IBM 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

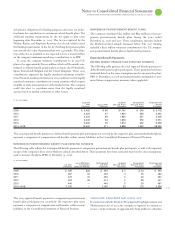

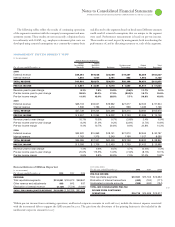

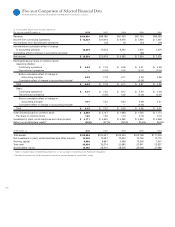

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

($ )

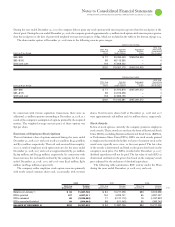

Qualified Qualified Nonqualified Total Expected

PPP Excess PPP Non-U.S. Plans Non-U.S. Plans Benefit

Payments Payments Payments Payments Payments

2009 $ 3,492 $ 86 $1,791 $ 349 $ 5,718

2010 3,226 87 1,804 348 5,465

2011 3,234 90 1,830 351 5,506

2012 3,249 93 1,853 356 5,551

2013 3,266 95 1,874 362 5,598

2014 – 2018 16,630 511 9,888 1,922 28,952

The expected benefit payments to defined benefit pension plan participants not covered by the respective plan assets (underfunded plans)

represent a component of compensation and benefits, within current liabilities, in the Consolidated Statement of Financial Position.

NONPENSION POSTRETIREMENT BENEFIT PLAN EXPECTED PAYMENTS

The following table reflects the total expected benefit payments to nonpension postretirement benefit plan participants, as well as the expected

receipt of the company’s share of the Medicare subsidy described below. These payments have been estimated based on the same assumptions

used to measure the plan’s APBO at December , .

($ )

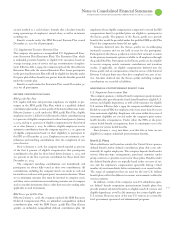

Less: IBM Share Net Expected Qualified Nonqualified Total Expected

U.S. Plan of Expected U.S. Plan Non-U.S. Plans Non-U.S. Plans Benefit

Payments Medicare Subsidy Payments Payments Payments Payments

2009 $ 496 $32 $ 464 $ 5 $ 23 $ 492

2010 487 34 453 4 25 482

2011 473 37 436 5 26 467

2012 453 39 414 5 28 447

2013 446 — 446 5 29 481

2014 – 2018 2,190 — 2,190 33 175 2,398

The expected benefit payments to nonpension postretirement

benefit plan participants not covered by the respective plan assets

represent a component of compensation and benefits, within current

liabilities, in the Consolidated Statement of Financial Position.

In connection with the Medicare Prescription Drug Improvement and

Modernization Act of , the company is expected to continue to

receive a federal subsidy of approximately $ million to subsidize

and pension obligations for funding purposes and raises tax deduc-

tion limits for contributions to retirement-related benefit plans. The

additional funding requirements by the Act apply to plan years

beginning after December , . The Act was updated by the

Worker, Retiree and Employer Recovery Act of , which revised

the funding requirements in the Act by clarifying that pension plans

may smooth the value of pension plans over months. The adop-

tion of the Act, as modified, is not expected to have a material effect

on the company’s minimum mandatory contributions to its PPP.

In , the company estimates contributions to its non-U.S.

plans to be approximately $, million, which will be mainly con-

tributed to defined benefit pension plans in Japan, the Netherlands,

Spain, Switzerland, Belgium and the United Kingdom. These

contributions represent the legally mandated minimum contribu-

tions. Financial market performance in could increase the legally

mandated minimum contribution in certain countries which require

monthly or daily remeasurement of the funded status. The company

could also elect to contribute more than the legally mandated

amount based on market conditions or other factors.

NONPENSION POSTRETIREMENT BENEFIT PLANS

The company contributed $ million and $ million to the non-

pension postretirement benefit plans during the years ended

December , and . These contribution amounts exclude

the Medicare-related subsidy discussed below. The funding

included a $ million voluntary contribution to the U.S. nonpen-

sion postretirement benefit plan to fund benefit payments.

Expected Benefit Payments

DEFINED BENEFIT PENSION PLAN EXPECTED PAYMENTS

The following table presents the total expected benefit payments to

defined benefit pension plan participants. These payments have been

estimated based on the same assumptions used to measure the plans’

PBO at December , and include benefits attributable to esti-

mated future compensation increases, where applicable.