... -

Page 13

... due to proportionally higher sales of update units to vehicle customers which generally carry a lower gross margin, partially off set by lower costs related to service delivery. OPERATING EXPENSES % to EUR ï ‰ million in , compared to EUR million in . HERE internal net sales decreased ï ‰% to EUR... -

Page 14

... costs of EUR million related to the Sale of D&S Business to Microsoft, partially off set by decreased restructuring charges. GROSS MARGIN Discontinued operations gross margin improved to . % in compared to . % in . The increase in gross margin in was primarily due to a higher Smart Devices... -

Page 15

... support systems (OSS) portfolio and related integration services; Zain Kuwait deployed our Customer Experience Management (CEM) solution, and our CEM contract with Beijing Mobile was extended. MAIN EVENTS IN 2013 Nokia â- Nokia completed the acquisition of Siemens' stake in Nokia Siemens Networks... -

Page 16

... Quadrant for LTE Network Infrastructure, for the second consecutive year. further strengthened the Windows Phone ecosystem by making the suite available for all Windows Phone devices. Technologies operating highlights â- Nokia was one of the founding industrial partners and board members for the... -

Page 17

... Nokia Group Leadership Team and President and CEO Pursuant to the Articles of Association, Nokia Corporation has a Board of Directors composed of a minimum of seven and a maximum of members. The members of the Board are elected for a one-year term at each Annual General Meeting, i.e. from the close... -

Page 18

... changes took place in the Nokia Leadership Team (as of May , renamed to Nokia Group Leadership Team): â- Stephen Elop stepped aside as President and CEO while continuing as a member of the Nokia Leadership Team as Executive Vice President, Devices & Services, effective as of September , . He... -

Page 19

... own shares, as well as information on related party transactions, the shareholders, stock options, shareholders' equity per share, dividend yield, price per earnings ratio, share prices, market capitalization, share turnover and average number of shares are available in the Annual Accounts and... -

Page 20

... new sources of revenue. â- Our sales, proï¬tability and cash ï¬,ow are dependent on the development of the mobile and communications industry in numerous diverse markets, as well as on general economic conditions globally and regionally. â- Networks is dependent on a limited number of customers... -

Page 21

...Board of Directors, Nokia Corporation April , As part of the overall capital structure optimization program, Nokia Board of Directors proposes to the Annual General Meeting, scheduled to take place on June , (Annual General Meeting ), the recommencement of ordinary dividend payments to shareholders... -

Page 22

20 NOK I A IN 2013 -

Page 23

... sheets, parent company, FAS ...82 Statements of cash ï¬,ows, parent company, FAS ...83 Notes to the ï¬nancial statements of the parent company ...84 Nokia shares and shareholders ...90 Nokia Group 2009 - 2013, IFRS ...96 Calculation of key ratios ...98 Signing of the Annual Accounts 2013 and... -

Page 24

...Continuing operations Net sales Cost of sales Gross proï¬t Research and development expenses Selling and marketing expenses Administrative and general expenses Impairment of goodwill Other income Other expenses Operating proï¬t (+)/loss (-) Share of results of associated companies Financial income... -

Page 25

... of the parent non-controlling interests Total comprehensive income(+)/expense (-) attributable to equity holders of the parent arises from: Continuing operations Discontinued operations 34 - 897 - 863 * Full years and reflect the retrospective application of Revised IAS ï ‰, Employee Benefits. 22... -

Page 26

... to equity holders of the parent Share capital Share issue premium Treasury shares, at cost Translation differences Fair value and other reserves Reserve for invested non-restricted equity Retained earnings Non-controlling interests Total equity Non-current liabilities Long-term interest... -

Page 27

... sale of ï¬ xed assets Dividends received Net cash used in/from investing activities Cash ï¬,ow from ï¬nancing activities Other contributions from shareholders Purchase of a subsidiary's equity instruments Proceeds from long-term borrowings Repayment of long-term borrowings Repayment of short-term... -

Page 28

...' EQUITY, IFRS Number Transof Share lation shares Share issue Treasury diff er(1 000's) capital premium shares ences Reserve Fair for value invested and nonother restrict. reserves equity Equity NonRetained holders of controlling earnings the parent interests Total Balance at December 31, 2010... -

Page 29

... bond - conversion to equity Total of other equity movements Balance at December 31, 2013 Dividends declared per share were EUR . Reserve Fair for value invested and nonother restrict. reserves equity -5 55 3 136 Equity NonRetained holders of controlling earnings the parent interests 3 997 7 937... -

