IBM 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ............................................................................................. 18

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

A – E ........................................................................................................................66

F – J ........................................................................................................................86

F. INVENTORIES ..................................................................................................86

G. FINANCING RECEIVABLES ..............................................................................86

H. PLANT, RENTAL MACHINES AND OTHER PROPERTY ................................... 86

I. INVESTMENTS AND SUNDRY ASSETS ...........................................................87

J. INTANGIBLE ASSETS INCLUDING GOODWILL ...............................................87

K– Q .......................................................................................................................88

R – W ..................................................................................................................... 102

Proceeds from sales of debt securities and marketable equity

securities were approximately $ million and $ million at

December , and , respectively. The gross realized gains

and losses (before taxes) on these sales totaled $ million and

$ million, respectively in . The gross realized gains and losses

(before taxes) on these sales totaled $ million and $ million,

respectively, in .

The contractual maturities of substantially all available-for-sale

debt securities are due in less than one year at December , .

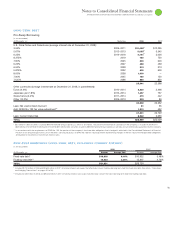

Note F.

Inventories

($ )

At December : 2008 2007

Finished goods $ 524 $ 668

Work in process and raw materials 2,176 1,996

TOTAL $2,701 $2,664

Note G.

Financing Receivables

($ )

At December : 2008 2007

Current:

Net investment in sales-type and

direct financing leases $ 4,226 $ 4,746

Commercial financing receivables 5,781 6,263

Client loan receivables 4,861 4,652

Installment payment receivables 608 629

TOTAL $15,477 $16,289

Noncurrent:

Net investment in sales-type and

direct financing leases $ 5,938 $ 6,085

Commercial financing receivables 94 113

Client loan receivables 4,718 4,931

Installment payment receivables 433 474

TOTAL $11,183 $11,603

Net investment in sales-type and direct financing leases is for leases

that relate principally to the company’s equipment and are for terms

ranging from two to seven years. Net investment in sales-type and

direct financing leases includes unguaranteed residual values of $

million and $ million at December , and , respectively,

and is reflected net of unearned income of $, million and $,

million and of allowance for uncollectible accounts receivable of

$ million and $ million at those dates, respectively. Scheduled

maturities of minimum lease payments outstanding at December ,

, expressed as a percentage of the total, are approximately: ,

percent; , percent; , percent; , percent; and

and beyond, percent.

Commercial financing receivables relate primarily to inventory

and accounts receivable financing for dealers and remarketers of IBM

and non-IBM products. Payment terms for inventory and accounts

receivable financing generally range from to days.

Client loan receivables are loans that are provided by Global

Financing primarily to the company’s clients to finance the purchase

of the company’s software and services. Separate contractual relation-

ships on these financing arrangements are for terms ranging from

two to seven years. Each financing contract is priced independently

at competitive market rates. The company has a history of enforcing

the terms of these separate financing agreements.

The company utilizes certain of its financing receivables as col-

lateral for non-recourse borrowings. Financing receivables pledged

as collateral for borrowings were $ million and $ million at

December , and , respectively. These borrowings are

included in note K, “Borrowings,” on pages to .

The company did not have any financing receivables held for sale

as of December , and .

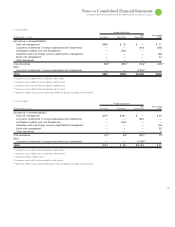

Note H.

Plant, Rental Machines and

Other Property

($ )

At December : 2008 2007

Land and land improvements $ 729 $ 701

Buildings and building improvements

8,819 8,498

Plant, laboratory and office equipment

24,950 25,273

34,499 34,471

Less: Accumulated depreciation 22,178 21,625

Plant and other property — net 12,321 12,847

Rental machines 3,946 4,113

Less: Accumulated depreciation 1,962 1,878

Rental machines — net 1,984 2,235

TOTAL— NET $14,305 $15,081