IBM 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

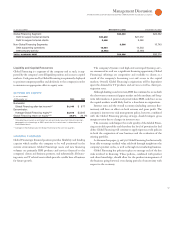

Events that could temporarily change the historical cash flow dynam-

ics discussed on page include significant changes in operating

results, material changes in geographic sources of cash, unexpected

adverse impacts from litigation or future pension funding require-

ments during periods of severe downturn in the capital markets.

Whether any litigation has such an adverse impact will depend on a

number of variables, which are more completely described on pages

to . With respect to pension funding, in , the company

contributed $ million to its non-U.S. defined benefit plans, versus

$ million in . Also, in , the company made a $ million

voluntary cash contribution to the U.S. nonpension postretirement

plan. As highlighted in the Contractual Obligations table below, the

company expects to make legally mandated pension plan contributions

to certain non-U.S. plans of approximately $. billion in the next

five years. The contributions are expected to be approximately

$ billion. Financial market performance in could increase the

legally mandated minimum contributions in certain non-U.S. coun-

tries that require more frequent remeasurement of the funded status.

The company is not quantifying any further impact from pension

funding because it is not possible to predict future movements in the

capital markets or pension plan funding regulations.

The Pension Protection Act of (the Act) was enacted into

law in , and, among other things, increases the funding require-

ments for certain U.S. defined benefit plans beginning after December

, . No mandatory contribution is required for the U.S. defined

benefit plan in or as of December , .

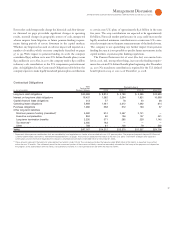

Contractual Obligations

Total

Contractual Payments due in

($ ) Payment Stream 2009 2010-11 2012-13 After 2013

Long-term debt obligations $30,289 $ 8,874 $ 5,190 $ 5,595 $10,630

Interest on long-term debt obligations 16,437 1,382 2,264 1,821 10,969

Capital (finance) lease obligations 213 57 78 40 38

Operating lease obligations 5,969 1,481 2,312 1,362 814

Purchase obligations 1,280 568 512 133 67

Other long-term liabilities:

Minimum pension funding (mandated)* 5,582 974 2,467 2,141 —

Executive compensation 894 60 136 157 541

Long-term termination benefits 2,230 571 285 229 1,145

Tax reserves** 3,485 163 — — —

Other 788 81 126 79 502

TOTAL $67,167 $14,212 $13,370 $11,557 $24,706

* Represents future pension contributions that are mandated by local regulations or statute, all associated with non-U.S. pension plans. The projected payments beyond 2013 are not

currently determinable. See note U, “Retirement-Related Benefits,” on pages 106 to 116 for additional information on the non-U.S. plans’ investment strategies and expected

contributions and for information regarding the company’s unfunded pension plans of $20,086 million at December 31, 2008.

** These amounts represent the liability for unrecognized tax benefits under FIN 48. The company estimates that approximately $163 million of the liability is expected to be settled

within the next 12 months. The settlement period for the noncurrent portion of the income tax liability cannot be reasonably estimated as the timing of the payments will depend on

the progress of tax examinations with the various tax authorities; however, it is not expected to be due within the next 12 months.