Page 30

... three businesses: Devices & Services, HERE and Nokia Siemens Networks, also referred to as NSN. For ï¬nancial reporting purposes, the Group previously reported four operating segments: Smart Devices and Mobile Phones within the Devices & Services business, HERE and Nokia Siemens Networks. On... -

Page 31

.... and loss in the periods when the costs are incurred and the related services are received. Identiï¬able assets acquired and liabilities assumed by the Group are measured separately at their fair value as of the acquisition date. Non-controlling interests in the acquired business are measured... -

Page 32

...exchange gains and losses related to noncurrent available-for-sale investments are recognized in other comprehensive income. FOREIGN GROUP COMPANIES Discontinued operations and assets held for disposal Discontinued operations are reported when a component of an entity comprising operations and cash... -

Page 33

...with software and services related revenue recognized on a straight-line basis over their respective terms. Also within the Devices & Services business, estimated reductions to revenue are recorded for special pricing agreements and other volume based discounts at the time of sale. Sales adjustments... -

Page 34

... interest by using quoted market rates, discounted cash ï¬,ow analyses and other appropriate valuation models. The Group uses valuation techniques that are appropriate in the circumstances and for which su fficient data are available to measure fair value, maximizing the use of relevant observable... -

Page 35

... the Group's right to receive payment is established. When the investment is disposed of, the related accumulated changes in fair value are released from shareholders' equity and recognized in proï¬t and loss. The weighted average method is used when determining the cost basis of publicly listed... -

Page 36

... valuation model. Changes in the fair value on these instruments are recognized in proï¬t and loss. Fair values of forward rate agreements, interest rate options, futures contracts and exchange traded options are calculated based on quoted market rates at each balance sheet date. Discounted cash... -

Page 37

... in fair value from qualifying hedges are released from fair value and other reserves to proï¬t and loss as adjustments to sales and cost of sales when the hedged cash ï¬,ow affects proï¬t and loss. Forecast foreign currency sales and purchases affect proï¬t and loss at various dates up to... -

Page 38

... on the expected cost of executing any such contractual and other commitments. Share-based compensation The Group offers three types of global equity settled sharebased compensation schemes for employees: stock options, performance shares and restricted shares. Employee services received, and the... -

Page 39

.... The Group has also issued certain stock options which are accounted for as cash-settled. Related employee services received, and the liability incurred, are measured at the fair value of the liability. The fair value of stock options is estimated based on the reporting date market value less the... -

Page 40

... unit discounted to present value. The key assumptions applied in the determination of recoverable amount include discount rate, length of an explicit forecast period, estimated growth rates, proï¬t margins and level of operational and capital investment. Amounts estimated could differ materially... -

Page 41

...ned beneï¬t pension plans and other long-term employee beneï¬ts is dependent on the Group's selection of certain assumptions which are used by actuaries in calculating such amounts. Those assumptions include, among others, the discount rate and annual rate of increase in future compensation levels... -

Page 42

... sales from both intellectual property right activities and technology licensing. Corporate Common Functions consists of company-wide functions. Devices & Services business focuses on developing and selling smartphones powered by the Windows Phone system, feature phones and affordable smart phones... -

Page 43

... loss of Net sales to external customers by geographic area by location of customer, EURm Finland 4 United States Japan China India Germany Brazil Russia Indonesia Other Total Segment non-current assets by geographic area 5, EURm 2013 594 1 542 1 388 896 656 609 511 421 410 5 682 12 709 2012... -

Page 44

... development, management and marketing of feature phone products, services and applications. Devices & Services Other includes net sales related to spare parts, related cost of sales and operating expenses and operating results of Vertu through October , , the date of divestment of the business... -

Page 45

... 856 January 1, 2011 shareholders' equity EUR m Total equity Equity attributable to equity holders of parent Equity attributable to non-controlling interests For the year ended and as of December 31, 2011 EUR m Nokia Group reported 16 231 14 384 1 847 Nokia Group reported Nokia AdjustGroup ments... -

Page 46

.... United Kingdom The Group has a UK deï¬ned beneï¬t plan divided into two sections: the money purchase section and the ï¬nal salary section, both being closed to future contributions and accruals as of April , . Individual beneï¬ts are generally dependent on eligible compensation levels and... -

Page 47

...: Employers Plan participants Payments from plans: Beneï¬t payments Acquired in a business combination Other movements Balance at December, 2012 Balance at January 1, 2013 Transfer to discontinued operations Current service cost Interest expense (-)/income (+) Past service cost and gains and losses... -

