IBM 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ................................................................................................18

ROAD MAP ............................................................................................................ 18

FORWARD-LOOKING AND CAUTIONARY STATEMENTS ...................................... 18

MANAGEMENT DISCUSSION SNAPSHOT ............................................................ 19

DESCRIPTION OF BUSINESS................................................................................ 20

YEAR IN REVIEW ...................................................................................................25

PRIOR YEAR IN REVIEW ......................................................................................39

DISCONTINUED OPERATIONS ............................................................................. 44

OTHER INFORMATION ..........................................................................................44

GLOBAL FINANCING .............................................................................................53

Report Of Management ............................................................................................... 58

Report Of Independent Registered Public Accounting Firm ................................. 59

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

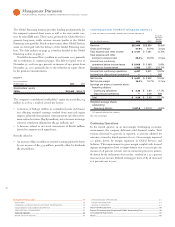

Stockholders’ equity of $, million was essentially flat versus

. Increased treasury stock ($, million) from share repur-

chases, which included the ASR, was largely offset by increased retained

earnings ($, million) driven by net income, increased common

stock ($, million) related to stock options and a decline in accu-

mulated gains and

(l

osses) not affecting retained earnings ($,

million) primarily due to the effects of pension remeasurements.

The company generated $, million in cash flow provided by

operating activities, an increase of $, million compared to ,

primarily driven by increased net income. Net cash used in investing

activities of $, million was $, million lower than driven

primarily by proceeds from disposition of short-term marketable

securities and a reduction in cash used for acquisitions. Net cash

used in financing activities of $, million decreased $, mil-

lion versus driven by increased net proceeds from total debt

($, million), partially offset by increased share repurchases

($, million).

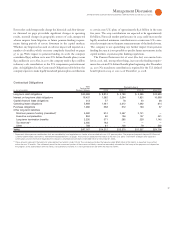

Discontinued Operations

On December , , the company sold its HDD business to Hitachi

for approximately $ billion. The final cash payment of $ million

was received on December , .

In , the company reported net income of $ million, net of

tax, primarily related to tax benefits from tax audit settlements.

Other Information

Looking forward, the company enters in an excellent operational

and financial position. The company has shifted its business to higher

value services and software, with less dependence on commoditizing

and cyclical businesses. The Global Services business in con-

tributed percent of total segment pre-tax income and managed

over percent of the company’s resources. The company’s software

capabilities have grown through internal investment and acquisitions

with Software segment pre-tax profit more than doubling in the

past five years to over $ billion in . In , over percent

of segment pre-tax profit came from Global Services and Software,

and over percent from Global Services, Software and Global

Financing. The company has changed the profile of the business to

make it more adaptable to different business environments.

The company enters and the current market from a position

of strength. The company will take advantage of the environment to

continue to execute its strategies.

The company has a significant global presence, operating in over

countries, with approximately percent of its revenue generated

outside the U.S. This global reach gives the company access to mar-

kets, with well-established organizations and management systems

who understand the clients and their challenges and who can respond

to these opportunities with value-add solutions. The company’s trans-

formation to a globally integrated enterprise provides the capabilities

to service clients globally and deliver the best skills and cost from

anywhere in the world.

In emerging markets, the company will continue to invest for

revenue growth by capturing new infrastructure spending in these

markets. While some of these economies have slowed, these markets

still offer good growth opportunities relative to the rest of the world.

The company has developed a strong value proposition for the

established markets based on cost reduction, capital conservation and

risk management. The high value, integrated offerings, including green

data centers, outsourcing and virtualization on high-end systems, have

performed well in these markets in the current environment.

Looking forward, the company’s “Smarter Planet” agenda will

provide an important new opportunity to deliver value to clients.

The company anticipates a significant opportunity in “smart infra-

structure” projects as governments around the world implement

economic stimulus programs focused on next generation smart

grids, healthcare-related information technology and broadband.

Projects of these types require technology integration and industry

insight which should uniquely position the company to participate

in these opportunities.

The company remains committed to technology leadership and

will continue to focus internal investments, complemented with

strategic acquisitions, on high-value, high-growth opportunities. The

company invested over $ billion in RD&E in and approxi-

mately $ billion over the past five years.

In addition, the company’s financial position is strong. Through its

efficient cash generation business model based on disciplined balance

sheet management, in , the company generated $. billion in

operating cash flow and ended the year with $. billion in cash and

marketable securities. This provides the company with the financial

flexibility for investments in changing business environments. The

company will also continue to focus on cost and expense reduction

and improved efficiency. In , those efforts translated to margin

expansion and the company expects this to continue into .

In May , the company met with investors and analysts and

discussed a road map to deliver earnings per share in in the

range of $ to $ per share, or to percent compound growth

rate from . The company’s road map is to generate earn-

ings per share in the range of $ to $ per share, or to percent