IBM 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ................................................................................................18

ROAD MAP ............................................................................................................ 18

FORWARD-LOOKING AND CAUTIONARY STATEMENTS ...................................... 18

MANAGEMENT DISCUSSION SNAPSHOT ............................................................ 19

DESCRIPTION OF BUSINESS................................................................................20

YEAR IN REVIEW ..................................................................................................25

PRIOR YEAR IN REVIEW ....................................................................................... 39

DISCONTINUED OPERATIONS ..............................................................................44

OTHER INFORMATION ..........................................................................................44

GLOBAL FINANCING .............................................................................................53

Report Of Management ............................................................................................... 58

Report Of Independent Registered Public Accounting Firm ................................. 59

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

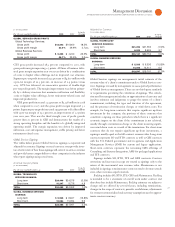

Interest Expense

($ )

Yr.-to-Yr.

For the year ended December : 2008 2007 Change

Interest expense

TOTAL $673 $611 10.3%

The increase in interest expense was primarily due to the increase in

debt in associated with the financing of the accelerated share

repurchase agreements, partially offset by lower interest rates in .

See note N, “Stockholders’ Equity,” on pages and for additional

information regarding the accelerated share repurchase. Interest

expense is presented in cost of financing in the Consolidated State-

ment of Earnings if the related external borrowings are to support

the Global Financing external business. See page for additional

information regarding Global Financing debt and interest expense.

Overall interest expense for was $, million, an increase of

$ million versus .

STOCK-BASED COMPENSATION

Total pre-tax stock-based compensation cost of $ million

decreased $ million compared to . The decrease was princi-

pally the result of a reduction in the level of stock option grants ($

million), offset by an increase related to restricted and performance-

based share units ($ million). The year-to-year change was

reflected in the following categories: reductions in cost ($ million)

and RD&E expense ($ million), and increases in SG&A expense ($

million) and other (income) and expense ($ million).

See note T, “Stock-Based Compensation,” on pages to for

additional information on the company’s stock-based incentive awards.

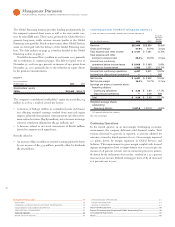

RETIREMENT-RELATED BENEFITS

The following table provides the total pre-tax cost for all retirement-

related plans. These amounts are included in the Consolidated

Statement of Earnings within the caption (e.g., cost, SG&A, RD&E)

relating to the job function of the plan participants.

($ )

Yr.-to-Yr.

For the year ended December : 2008 2007 Change

Defined benefit and contribution

pension plans cost $1,053 $2,198 (52.1)%

Nonpension postretirement plans costs 363 399 (9.0)

TOTAL $1,416 $2,597 (45.5)%

Overall, retirement-related plan costs decreased $, million ver-

sus primarily as a result of pension plan redesign efforts and a

lower level of recognized actuarial losses.

Effective January , , benefit accruals ceased in the IBM Per-

sonal Pension Plan, a U.S. defined benefit plan. This decrease was

partially offset by an increase in defined contribution plans, primarily

in the U.S. See note U, “Retirement-Related Benefits,” on pages

to for additional information on these plan changes and all the

factors driving the year-to-year change in total cost.

Retirement-related plan costs decreased approximately $ mil-

lion in cost, $ million in SG&A expense, $ million in RD&E

expense and $ million in other (income) and expense year to year.

ACQUIRED INTANGIBLE ASSET AMORTIZATION

The company has been investing in targeted acquisitions to increase

its capabilities in higher value businesses. The following table pres-

ents the total acquired intangible asset amortization included in the

Consol idated Statement of Earnings. See note J, “Intangible Assets

Including Goodwill,” on pages and for additional information.

($ )

Yr.-to-Yr.

For the year ended December : 2008 2007* Change

Cost:

Software (Sales) $173 $ 91 89.2%

Global Technology Services (Services) 32 41 (21.0)

Global Business Services (Services) 0 1 (67.0)

Systems and Technology (Sales) 8 0 NM

Selling, general and

administrative expense 306 234 30.5

TOTAL $520 $367 41.5%

* Reclassified to conform with 2008 presentation disclosing the two services segments

separately.

NM—Not meaningful

INCOME TAXES

The effective tax rate for was . percent, compared with

. percent in . The . point decrease was primarily driven by

the net increase in the utilization of foreign and state tax credits

(. points), the benefit associated with the second quarter

agreement reached with the U.S. Internal Revenue Service (IRS)

regarding claims for certain tax incentives (. points) and the benefit

related to certain issues associated with newly published U.S. tax

regulations (. points). These benefits were partially offset by several