Page 48

... present values Annual rate of increase in future compensation levels Pension growth rate Inï¬,ation rate Life expectancy 1.0% 173 -225 2013 2012 2011 1.0% 1.0% 1.0% 1 year - 24 - 127 - 136 - 27 21 123 126 26 Remeasurements Return on plan assets (excl. interest income), gain (+)/loss... -

Page 49

... in the process used by the Group to manage its risk from prior periods. Disaggregation of plan assets Pension assets are comprised as follows: 2013 Quoted Unquoted EUR m EUR m Asset category Equity securities Debt securities Insurance contracts Real estate Short-term investments Others Total... -

Page 50

... Sale of the D&S business to Microsoft, as well as Nokia's acquisition of the Siemens' stake in NSN, the Group reviewed the structure of its CGUs. In consequence of the Purchase Agreement with Microsoft, the Smart Devices and Mobile Phones CGUs have been combined to a single Devices & Services CGU... -

Page 51

... information has been included for the Devices & Services CGU as the recoverable amount was not determined using a discounted cash ï¬,ow analysis and the CGU is attributable to discontinued operations: Cash-generating unit Radio Access Networks group of CGUs in Mobile Broadband 1 2013 1.5 10.8 2012... -

Page 52

...at fair value less cost of disposal. Furthermore, the Group recognized impairment losses of EUR million related to certain properties attributable to Corporate Common Functions. (renamed Nokia Solutions and Networks) for a consideration of EUR million. Cash of EUR million was paid at the closing of... -

Page 53

... related to funding the purchase of NSN non-controlling interest from Siemens. During , interest income decreased mainly as a result of lower cash levels than in and lower interest rates in certain currencies where the Group has investments. During foreign exchange gains (or losses) were positively... -

Page 54

... PLANT AND EQUIPMENT 2013 1 028 - 284 -6 - 738 - 1 028 284 6 - - 738 - - 2012 1 035 - -7 - 1 028 - 1 029 - 7 -6 - 1 028 6 - EUR m 2013 2012 62 4 - 25 33 62 33 Capitalized development costs Acquisition cost January 1 Transfer to assets held for sale Retirements during the period Disposals... -

Page 55

... IN ASSOCIATED COMPANIES EUR m 2013 58 -1 9 - - 4 -5 65 2012 67 3 1 -4 -8 -1 - 58 Net carrying amount January 1 Translation differences Additions Deductions Impairments (Note 9) Share of results Dividend Net carrying amount December 31 Shareholdings in associated companies are comprised... -

Page 56

... of long-term loans payable 2 Short-term borrowing Other ï¬nancial liabilities Accounts payable Total ï¬nancial liabilities At December 31, 2012, EURm Available-for-sale investments, publicly quoted equity shares Available-for-sale investments, carried at fair value Available-for-sale investments... -

Page 57

... the valuation methods used to determine fair values of ï¬nancial instruments that are measured at fair value on a recurring basis: Instruments with quoted prices in active markets (Level 1) At December 31, 2013, EURm Available-for-sale investments, publicly quoted equity shares Available-for-sale... -

Page 58

...taking into account Nokia's divestment strategy for these assets as well as relevant market dynamics. This evaluation includes non-market observable inputs and hence these assets are considered to be level category assets that are measured at fair value on a non-recurring basis. 56 NOK I A IN 2013 -

Page 59

...to write-down the inventories to net realizable value. The write-down relates to discontinued operations inventories. 20. PREPAID EXPENSES AND ACCRUED INCOME - 18 - -6 - 48 -1 - 90 3 337 - 289 513 9 8 488 EUR m 2013 286 43 33 14 15 269 660 2012 875 71 45 145 34 1 512 2 682 Social security, VAT... -

Page 60

...31, 2010 Pension remeasurements: Remeasurements of deï¬ned beneï¬t plans Cash ï¬,ow hedges: Net fair value gains (+)/losses (-) Transfer of gains (-)/losses (+) to proï¬t and loss account as adjustment to net sales Transfer of gains (-)/losses (+) to proï¬t and loss account as adjustment to cost... -

Page 61

... maximum share capital or a par value of a share. At the Annual General Meeting held on May , , Nokia shareholders authorized the Board of Directors to issue a maximum of million shares through one or more issues of shares or special rights entitling to shares, including stock options. The Board of... -

Page 62

... granted by the Annual General Meeting on May , . At the Annual General Meeting held on May , , Nokia shareholders authorized the Board of Directors to repurchase a maximum of million Nokia shares by using funds in the unrestricted equity. Nokia did not repurchase any shares on the basis of this... -

