IBM 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ............................................................................................. 18

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

A – E ........................................................................................................................66

A. SIGNIFICANT ACCOUNTING POLICIES ...........................................................66

B. ACCOUNTING CHANGES .................................................................................76

C. ACQUISITIONS/DIVESTITURES .......................................................................78

D. FAIR VALUE ......................................................................................................84

E. FINANCIAL INSTRUMENTS (EXCLUDING DERIVATIVES) .................................85

F – J ........................................................................................................................86

K– Q .......................................................................................................................88

R –W ..................................................................................................................... 102

Software, Global Technology Services and Global Business Services

segments upon acquisition and goodwill, as reflected in the table on

page , has been assigned to the Software segment for $ million,

Global Technology Services segment for $ million and Global

Business Services segment for $ million. The overall weighted-

average useful life of the intangible assets purchased, excluding

goodwill, is . years.

OTHER ACQUISITIONS—The company acquired nine additional

companies that are presented as “Other Acquisitions” in the table on

page . Three of the acquisitions were Global Services-related com-

panies: two were integrated into the Global Technology Services

segment: Viacore, Inc. and Palisades Technology Partners, LLP; the

third, Valchemy, Inc., was integrated into the Global Business Services

segment. Six of the acquisitions were software-related companies that

were integrated into the Software segment: Cims Lab; Language

Analysis Systems, (LAS) Inc.; Buildforge; Unicorn Solutions, Inc.;

Rembo Technology; and Webify Solutions. The purchase price allo-

cations resulted in aggregate goodwill of $ million, of which $

million was assigned to the Software segment and $ million was

assigned to the Global Technology Services segment. The overall

weighted-average useful life of the intangible assets purchased in

these acquisitions, excluding goodwill, is . years.

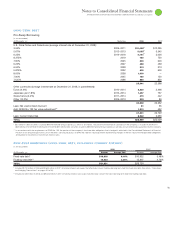

2006 ACQUISITIONS

($ )

Micromuse, Inc.

Original Amount

Amortization Disclosed in Purchase Total FileNet

Life (in Years) First Qtr. 2006 Adjustments* Allocation Corporation

Current assets $ 201 $ 56 $ 257 $ 681

Fixed assets/noncurrent 8 — 8 69

Intangible assets:

Goodwill N/A 694 137 831 894

Completed technology 3 to 5 46 — 46 73

Client relationships 3 to 7 46 — 46 194

Other 2 to 4 4 — 4 55

In-process R&D N/A 1 — 1 3

Total assets acquired 1,000 193 1,193 1,969

Current liabilities (89) (193) (282) (252)

Noncurrent liabilities (49) — (49) (108)

Total liabilities assumed (138) (193) (331) (360)

TOTAL PURCHASE PRICE $ 862 $ — $ 862 $1,609

* Adjustments primarily relate to acquisition costs, deferred taxes and other accruals.

N/A—Not applicable

vulnerabilities and rapidly respond in advance of potential threats.

The acquisition advances the company’s strategy to utilize IT ser-

vices, software and consulting expertise to automate labor-based

processes into standardized, software-based services that can help

clients optimize and transform their businesses. ISS was integrated

into the Global Technology Services segment upon acquisition and

goodwill, as reflected in the table on page , has been entirely

assigned to the Global Technology Services segment. The overall

weighted-average useful life of the intangible assets purchased,

excluding goodwill, is . years.

MRO SOFTWARE INC. (MRO)—On October , , the company

acquired percent of the outstanding common shares of MRO

for cash consideration of $ million. MRO’s asset and service man-

agement software and consulting services are used by many of the

world’s top companies to effectively manage how they buy, maintain

and retire assets — such as production equipment, facilities, transpor-

tation and information technology hardware and software — in a

wide variety of industries including utilities, manufacturing, energy,

pharmaceutical and telecommunications. The acquisition builds

upon the company’s strategy to leverage business consulting, IT

services, and software to develop repeatable tools that help clients

optimize and transform their business. MRO was integrated into the