IBM 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ............................................................................................. 18

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

A – E ........................................................................................................................66

F – J ........................................................................................................................86

K– Q .......................................................................................................................88

K. BORROWINGS ................................................................................................. 88

L. DERIVATIVES AND HEDGING TRANSACTIONS ................................................90

M. OTHER LIABILITIES ..........................................................................................94

N. STOCKHOLDERS’ EQUITY ACTIVITY ..............................................................95

O. CONTINGENCIES AND COMMITMENTS .........................................................97

P. TAXES ...............................................................................................................99

Q. RESEARCH, DEVELOPMENT AND ENGINEERING ......................................... 101

R –W ..................................................................................................................... 10 2

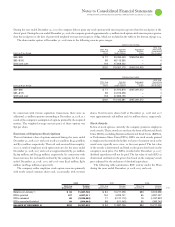

second settlement occurred on December , , resulting in a set-

tlement payment to the bank of $. million. The third settlement

occurred on March , , resulting in a settlement payment to the

company of $. million. The adjusted average price paid per share

during the ASR was $., resulting in a total purchase price of

$, million. The $ million difference was settled in cash. The

settlement amounts were paid in cash at the election of IIG in accor-

dance with the provisions of the ASR agreements and were recorded

as adjustments to stockholders’ equity in the Consolidated Statement

of Financial Position on the settlement dates.

The company issued ,, treasury shares in , ,,

treasury shares in and ,, treasury shares in , as a

result of exercises of stock options by employees of certain recently

acquired businesses and by non-U.S. employees. At December , ,

$, million of Board authorized common stock repurchases was

still available. The company plans to purchase shares on the open

market or in private transactions from time to time, depending on

market conditions. In connection with the issuance of stock as part of

the company’s stock-based compensation plans, ,, common

shares at a cost of $ million, ,, common shares at a cost of

$ million and , common shares at a cost of $ million in

, and , respectively, were remitted by employees to the

company in order to satisfy minimum statutory tax withholding

requirements. These amounts are included in the treasury stock bal-

ance in the Consolidated Statement of Financial Position and the

Consolidated Statement of Stockholders’ Equity.

() ( )

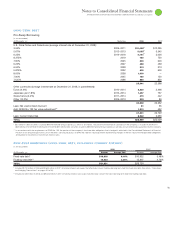

Net Unrealized Accumulated

Gains/(Losses) Foreign Currency Net Change Net Unrealized Gains/(Losses)

on Cash Flow Translation Retirement-related Gains/(Losses) on Not Affecting

($ ) Hedge Derivatives Adjustments* Benefit Plans Marketable Securities Retained Earnings

December 31, 2006 $(104) $ 2,929 $(11,846) $ 119 $ (8,901)

Change for period (123) 726 4,678 206 5,487

December 31, 2007 (227) 3,655 (7,168) 325 (3,414)

Change for period 301 (3,552) (14,856) (324) (18,431)

DECEMBER 31, 2008 $ 74 $ 103 $(22,025) $ 2 $(21,845)

* Foreign currency translation adjustments are presented gross with associated hedges shown net of tax.

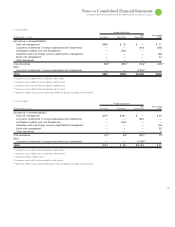

()/ ( )

($ )

For the period ended December : 2008 2007*

Net unrealized (losses)/gains arising during the period $(224) $255

Less: Net gains included in net income for the period** 100 49

NET CHANGE IN UNREALIZED (LOSSES)/GAINS ON MARKETABLE SECURITIES $(324) $206

* Reclassified to conform with 2008 presentation.

** Includes writedowns of $3.0 million and $0.5 million in 2008 and 2007, respectively.