Page 63

... date on which the subscribed shares are entered in the Trade Register. The stock option grants are generally forfeited if the employment relationship terminates with Nokia. Unvested stock options for employees who have transferred to Microsoft following the sale of Devices & Services business have... -

Page 64

...Performance shares outstanding Plan at threshold 1 2010 2011 2012 2013 - - 4 476 263 6 513 941 Number of participants (approx.) 3 000 2 200 2 800 3 500 Performance period 2010 - 2012 2011 - 2013 2012 - 2013 2 2013 - 2014 3 Settlement 2013 2014 2015 2016 Shares under Performance Share Plan vested... -

Page 65

... other than global equity plans. For further information see "Other equity plans for employees" below. The fair value of performance shares is estimated based on the grant date market price of the Nokia share less the present value of dividends expected to be paid during the vesting period. Includes... -

Page 66

...was offered in to Nokia employees working for Devices & Services business, HERE , Advanced Technologies and Corporate Common Functions. Under the plan employees make monthly contributions from their salary to purchase Nokia shares on a monthly basis during a -month savings period. Nokia offers one... -

Page 67

..., sales and marketing practices, commercial disputes, employment, and wrongful discharge, antitrust, securities, health and safety, environmental, tax, international trade and privacy matters. As a result, the Group may become subject to substantial liabilities that may not be covered by insurance... -

Page 68

...of payments made within Nokia for the supply of operating software from its parent company in Finland. Subsequently, Indian authorities have extended the investigation to other related tax consequences, such as allegations claiming that Nokia Corporation would have a permanent establishment in India... -

Page 69

...the US Employee Retirement Income Security Act (" ERISA") entitled Romero v. Nokia was ï¬led in the United States District Court for the Southern District of New York. The complaint named Nokia Corporation, certain Nokia Corporation Board members, Fidelity Management Trust Co., The Nokia Retirement... -

Page 70

... bonds, where dilutive - Proï¬t used to determine diluted earnings per share Continuing operations Discontinued operations Total Group Denominator/1 000 shares Basic: Weighted average number of shares in issue Stock options Performance shares Restricted shares and other Assumed conversion of... -

Page 71

... following table sets forth the salary and cash incentive information awarded and paid or payable by the Group to the Chief Executive O fficer and President of Nokia Corporation for ï¬scal years - , share-based compensation expense relating to equity-based awards, expensed by the Group as well as... -

Page 72

.... Total sharebased compensation expense relating to equity-based awards in (EUR expensed by the Group was EUR ï ‰ in and EUR in ). The members of the Nokia Leadership Team participate in the local retirement programs applicable to employees in the country where they reside. Board of Directors The... -

Page 73

...the role of Executive Vice President, Devices & Services. He also resigned from his position as a member of Board of Directors as of the same date. After the closing of the Sale of D&S Business, he transferred to Microsoft as agreed with Microsoft. In accordance with his service contract he received... -

Page 74

...and Networks B.V. Nokia Solutions and Networks Oy Nokia Solutions and Networks US LLC Nokia Solutions and Networks Japan Corp. Nokia Solutions and Networks India Private Limited The Hague, Netherlands Helsinki, Finland Holding company Sales and manufacturing company Sales company Sales company Sales... -

Page 75

...to identify risks, which prevent Nokia from reaching its objectives. Risk management covers strategic, operational, ï¬nancial and hazard risks. Key risks and opportunities are reviewed by the Nokia Leadership team and the Board of Directors in order to create visibility on business risks as well as... -

Page 76

...Sensitivities to credit spreads are not reï¬,ected in the below numbers. ' EUR m 2013 2012 At December 31 Average for the year Range for the year 42 45 20 - 84 22 19 9 - 44 Equity price risk Nokia's exposure to equity price risk is related to certain publicly listed equity shares. The fair value of... -

Page 77

...180 days Business related credit risk The Company aims to ensure the highest possible quality in accounts receivable and loans due from customers and other third parties. Nokia and NSN Credit Policies, both approved by the respective Leadership Teams, lay out the framework for the management of the... -

Page 78

... contractual or legal obligations. Bank parent company ratings used here for bank groups. In some emerging markets countries actual bank subsidiary ratings may differ from parent company rating. ï ‰ % of Nokia's cash in bank accounts is held with banks of investment grade credit rating (ï ‰ % for... -

Page 79

... Securities and Exchange Commission Euro Medium-Term Note Program, totaling EUR 5 000 million The most signiï¬cant existing short-term funding programs as of December Issuer(s) Nokia Corporation Nokia Corporation Nokia Corporation and Nokia Finance International B.V. Nokia Solutions and Networks... -

