IBM 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

items including the net impact related to the completion of the U.S.

federal income tax examination for the years 2004 and 2005 including

the associated income tax reserve redeterminations (0.5 points), the

second quarter 2008 tax cost associated with the intercompany transfer

of certain intellectual property (2.8 points) and lower capital loss

utilization in 2008 (0.7 points). The remaining items were individu-

ally insignificant.

EARNINGS PER SHARE

Basic earnings per share is computed on the basis of the weighted-

average number of shares of common stock outstanding during the

period. Diluted earnings per share is computed on the basis of the

weighted-average number of shares of common stock plus the effect

of dilutive potential common shares outstanding during the period

using the treasury stock method. Dilutive potential common shares

include outstanding stock options, share awards, convertible notes

and shares which may be required to settle accelerated share repur-

chase (ASR) agreements.

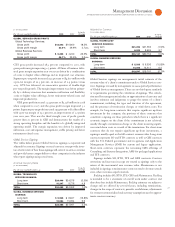

Yr.-to-Yr.

For the year ended December : 2008 2007 Change

Earnings per share of common stock:

Assuming dilution:

Continuing operations $8.93 $ 7.18 24.4%

Discontinued operations — (0.00) NM

Total $8.93 $ 7.18 24.4%

Basic:

Continuing operations $9.07 $ 7.32 23.9%

Discontinued operations — (0.00) NM

Total $9.07 $ 7.32 23.9%

Weighted-average shares

outstanding (in millions):

Assuming dilution 1,381.8 1,450.6 (4.7)%

Basic 1,359.8 1,423.0 (4.4)%

NM—Not meaningful

Actual shares outstanding at December 31, 2008 and December 31,

2007 were 1,339.1 million and 1,385.2 million, respectively. The aver-

age number of common shares outstanding assuming dilution was

68.8 million shares lower in 2008 versus 2007. The decrease was

primarily the result of the company’s common stock repurchase pro-

gram. See note N, “Stockholders’ Equity Activity,” on pages 95 and

96 for additional information regarding common stock activities. Also

see note R, “Earnings Per Share of Common Stock,” on page 102.

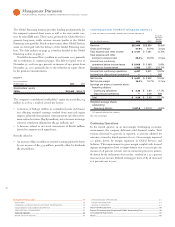

Financial Position

DYNAMICS

At December 31, 2008, the company’s balance sheet and liquidity

position remain strong. Cash on hand at year-end was $12,741 mil-

lion. Total debt of $33,926 million decreased $1,349 million from

prior year-end levels. The commercial paper balance at December 31

was $468 million, down $5,363 million from December 31, 2007. In

2008, the company generated $18,812 million in cash from operations,

an increase of $2,718 million compared to 2007. The company has

consistently generated strong cash flow from operations and contin-

ues to have access to additional sources of liquidity through the

capital markets and its $10 billion global credit facility.

Consistent with retirement and postretirement plan accounting

standards, the company remeasures the funded status of its plans at

December 31. The funded status is measured as the difference

between the fair value of the plan assets and the benefit obligation

and is recognized in the Consolidated Statement of Financial

Position. At December 31, 2008, primarily as a result of the returns

on plan assets, coupled with changes in certain plan assumptions and

plan contributions, the overall net funded position decreased $21,793

million from December 31, 2007 to a net under-funded position of

$18,485 million. This change is primarily reflected in prepaid pen-

sion assets and retirement and nonpension postretirement benefit

obligations which decreased $15,816 million and increased $5,871

million respectively from year-end 2007 levels. Due to the extreme

volatility in the equity markets in 2008, the return on IBM Personal

Pension Plan assets declined 15 percent, compared to a 14 percent

increase in 2007. The company’s asset return in the non-U.S. plans

declined approximately 21 percent. Within the company’s defined

benefit plans, the net funded status declined in 2008 due to the vola-

tility in the financial markets. At December 31, 2008, the company’s

qualified defined benefit plans worldwide were 93 percent funded,

with the U.S. qualified Personal Pension Plan 97 percent funded.

In addition, stockholders’ equity decreased $15,004 million, net of

tax, primarily as a result of changes from pension remeasurements

and current

year activity within accumulated gains and (losses) not

affecting retained

earnings. This is a non-cash impact to equity and

does not affect the company’s access to capital markets or its ability

to meet its obligations.

The assets and debt associated with the Global Financing business

are a significant part of the company’s financial position. The financial

position amounts appearing on pages 34 to 36 are the consolidated

amounts including Global Financing. The amounts appearing in the

separate Global Financing section on pages 53 through 57 are supple-

mentary data presented to facilitate an understanding of the Global

Financing business.