IBM 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

•

•

•

•

•

•

•

•

Partially offset by:

• The net impact of the purchases and sales of marketable securi-

ties and other investments resulted in an increase in cash of

$ million; and

• A decrease in net capital spending of $ million resulting from:

– a decrease of $ million primarily driven by lower spending by

Global Technology Services and Systems and Technology; and

– a decrease of $ million in capitalized software development

expenditures.

Net cash used in financing activities increased $, million com-

pared to as a result of:

• An increase of $, million in cash used to retire debt, net of

cash proceeds, primarily driven by higher proceeds in due to

the issuance of debt for the ASR and a decline in commercial

paper in ;

• Higher dividend payments of $ million; and

•

A decrease of $ million in cash received due to lower other com-

mon stock transactions primarily due to stock option exercises;

Partially offset by:

• Lower common stock repurchases of $, million.

Within total debt, on a net basis, the company utilized $, million

in net cash to retire debt versus $, million in net cash proceeds

in . The net cash used to retire debt in was comprised of:

$, million in cash payments to settle debt and net payments of

$, million in short-term borrowings, partially offset by $,

million of new debt issuances. See note K, “Borrowings,” on pages

to for a listing of the company’s debt securities.

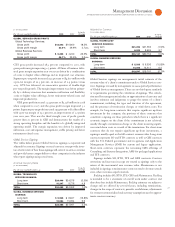

NONCURRENT ASSETS AND LIABILITIES

($ )

At December : 2008 2007

Noncurrent assets $60,520 $67,254

Long-term debt $22,689 $23,039

Noncurrent liabilities (excluding debt)

$30,934 $24,612

The decrease in noncurrent assets of $, million compared to the

prior year-end balance was primarily driven by:

• A decrease of $, million in prepaid pension assets primarily

resulting from pension remeasurements;

• A decrease of $ million in plant, rental machines and other

property mainly due to currency impact ($ million) and lower

capital spending primarily in Global Technology Services; and

• A decrease of $ million in long-term financing receivables

mainly due to currency impact;

Partially offset by:

• An increase in deferred tax assets of $, million primarily due

to pension remeasurements; and

• An increase in goodwill of $, million (net of a $, million

negative currency impact) and an increase of $ million (net of

a $ million negative currency impact) in intangible assets-net

primarily driven by the Cognos and Telelogic acquisitions.

Long-term debt decreased $ million primarily due to reclasses to

short-term debt as certain instruments approached maturity; offset

by new debt issuances.

Other noncurrent liabilities, excluding debt, increased $, million

primarily driven by:

• An increase of $, million in retirement and nonpension

postretirement benefit obligations primarily driven by pension

remeasurement; and

• An increase in noncurrent tax reserves of $, million related

to unrecognized tax benefits;

Partially offset by:

• A decrease of $ million in noncurrent deferred tax liabilities

primarily due to pension remeasurement; and

• A decrease of $ million in restructuring liabilities mainly

driven by the reclass to current liabilities.

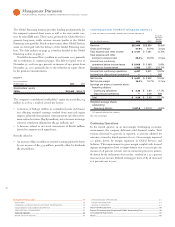

DEBT

The company’s funding requirements are continually monitored and

strategies are executed to manage the overall asset and liability profile.

($ )

At December : 2008 2007

Total company debt $33,926 $35,274

Total Global Financing segment debt:

$24,360 $24,532

Debt to support external clients 20,892 21,072

Debt to support internal clients 3,468 3,460