Page 80

... , Group's interest bearing liabilities consisted of: Issuer/Borrower Final Maturity March 2016 May 2039 September 2020 September 2019 May 2019 February 2019 September 2018 October 2017 February 2014 February 2014 2013 EUR m 2012 EUR m Nokia Revolving Credit Facility (EUR 1 500 million) USD Bond... -

Page 81

... portion of long-term loans receivable Short-term loans receivable Investments at fair value through proï¬t and loss Available-for-sale investment Cash Cash ï¬,ows related to derivative ï¬nancial assets net settled: Derivative contracts - receipts Cash ï¬,ows related to derivative ï¬nancial... -

Page 82

... cost and retention levels. Nokia purchases both annual insurance policies for speciï¬c risks as well as multiline and/or multiyear insurance policies, where available. 36. SUBSEQUENT EVENTS On April , Nokia completed the sale of substantially all of its Devices & Services business to Microsoft... -

Page 83

...be materially compensated for any retained liabilities. In India, our manufacturing facility remains part of Nokia following the closing of the transaction. Nokia and Microsoft have entered into a service agreement whereby Nokia would produce mobile devices for Microsoft for a limited time. In Korea... -

Page 84

... sales Cost of sales Gross proï¬t Selling and marketing expenses Research and development expenses Administrative expenses Other operating expenses Other operating income Operating proï¬t Financial income and expenses Income from long-term investments Dividend income from Group companies Dividend... -

Page 85

... December 31 Cash ï¬,ow from operating activities Net loss Adjustments, total 2013 Notes 2012 EURm EUR m SHAREHOLDERS' EQUITY AND LIABILITIES Shareholders' equity Share capital Share issue premium Treasury shares Fair value reserve Reserve for invested non-restricted equity Retained earnings... -

Page 86

... Total share-based compensation expense relating to equity-based in awards expensed by the company was EUR ï ‰ (EUR in and EUR in ). The members of the Nokia Leadership Team participate in the local retirement programs applicable to employees in the country where they reside. Board of Directors The... -

Page 87

...the role of Executive Vice President, Devices & Services. He also resigned from his position as a member of Board of Directors as of the same date. After the closing of the Sale of D&S Business, he transferred to Microsoft as agreed with Microsoft. In accordance with his service contract he received... -

Page 88

... Selling, marketing and administration Total Capitalized development costs Acquisition cost January 1...end of and the parent company had only minor amounts of tangible assets. These assets were leased from Nokia Asset Management Oy, a company wholly owned by Nokia Corporation. 86 NOK I A IN 2013 -

Page 89

...Parent Company, EURm Balance at December 31, 2010 Other contribution from shareholders Total 6 334 46 7 68 - 1 484 1 542 6 513 3 - 114 - 743 - 154 5 505 5 27 - - 569 4 968 Settlement of performance and restricted shares Fair value reserve increase Dividend Net proï¬t Balance at December 31, 2011... -

Page 90

... Long-term liabilities, total Bonds 2009 - 2014 2009 - 2019 2009 - 2019 2009 - 2039 Million 1 250 EUR 1 000 USD 500 EUR 500 USD Interest, % 5.534 * 5.572 6.792 6.775 12. LOANS GRANTED TO THE MANAGEMENT OF THE COMPANY There were no loans granted to the members of the Group Executive Board and Board... -

Page 91

...-line item on the face of the income statement. 19. DEFERRED TAXES EUR m 2013 - - 2012 - 475 - 475 Deferred taxes Total No deferred tax asset has been recognized for tax losses carry forward, temporary differences and tax credits due to uncertainty of utilization of these items. N OT E S TO... -

Page 92

..., warrants or stock options. Other authorizations At the Annual General Meeting held on May , , Nokia shareholders authorized the Board of Directors to repurchase a maximum of million Nokia shares by using funds in the unrestricted equity. Nokia did not repurchase any shares on the basis of this... -

Page 93

... the Annual General Meeting convening on June , authorize the Board to resolve to repurchase a maximum of million Nokia shares. The proposed maximum number of shares that may be repurchased corresponds to less than % of all the shares of the Company. The shares may be repurchased in order to develop... -

Page 94

... Plan 2010 2Q Nokia Stock Option Plan 2010 3Q Nokia Stock Option Plan 2010 4Q Total 24.15 19.16 17.80 12.43 9.82 11.18 9.28 8.76 10.11 8.86 7.29 7.59 18.39 21.86 27.53 24.15 19.16 17.80 12.43 9.82 11.18 9.28 8.76 10.11 8.86 7.29 7.59 EUR Number of new shares... -

