IBM 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ............................................................................................. 18

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

A – E ........................................................................................................................66

F – J ........................................................................................................................86

K– Q .......................................................................................................................88

R –W ..................................................................................................................... 102

R. EARNINGS PER SHARE OF COMMON STOCK .............................................. 102

S. RENTAL EXPENSE AND LEASE COMMITMENTS ........................................... 10 3

T. STOCK-BASED COMPENSATION ................................................................... 103

U. RETIREMENT-RELATED BENEFITS ............................................................... 106

V. SEGMENT INFORMATION .............................................................................. 116

W. SUBSEQUENT EVENT .................................................................................... 119

($ )

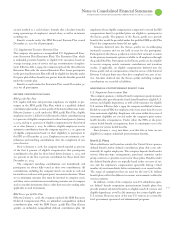

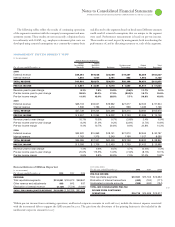

2008 2007

Benefit Benefit

At December : Obligation Plan Assets Obligation Plan Assets

Plans with PBO in excess of plan assets $75,341 $60,898 $14,472 $ 5,980

Plans with ABO in excess of plan assets 73,939 60,630 13,607 5,687

Plans with assets in excess of PBO 12,586 14,183 75,491 92,908

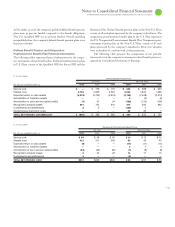

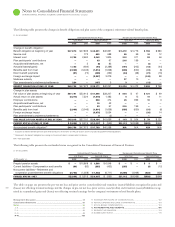

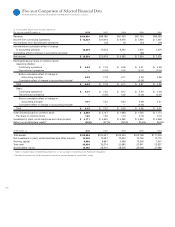

Note V.

Segment Information

The company uses business insight and its broad range of IT capabili-

ties to create client- and industry-specific information solutions. The

company operates primarily in a single industry using several segments

that create value by offering solutions that include, either singularly

or in some combination, services, software, hardware and financing.

The company’s major operations are comprised of a Global

Tech nol ogy Services segment; a Global Business Services segment; a

Software segment; a predominantly hardware product segment —

Systems and Technology; and a Global Financing segment. The seg-

ments repre sent components of the company for which separate

financial information is available that is utilized on a regular basis by

the chief executive officer in determining how to allocate the compa-

ny’s resources and evaluate performance. The segments are determined

based on several factors, including client base, homogeneity of products,

technology, delivery channels and similar economic characteristics.

Information about each segment’s business and the products and

services that generate each segment’s revenue is located in the

“Description of Business” section of the Management Discussion on

pages and , and “Segment Details,” on pages to .

Segment revenue and pre-tax income include transactions between

the segments that are intended to reflect an arm’s-length transfer price.

Hardware and software that is used by the Global Technology Services

segment in outsourcing engagements is primarily sourced internally

from the Systems and Technology and Software segments. For the

internal use of IT services, Global Technology Services and Global

Business Services recover cost, as well as a reasonable fee, reflecting

the arm’s-length value of providing the services. The Global Services

segments enter into arm’s-length leases and loans at prices equivalent

to market rates with the Global Financing segment to facilitate the

acquisition of equipment used in services engagements. All internal

transaction prices are reviewed annually, and reset if appropriate.

The company utilizes globally integrated support organizations

to realize economies of scale and efficient use of resources. As a

result, a considerable amount of expense is shared by all of the seg-

ments. This shared expense includes sales coverage, marketing and

support functions such as Accounting, Treasury, Procurement, Legal,

Human Re sources and Billing and Collections. Where practical,

shared expenses are allocated based on measurable drivers of expense,

e.g., headcount. When a clear and measurable driver cannot be identi-

fied, shared expenses are allocated on a financial basis that is consistent

with the company’s management system; e.g., advertising is allocated

based on the gross profits of the segments. The unallocated corporate

amounts arising from certain divestitures, indirect infrastructure reduc-

tions, miscellaneous tax items and the unallocated corporate expense

pool are recorded in net income but are not allocated to the segments.

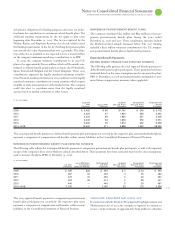

the prescription drug coverage provided by the U.S. nonpension

postretirement benefit plan, which is expected to extend until .

Approx imately $ million of the subsidy will be used by the com-

pany to reduce its obligation and cost related to the U.S. nonpension

postretirement benefit plan. The company will contribute the

remain

ing subsidy of $ million to the plan in order to reduce con-

tributions

required by the participants. The company received a total

subsidy of $ million and $ million for prescription drug-related

coverage during the years ended December , and , which

was utilized to reduce the company contributions to the U.S. non-

pension postretirement benefit plan.

The company has included the impact of its portion of the sub-

sidy in the determination of net periodic cost and APBO for the U.S.

nonpension postretirement benefit plan at and for the years ended

December , , and . The impact of the subsidy resulted

in a reduction in APBO of $ million and $ million at December

, and , respectively. The impact of the subsidy resulted

in a reduction in the , and net periodic cost of $

million, $ million and $ million, respectively.

The following table presents information for defined benefit pension

plans with accumulated benefit obligations (ABO) in excess of plan

assets. For a more detailed presentation of the funded status of the

company’s defined benefit pension plans, see table on page .