IBM 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

TELELOGIC, AB (TELELOGIC)—On April , , IBM acquired

percent of the outstanding common shares of Telelogic for cash

consideration of $ million. Telelogic is a leading global provider

of solutions that enable organizations to align the development of

products, complex systems and software with business objectives and

customer needs. This results in improved quality and predictability,

while reducing time-to-market and overall costs. Clients will benefit

from the combined technologies and services of both companies,

providing them a wider range of software and system development

capabilities used to build complex systems. Telelogic was integrated

into the Software segment upon acquisition, and goodwill, as

reflected in the table below has been entirely assigned to the Software

segment. Substantially all of the goodwill is not deductible for tax

purposes. The overall weighted-average useful life of the intangible

assets acquired, excluding goodwill, is . years.

OTHER ACQUISITIONS—The company acquired additional com-

panies at an aggregate cost of $ million that are presented in the

table below as “Other Acquisitions.”

The Software segment completed eight other acquisitions, seven

of which were privately held companies: in the first quarter; AptSoft

Corporation, Solid Information Technology, Net Integration Tech-

nologies Inc., and Encentuate, Inc; in the second quarter; Infodyne,

Beijing Super Info and FilesX. In the fourth quarter, ILOG S.A.

(ILOG), a publicly held company, was acquired for $ million.

ILOG adds significant capability across the company’s entire soft-

ware platform and bolsters its existing rules management offerings.

Global Technology Services (GTS) completed one acquisition in

the first quarter: Arsenal Digital Solutions, a privately held company.

Arsenal provides global clients with security rich information protection

services designed to handle increasing data retention requirements.

Global Business Services (GBS) completed one acquisition in the

first quarter: uconsult, a privately held company. uconsult comple-

ments the company’s existing capabilities in value chain consulting.

Systems and Technology completed three acquisitions: in the

second quarter; Diligent Technologies Corporation and Platform

Solutions, Inc (PSI), both privately held companies. Diligent will be

an important component of IBM’s New Enterprise Data Center

model, which helps clients improve IT efficiency and facilitates the

rapid deployment of new IT services for future business growth.

PSI’s technologies and skills, along with its intellectual capital, will be

integrated into the company’s mainframe product engineering cycles

and future product plans. In the second quarter, $ million of the

purchase price of PSI was attributed to the settlement of a preexisting

lawsuit between IBM and PSI and recorded in SG&A expense. See

note O, “Contingencies and Commitments,” on pages to for

additional information regarding this litigation. Also, the company

recorded a $ million in-process research and development (IPR&D)

charge related to this acquisition in the second quarter. The acquisition

of Transitive Corporation (Transitive) was completed in the fourth

quarter. Transitive’s cross-platform technology will allow clients to

consolidate their Linux-based applications onto the IBM systems

that make the most sense for their business needs.

Purchase price consideration for the “Other Acquisitions” was

paid all in cash. All acquisitions are reported in the Consolidated

Statement of Cash Flows net of acquired cash and cash equivalents.

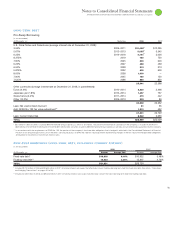

2008 ACQUISITIONS

($ )

Amortization Other

Life (in Years) Cognos* Telelogic* Acquisitions

Current assets $ 504 $ 242 $ 185

Fixed assets/noncurrent 126 7 75

Intangible assets:

Goodwill N/A 4,207 690 676

Completed technology 3 to 7 534 108 94

Client relationships 3 to 7 512 127 39

In-process R&D N/A — — 24

Other 3 to 7 78 15 19

Total assets acquired 5,960 1,189 1,112

Current liabilities (798) (141) (233)

Noncurrent liabilities (141) (163) (14)

Total liabilities assumed (939) (304) (247)

Settlement of preexisting litigation — — 24

TOTAL PURCHASE PRICE $5,021 $ 885 $ 889

* Purchase price allocation at December 31, 2008 reflects immaterial adjustments from the September 30, 2008 balances.

N/A—Not applicable