Page 95

... 5.82 Share prices, USD (New York Stock Exchange) ADS Low/high Average 1 Year-end Calculated by weighting average price with daily volumes. 2013 3.02/8.18 4.82 8.11 2012 1.63/5.87 3.41 3.95 2011 4.46/11.75 7.13 4.82 2010 8.00/15.89 11.11 10.32 2009 8.47/16.58 13.36 12.85 Nokia share prices on... -

Page 96

... the total number of shares in Nokia. , Largest shareholders registered in Finland, December , Total number of shares (1 000) 85 394 61 394 29 500 23 506 14 304 13 506 12 463 10 200 9 768 8 250 Shareholder Varma Mutual Pension Insurance Company Ilmarinen Mutual Pension Insurance Company The State... -

Page 97

NOKIA SHARES AND SHAREHOLDERS 95 -

Page 98

... Inventories Accounts receivable and prepaid expenses Total cash and other liquid assets Assets held for sale Assets of disposal groups classiï¬ed as assets held for sale Total equity Capital and reserves attributable to the Company's equity holders Non-controlling interests Long-term liabilities... -

Page 99

...sales Taxes, EUR m Dividends 2, EUR m Capital expenditure, EUR m % of net sales Gross investments 3, EUR m % of net sales R&D expenditure, EUR m % of net sales Average personnel Non-interest bearing liabilities, EUR m Interest-bearing liabilities, EUR m Return on capital employed, % Return on equity... -

Page 100

... Number of shares traded during the period Average number of shares during the period Return on capital employed, % Proï¬t before taxes + interest and other net ï¬nancial expenses Average capital and reserves attributable to the Company's equity holders + short-term borrowings + long-term interest... -

Page 101

...ACCOUNTS 2013 AND PROPOSAL BY THE BOARD OF DIRECTORS FOR DISTRIBUTION OF PROFIT The distributable funds in the balance sheet of the Company at December , amounted to EUR million. The Board proposes to the Annual General Meeting that from the retained earnings an ordinary dividend of EUR , per share... -

Page 102

... view in accordance with the laws and regulations governing the preparation of the ï¬nancial statements and the review by the Board of Directors in Finland. The Board of Directors is responsible for the appropriate arrangement of the control of the company's accounts and ï¬nances, and the Managing... -

Page 103

... policies ...102 Corporate governance statement Corporate governance ...108 Board of Directors ...114 Nokia Group Leadership Team ...117 Compensation of the Board of Directors and the Nokia Group Leadership Team ...119 Auditor fees and services ...140 Investor information ...141 Contact information... -

Page 104

... criteria described above generally results in recognition of hardware related revenue at the time of delivery with software and services related revenue recognized on a straight-line basis over their respective terms. REVENUE RECOGNITION Revenues within the Group are generally recognized when the... -

Page 105

... warranty provision was EUR ï ‰ million at the end of . The ï¬nancial impact of the assumptions regarding this provision mainly affects the cost of sales of the Nokia Solutions and Networks business and the results from discontinued operations through the Devices & Services business. CUSTOMER... -

Page 106

...ows and out ï¬,ows. Management determines discount rates to be used based on the risk inherent in the related activity's current business model and industry comparisons. Terminal values are based on the expected life of products and forecasted life cycle and forecasted cash ï¬,ows over that period... -

Page 107

... value less cost of disposal are categorized as level of the fair value hierarchy. Discounted cash ï¬,ows for the Nokia Solutions and Networks groups of CGUs and HERE CGU were modeled over ten annual periods. The growth rates used in transition to terminal year reï¬,ect estimated long term stable... -

Page 108

...market share, customer adoption of the new location-based platform and related service offerings, projected value of the services sold to Microsoft and assumptions regarding pricing as well as continued focus on cost efficiency are the main drivers for the HERE net cash ï¬,ow projections. The Group... -

Page 109

CRITICAL ACCOUNTING POLICIES 107 -

Page 110

...Limited Liability Companies Act and Nokia's Articles of Association, the control and management of Nokia is divided among the shareholders at a general meeting, the Board of Directors (the "Board"), the President and CEO and the Nokia Group Leadership Team, chaired by the President and CEO. General... -

Page 111

...internal control and risk management systems in relation to the ï¬nancial reporting process" below. The Board has the responsibility for appointing and discharging the President and Chief Executive O fficer (CEO), the Chief Financial O fficer and the other members of the Nokia Group Leadership Team... -

Page 112

... rules of the New York Stock Exchange due to his position as interim CEO from September , . Nokia does not have a policy concerning the combination or separation of the roles of the Chairman and the President and CEO, but the Board leadership structure is dependent on the company needs, shareholder... -

