IBM 2008 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ................................................................................................18

ROAD MAP ............................................................................................................ 18

FORWARD-LOOKING AND CAUTIONARY STATEMENTS ...................................... 18

MANAGEMENT DISCUSSION SNAPSHOT ............................................................ 19

DESCRIPTION OF BUSINESS................................................................................ 20

YEAR IN REVIEW ..................................................................................................25

PRIOR YEAR IN REVIEW .......................................................................................39

DISCONTINUED OPERATIONS ..............................................................................44

OTHER INFORMATION ..........................................................................................44

GLOBAL FINANCING .............................................................................................53

Report Of Management ............................................................................................... 58

Report Of Independent Registered Public Accounting Firm ................................. 59

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

Contract portfolios purchased in an acquisition are treated as posi-

tive backlog adjustments provided those contracts meet the company’s

requirements for initial signings. A new signing will be recognized if

a new services agreement is signed incidental or coincidental to an

acquisition or divestiture.

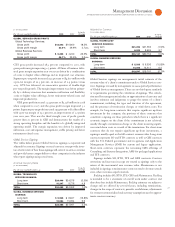

SOFTWARE

($ )

Yr.-to -Yr.

For the year ended December : 2008 2007 Change

SOFTWARE REVENUE: $22,089 $19,982 10.5%

Middleware $17,305 $15,505 11.6%

Key Branded Middleware 12,383 10,827 14.4

WebSphere Family 6.2

Information Management 24.5

Lotus 10.4

Tivoli 2.9

Rational 13.2

Other middleware 4,922 4,678 5.2

Operating systems 2,337 2,319 0.8

Product Lifecycle

Management 960 1,051 (8.6)

Other 1,488 1,107 34.4

Software segment revenue of $, million increased . percent

( percent adjusted for currency) in led by growth in the Key

Branded Middleware products and strong contributions from the

annuity base and acquisitions. Clients continue to embed the compa-

ny’s software in the fabric of their IT infrastructures.

Key Branded Middleware revenue increased . percent ( per-

cent adjusted for currency) and represented percent of total Software

segment revenue, an increase of points from . When adjusted

for currency, growth in was led by Information Management,

Rational and Lotus. Strategic acquisitions, including Cognos and

Telelogic, have extended the segment’s middleware capabilities.

WebSphere Family revenue increased . percent ( percent

adjusted for currency) in and was led by growth in WebSphere

Application Servers and WebSphere Business Integration software.

In December , the company completed the acquisition of ILOG,

whose products help customers improve business decisions with opti-

mization, visualization and business rules software. The WebSphere

products provide the foundation for Web-enabled applications and

are

a key product set in deploying a client’s SOA. Information

Manage ment revenue increased . percent ( percent adjusted

for currency) in versus the prior year, reflecting the contribu-

tion from Cognos and strong demand for the distributed relational

database products. Cognos’ performance management solution helps

customers improve decision-making across the enterprise to opti-

mize business performance.

Lotus revenue increased . percent ( percent adjusted for

currency) in led by growth in Lotus Notes products as customers

continue to invest to improve their workforce efficiency. Lotus soft-

ware is well established as a tool for providing improved workplace

collaboration and productivity.

Tivoli revenue increased . percent ( percent adjusted for cur-

rency) in when compared to . Revenue performance was

led by growth in Tivoli Security and Storage Management products.

Tivoli software provides the advanced capabilities required to run

large mission-critical environments. This includes security and storage

software which helps customers improve utilization and reduce costs.

Rational revenue increased . percent ( percent adjusted for

currency) in driven primarily by Telelogic contributions.

Telelogic’s suite of system programming tools complements Rational’s

IT tool set, providing a common framework for software and systems

delivery across a client’s enterprise.

Revenue from Other middleware products increased . percent

( percent adjusted for currency) in versus the prior year. This

software product set includes more mature products which provide a

more stable flow of revenue.

Other software segment revenue increased . percent ( per-

cent adjusted for currency) versus reflecting continued growth

in software-related services.

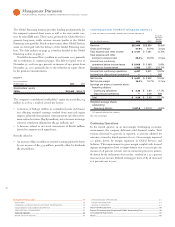

($ )

Yr.-to -Yr.

For the year ended December : 2008 2007 Change

SOFTWARE GROSS PROFIT:

Gross profit $18,859 $17,015 10.8%

Gross profit margin 85.4% 85.2% 0.2 pts.

Software segment gross profit increased . percent to $, mil-

lion in , driven primarily by the strong revenue growth. The

large annuity base of this business continues to provide a predictable

and growing profit stream. Gross profit margin was . percent in

, an increase of . points versus . The company has been

investing significantly in the software business with good results. The

Software segment contributed $, million of pre-tax profit in ,

an increase of . percent versus while successfully integrating

Cognos and Telelogic. Software contributed approximately percent

of the company’s segment pre-tax profit in . The segment pre-tax

profit margin increased . points to . percent. The pre-tax income

and margin improvements have been driven primarily by revenue

growth and increasing operational efficiencies.