IBM 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

For income tax return purposes, the company has foreign and domes-

tic loss carryforwards, the tax effect of which is $ million as well

as state tax credit carryforwards of $ million. Substantially all of

these carryforwards are available for at least two years or are available

for ten years or more.

The company has certain foreign tax loss carryforwards that have

not been reflected in the gross deferred tax asset balance. These

losses, the potential tax benefit of which is approximately $. billion,

have not been recorded in the Consolidated Statement of Financial

Position as the company has not determined if it will claim these

losses. The company is currently evaluating whether to claim these

losses and expects to make a decision within the next six months.

The valuation allowance at December , , principally applies

to certain foreign, state and local loss carryforwards that, in the opin-

ion of management, are more likely than not to expire unutilized.

However, to the extent that tax benefits related to these carryforwards

are realized in the future, the reduction in the valuation allowance

will reduce income tax expense. The year-to-year change in the

allowance balance was a decrease of $ million.

The amount of unrecognized tax benefits at December ,

determined in accordance with the provisions of FIN increased by

$ million in to $, million. A reconciliation of the begin-

ning and ending amount of unrecognized tax benefits is as follows:

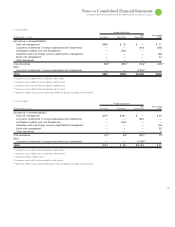

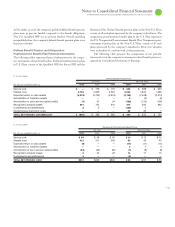

($ ) 2008 2007

Balance at January 1 $ 3,094 $2,414

Additions based on tax positions related

to the current year 1,481 745

Additions for tax positions of prior years

747 195

Reductions for tax positions of prior years

(including impacts due to a lapse in statute) (1,209) (144)

Settlements (215) (116)

BALANCE AT DECEMBER 31 $ 3,898 $3,094

The additions to the unrecognized tax benefits related to the current

and prior years are primarily attributable to various transfer pricing

and related valuation matters, certain tax incentives and credits,

acquisition-related matters and other non-U.S. and state matters.

The settlements and reductions to the unrecognized tax benefits

for tax positions of prior years are primarily attributable to the con-

clusion of the company’s various U.S. and non-U.S. income tax

examinations, the agreement reached with the IRS regarding claims

for certain tax incentives, the company’s analysis with respect to

certain issues associated with newly published U.S. tax regulations

and various non-U.S. matters including impacts due to lapses in

statutes of limitation.

The liability at December , of $, million can be

reduced by $ million of offsetting tax benefits associated with the

correlative effects of potential transfer pricing adjustments, state

income taxes and timing adjustments. The net amount of $,

million, if recognized, would favorably affect the company’s effective

tax rate.

Interest and penalties related to income tax liabilities are included

in income tax expense. During the year ended December , ,

the company recognized $ million in interest and penalties; in

, the company recognized $ million in interest and penalties.

The company has $ million for the payment of interest and penal-

ties accrued at December , and had $ million accrued at

December , .

It is not anticipated that the amount of unrecognized tax benefits

reflected as of December , will materially change in the next

months; any changes are not expected to have a significant impact

on the results of operations, cash flows or the financial position of

the company.

With limited exception, the company is no longer subject to U.S.

federal, state and local or non-U.S. income tax audits by taxing author-

ities for years through . The years subsequent to contain

matters that could be subject to differing interpretations of applicable

tax laws and regulations as it relates to the amount and/or timing

of income, deductions and tax credits. Although the outcome of

tax audits is always uncertain, the company believes that adequate

amounts of tax and interest have been provided for any adjustments

that are expected to result for these years.

It is expected that the audit of the company’s and U.S.

income tax returns will commence in the first quarter of .

The company has not provided deferred taxes on $. billion of

undistributed earnings of non-U.S. subsidiaries at December ,

, as it is the company’s policy to indefinitely reinvest these earn-

ings in non-U.S. operations. However, the company periodically

repatriates a portion of these earnings to the extent that it does not

incur an additional U.S. tax liability. Quantification of the deferred

tax liability, if any, associated with indefinitely reinvested earnings is

not practicable.

For additional information on the company’s effective tax rate

refer to the “Looking Forward” section of the Management Discussion

on page .

Note Q.

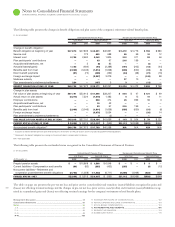

Research, Development and Engineering

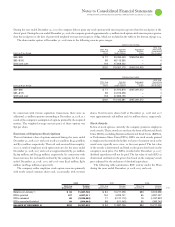

RD&E expense was $, million in , $, million in

and $, million in .

The company incurred expense of $, million in , $,

million in and $, million in for scientific research and

the application of scientific advances to the development of new and

improved products and their uses, as well as services and their appli-

cation. Within these amounts, software-related expense was $,

million, $, million and $, million in , and ,

respectively. In addition, included in the expense was a charge of $

million in and $ million in for acquired IPR&D.

Expense for product-related engineering was $ million, $

million and $ million in , and , respectively.