Page 113

... BOARD OF DIRECTORS The Audit Committee consists of a minimum of three members of the Board who meet all applicable independence, ï¬nancial literacy and other requirements of Finnish law and the rules of the stock exchanges where Nokia shares are listed, i.e. NASDAQ OMX Helsinki and the New York... -

Page 114

... Team can be a member of both the Board of Directors and the Nokia Group Leadership Team. The Chief Executive O fficer also acts as President, and his rights and responsibilities include those allotted to the President under Finnish law. MAIN FEATURES OF THE INTERNAL CONTROL AND RISK MANAGEMENT... -

Page 115

..., processes and locations, corporate level controls, control activities and information systems' general controls. As part of its assessment the management documented: â- The corporate-level controls, which create the "tone from the top" containing Nokia values and Code of Conduct and provide... -

Page 116

... related to the proposed Sale of the D&S business. The members of the Board of Directors are elected on an annual basis for a one-year term ending at the close of the next Annual General Meeting. The election is made by a simple majority of the shareholders' votes cast at the Annual General Meeting... -

Page 117

... of New York University). Chief Technology O fficer of The Procter & Gamble Company until February , . Various executive and managerial positions in Baby Care, Feminine Care, and Beauty Care units of The Procter & Gamble Company since ï ‰ in the United States, Germany and Japan. Member of the Board... -

Page 118

... Annual General Meeting on May , , Stephen Elop, then President and CEO, was elected as a member of the Board of Directors. Mr. Elop resigned from the Board of Directors effective as of September , . The following individuals served on Nokia Board until the close of the Annual General Meeting held... -

Page 119

...Group Leadership Team are appointed by the Board of Directors. Only the Chairman of the Nokia Group Leadership Team, the President and CEO, can be a member of both the Board of Directors and the Nokia Group Leadership Team. â- Kai Ã-istämö, formerly Executive Vice President, Corporate Development... -

Page 120

...Vice President, Sales, Markets, Nokia - ï ‰. Executive Vice President, Sales and Portfolio Management, Mobile Phones, Nokia . Senior Vice President, CDMA Business Unit, Mobile Phones, Nokia - . Vice President, Finance, Corporate Treasurer, Nokia - . Director, Corporate Finance, Nokia Vice President... -

Page 121

..., use the name "Nokia Group Leadership Team" in other connections. The terms "Nokia Leadership Team" and "Nokia Group Leadership Team" can be used interchangeably in this annual report. The compensation of the Board of Directors is resolved annually by our shareholders at our Annual General Meeting... -

Page 122

... . There were no payments under the vested Performance Share Plan to any Nokia Leadership Team members and some did not receive annual short-term variable incentive. Proposal by the Corporate Governance and Nomination Committee for compensation to the Board of Directors in 2014 On April ï ‰, , the... -

Page 123

...executive compensation Our compensation program for Nokia Group Leadership Team members includes annual cash compensation in the form of a base salary and short-term variable cash incentives, as well as long-term equity-based incentives in the form of performance shares, stock options and restricted... -

Page 124

... our named executive officers, please see "Summary compensation table ". Long-term equity-based incentives In , long-term equity-based incentives in the form of performance shares, stock options and restricted shares were used to align the Nokia Leadership Team members' interests with shareholders... -

Page 125

... vesting. Executive compensation SERVICE CONTRACT OF STEPHEN ELOP DUE TO HIS PRESIDENT AND CEO ROLE Recoupment of certain equity gains The Board of Directors has approved a policy allowing for the recoupment of equity gains realized by Nokia Group Leadership Team members under Nokia equity plans... -

Page 126

... ï ‰ ï ‰. His annual management incentive target under the Nokia short-term cash incentive program is % of annual base salary. He is eligible to participate in Nokia's long-term equity-based incentive programs according to Nokia policies and guidelines and as determined by the Board of Directors. Mr... -

Page 127

... up to months of compensation (including annual base salary, beneï¬ts, and target incentive) and cash payment(or payments) for the pxro-rated value of his outstanding unvested equity awards, including equity awards under the NSN Equity Incentive Plan, restricted shares, performance shares and stock... -

Page 128

...) and cash payment (or payments) for the pro-rated value of the individual's outstanding unvested equity, including restricted shares, performance shares, stock options and equity awards under NSN Equity Incentive Plan, payable pursuant to the terms of the agreement. The Board of Directors has the... -

