IBM 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ................................................................................................18

ROAD MAP ............................................................................................................ 18

FORWARD-LOOKING AND CAUTIONARY STATEMENTS ...................................... 18

MANAGEMENT DISCUSSION SNAPSHOT ............................................................ 19

DESCRIPTION OF BUSINESS................................................................................20

YEAR IN REVIEW ...................................................................................................25

PRIOR YEAR IN REVIEW ....................................................................................... 39

DISCONTINUED OPERATIONS ..............................................................................44

OTHER INFORMATION ..........................................................................................44

GLOBAL FINANCING .............................................................................................53

Report Of Management ............................................................................................... 58

Report Of Independent Registered Public Accounting Firm ................................. 59

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

taxable income and the feasibility of ongoing tax planning strategies.

In the event that the company changes its determination as to the

amount of deferred tax assets that can be realized, the company will

adjust its valuation allowance with a corresponding impact to income

tax expense in the period in which such determination is made.

To the extent that the provision for income taxes increases/

decreases by percent of income from continuing operations before

income taxes, consolidated income from continuing operations

would have decreased/improved by $ million in .

Valuation of Assets and Reporting Units

The application of business combination and impairment accounting

requires the use of significant estimates and assumptions. The pur-

chase method of accounting for business combinations requires the

company to estimate the fair value of assets acquired and liabilities

assumed to properly allocate purchase price consideration between

assets that are depreciated and amortized from goodwill. Impairment

testing for assets, other than goodwill, requires the allocation of cash

flows to those assets or group of assets and if required, an estimate of

fair value for the assets or group of assets. The company’s estimates

are based upon assumptions believed to be reasonable, but which are

inherently uncertain and unpredictable. These valuations require the

use of management’s assumptions, which would not reflect unantici-

pated events and circumstances that may occur.

Valuation of Goodwill

The company reviews goodwill for impairment annually and when-

ever events or changes in circumstances indicate the carrying value of

goodwill may not be recoverable in accordance with SFAS No. ,

“Goodwill and Other Intangible Assets.” The provisions of SFAS No.

require that the company perform a two-step impairment test. In

the first step, the company compares the fair value of each reporting

unit to its carrying value. The company determines the fair value of

its reporting units based on the income approach. Under the income

approach, the company calculates the fair value of a reporting unit

based on the present value of estimated future cash flows. If the fair

value of the reporting unit exceeds the carrying value of the net assets

assigned to that unit, goodwill is not impaired. If the carrying value

of the net assets assigned to the reporting unit exceeds the fair value

of the reporting unit, then the second step of the impairment test

is performed in order to determine the implied fair value of the

reporting unit’s goodwill. If the carrying value of a reporting unit’s

goodwill exceeds its implied fair value, then the company records an

impairment loss equal to the difference.

Determining the fair value of a reporting unit is judgmental in

nature and involves the use of significant estimates and assumptions.

These estimates and assumptions include revenue growth rates and

operating margins used to calculate projected future cash flows,

discount rates and future economic and market conditions. The

company’s estimates are based upon assumptions believed to be

reasonable, but which are inherently uncertain and unpredictable.

These valuations require the use of management’s assumptions,

which would not reflect unanticipated events and circumstances that

may occur.

The company’s annual goodwill impairment analysis, which the

company performed during the fourth quarter of , did not result

in an impairment charge. The excess of fair value over carrying value

for each of the company’s reporting units as of September , ,

the annual testing date, ranged from approximately $. billion to

approximately $. billion. In order to evaluate the sensitivity of the

fair value calculations on the goodwill impairment test, the company

applied a hypothetical percent decrease to the fair values of each

reporting unit. This hypothetical percent decrease would result in

excess fair value over carrying value ranging from approximately

$. billion to approximately $. billion for each of the company’s

reporting units.

Loss Contingencies

The company is currently involved in various claims and legal pro-

ceedings. Quarterly, the company reviews the status of each significant

matter and assesses its potential financial exposure. If the potential

loss from any claim or legal proceeding is considered probable and

the amount can be reasonably estimated, the company accrues a lia-

bility for the estimated loss. Significant judgment is required in both

the determination of probability and the determination as to whether

an exposure is reasonably estimable. Because of uncertainties related

to these matters, accruals are based only on the best information

available at the time. As additional information becomes available,

the company reassesses the potential liability related to its pending

claims and litigation and may revise its estimates. These revisions in

the estimates of the potential liabilities could have a material impact

on the company’s results of operations and financial position.

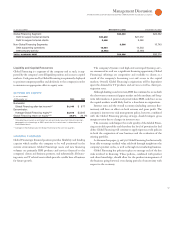

Financing Receivables Reserves

The Global Financing business reviews its financing receivables

port folio at least quarterly in order to assess collectibility. A descrip-

tion of the methods used by management to estimate the amount of

uncollectible receivables is included on page . Factors that could

result in actual receivable losses that are materially different from the

estim ated reserve include sharp changes in the economy, or a significant

change in the economic health of a particular industry segment that

represents a concentration in Global Financing’s receivables portfolio.