IBM 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ............................................................................................. 18

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

A – E ........................................................................................................................66

F – J ........................................................................................................................86

K– Q .......................................................................................................................88

K. BORROWINGS .................................................................................................88

L. DERIVATIVES AND HEDGING TRANSACTIONS ..............................................90

M. OTHER LIABILITIES .........................................................................................94

N. STOCKHOLDERS’ EQUITY ACTIVITY ..............................................................95

O. CONTINGENCIES AND COMMITMENTS ..........................................................97

P. TAXES ...............................................................................................................99

Q. RESEARCH, DEVELOPMENT AND ENGINEERING ......................................... 101

R –W ..................................................................................................................... 102

At December , , in connection with its cash flow hedges of

anticipated royalties and cost transactions, the company recorded

net gains of $ million, net of tax, in accumulated gains and

(l

osses)

not affecting retained earnings. Of this amount, $ million of

gains are expected to be reclassified to net income within the next

year, providing an offsetting economic impact against the underly-

ing anticipated transactions. At December , , net losses of

approximately $ million, net of tax, were recorded in accumulated

gains and

(l

osses) not affecting retained earnings in connection with

cash flow hedges of the company’s borrowings. Of this amount,

$ million of gains are expected to be reclassified to net income

within the next year, providing an offsetting economic impact

against the underlying transactions.

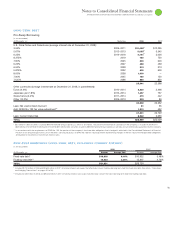

The following table summarizes activity in the accumulated gains

and

(l

osses) not affecting retained earnings section of the Consolidated

Statement of Stockholders’ Equity related to all derivatives classified

as cash flow hedges.

($ , ) (Credit)/Debit

December 31, 2005 $(238)

Net gains reclassified into earnings from

equity during 2006 205

Changes in fair value of derivatives in 2006 138

December 31, 2006 104

Net losses reclassified into earnings from

equity during 2007 (116)

Changes in fair value of derivatives in 2007 239

December 31, 2007 227

Net losses reclassified into earnings from

equity during 2008 (303)

Changes in fair value of derivatives in 2008 2

DECEMBER 31, 2008 $ (74)

For the years ending December , , and , there were

no significant gains or losses recognized in earnings representing

hedge ineffectiveness or excluded from the assessment of hedge effec-

tiveness (for fair value hedges and cash flow hedges), or associated

with an underlying exposure that did not or was not expected to

occur (for cash flow hedges); nor are there any anticipated in the

normal course of business.

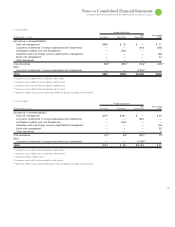

Note M.

Other Liabilities

($ )

At December : 2008 2007

Income tax reserves $3,557 $2,107

Executive compensation accruals 860 1,058

Disability benefits 743 734

Derivative liabilities 702 534

Restructuring actions 476 631

Workforce reductions 415 476

Deferred taxes 270 1,064

Environmental accruals 246 231

Noncurrent warranty accruals 189 157

Asset retirement obligations 119 114

Other 735 864

TOTAL $8,311 $7,970

In response to changing business needs, the company periodically

takes workforce reduction actions to improve productivity, cost com-

petitiveness and to rebalance skills. The noncurrent contractually

obligated future payments associated with these activities are reflected

in the workforce reductions caption in the table above.

In addition, the company executed certain special actions as

follows: () the second quarter of associated with Global Services

segments, primarily in Europe, () the second quarter of asso-

ciated with the Microelectronics Division and rebalancing of both

the company’s workforce and leased space resources, () the fourth

quarter of associated with the acquisition of the Pricewaterhouse-

Coopers consulting business, () the actions associated with the

HDD business for reductions in workforce, manufacturing capacity

and space, () the actions taken in , and () the actions that were

executed prior to .

The table on page provides a roll forward of the current and

noncurrent liabilities associated with these special actions. The current

liabilities presented in the table are included in other accrued expenses

and liabilities in the Consolidated Statement of Financial Position.