Page 129

...12 58 732 2 178 678 1 162 921 2 037 879 1 315 397 Jo Harlow 8 EVP, Smart Devices The positions set forth in this table are the positions of the named executive officers as of December , . The amount consists of the annual short term variable compensation and/ or other incentives earned and paid or... -

Page 130

... date fair value 3 EUR Performance shares at threshold (number) Stock awards Performance shares at maximum (number) Grant Restricted date shares fair value 4 (number) EUR Name and principal position 2 Year Grant date Stephen Elop, EVP Devices & Services, former President and CEO 2013 2013 2013... -

Page 131

...week weighted average to mitigate any dayspeciï¬c ï¬,uctuations in Nokia's share price. The determination of exercise price is deï¬ned in the terms and conditions of the stock option plans, which were approved by the shareholders at the Annual General Meetings and . The Board of Directors does not... -

Page 132

...The Board of Directors decided not to propose stock options for the Annual General Meeting. Similarly to the earlier equity incentive programs, the Equity Program is designed to support the participants' focus and alignment with Nokia's long term success. Nokia's use of the performance-based plan as... -

Page 133

... the annual compensation reviews. The restricted shares under the Nokia Restricted Share Plan have a three-year restriction period. The restricted shares will vest and the resulting Nokia shares will be delivered in , The approximate maximum numbers of planned grants under the Nokia Equity Program... -

Page 134

... Nokia Group Leadership Team members have received equity-based compensation in the form of performance shares, restricted shares, stock options and equity awards under the Networks Equity Incentive Plan. For a description of our equity-based compensation programs for employees and executives, see... -

Page 135

... following table sets forth the number of shares and ADSs in Nokia held by members of the Nokia Leadership Team as of December , . Became Nokia Leadership Team member (year) 2010 2011 2011 2007 2011 2012 2011 2012 2012 2010 2005 and held shares Name 1 Stephen Elop Michael Halbherr Jo Harlow Timo... -

Page 136

... information relating to stock options held by members of the Nokia Leadership Team as of December , . These stock options were issued pursuant to Nokia Stock Option Plans and . For a description of our stock option plans, please see Note to our consolidated ï¬nancial statements. Number of stock... -

Page 137

... Leadership Team on December 31, 2013, Total 4 All outstanding stock option plans (global plans), Total Number of stock options equals the number of underlying shares represented by the option entitlement. Stock options granted under and Stock Option Plans have different vesting schedules. The Group... -

Page 138

... closing market price of Nokia shares on NASDAQ OMX Helsinki as at October , of EUR . . Performance shares and restricted shares of the Nokia Leadership Team The following table provides certain information relating to performance shares and restricted shares held by members of the Nokia Leadership... -

Page 139

... and for the plan on July , . The intrinsic value is based on the closing market price of a Nokia share on NASDAQ OMX Helsinki as at December , of EUR . . During , Marko Ahtisaari stepped down from the Nokia Leadership Team. The information related to performance shares and restricted shares held by... -

Page 140

... of employment as of May , in accordance with the plan rules. ï ‰ The intrinsic value is based on the closing market price of a Nokia share on NASDAQ OMX Helsinki as at October , , of EUR . . The threshold number will vest as Nokia shares, subject to the predetermined threshold performance levels... -

Page 141

... on exercise E UR 0 Performance shares awards 2 Number of shares delivered on vesting 0 Value realized on vesting E UR 0 Restricted shares awards Number of shares delivered on vesting 7 000 4 Value realized on vesting E UR 18 410 Name Marko Ahtisaari 5 as per October 31, 2013 CO M P E N S AT... -

Page 142

..., employment laws and compensation programs and tax implications on short-term international transfers). All other fees include fees billed for company establishment, forensic accounting, data security, investigations and reviews of licensing arrangements with customers, other consulting services... -

Page 143

...nancial reports, members of Nokia's management, conference call and other investor related materials, press releases as well as environmental and social information. INVESTOR RELATIONS CONTACTS [email protected] Nokia Investor Relations P.O. Box FINOKIA GROUP Finland Tel. + Nokia USA... -

Page 144

... our dependence on the development of the mobile and communications industry in numerous diverse markets, as well as on general economic conditions globally and regionally; ) our Networks business' dependence on a limited number of customers and large, multi-year contracts; ) our ability to retain... -

Page 145

CONTACT INFORMATION NOKIA HEAD OFFICE Karakaari Espoo P.O.Box , FIFINLAND Tel. + Fax + Nokia Group CO N TAC T I N FO R M AT I O N 143 -

Page 146

Copyright © 2014 Nokia Corporation. All rights reserved. Nokia and Nokia Connecting People are registered trademarks of Nokia Corporation.