IBM 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ................................................................................................18

ROAD MAP ............................................................................................................ 18

FORWARD-LOOKING AND CAUTIONARY STATEMENTS ...................................... 18

MANAGEMENT DISCUSSION SNAPSHOT ............................................................ 19

DESCRIPTION OF BUSINESS................................................................................ 20

YEAR IN REVIEW ..................................................................................................25

PRIOR YEAR IN REVIEW ......................................................................................39

DISCONTINUED OPERATIONS ..............................................................................44

OTHER INFORMATION ..........................................................................................44

GLOBAL FINANCING .............................................................................................53

Report Of Management ............................................................................................... 58

Report Of Independent Registered Public Accounting Firm ................................. 59

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

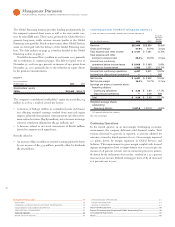

Systems and Technology segment revenue was $5,425 million, a

decrease of 20.2 percent (16 percent adjusted for currency), reflecting

growth in high-end servers offset by a decline in x86 and storage

products. System z revenue decreased 5.9 percent (increased 1 percent

adjusted for currency). Adjusted for currency, revenue performance

was led by double-digit growth in the Americas and strong growth in

the Financial Services and Industrial sectors globally. System z contin-

ues to perform well due to its ability to consolidate multiple workloads

onto a single, virtualized platform. System z MIPS shipments increased

12 percent year to year. This was the fourth consecutive quarter of

double-digit MIPS growth. Converged System p revenue grew 8.0

percent (14 percent adjusted for currency), driven by strong growth

in both high-end and midrange servers. This was the tenth consecu-

tive quarter of revenue growth for converged System p. System x

revenue decreased 33.0 percent (29 percent adjusted for currency)

reflecting a significant slowdown in the industry-standard x86 market

as customers are virtualizing and consolidating workloads onto more

efficient platforms such as POWER and mainframe. System x server

revenue declined 32 percent (28 percent adjusted for currency) with

blades down 27 percent (23 percent adjusted for currency). Legacy

System i revenue decreased 91.6 percent (91 percent adjusted for

currency) as the company continues to transition the System i cus-

tomer base to the converged POWER platform within System p.

Systems Storage revenue decreased 19.9 percent (16 percent

adjusted

for currency) driven by revenue declines in total disk and total

tape

products. Retail Store Solutions revenue decreased 27.8 percent (22

percent adjusted for currency) and Microelectronics OEM revenue

declined 34.3 percent.

Systems and Technology gross margin of 39.9 percent, declined

5.8 points versus the fourth quarter of 2007 driven by margin declines

in

all system brands and Microelectronics OEM; partially offsetting

these

margin declines was a revenue mix benefit due to a shift in

revenue toward System z and converged System p. Systems and

Technology segment pre-tax profit decreased 47.1 percent to $722

million. Pre-tax margin declined 6.7 points to 12.7 percent compared

to the fourth quarter of 2007.

Global Financing revenue of $660 million decreased 1.3 percent

(increased 5 percent adjusted for currency). Increased financing rev-

enue was more than offset by a decline in sales of used equipment.

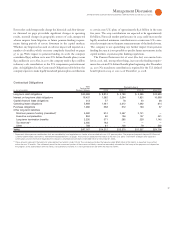

Geographic revenue decreased 5.6 percent (flat adjusted for cur-

rency) with mixed performance by geography. Adjusted for currency,

Americas had the strongest performance with Europe and Asia

both declining year to year. Globally, revenue in the major markets

decreased 5.3 percent (1 percent adjusted for currency) while revenue

from the company’s growth markets organization decreased 7.1 per-

cent (increased 6 percent adjusted for currency). Americas revenue

was $11,454 million, a decrease of 1.9 percent (increase of 2 percent

adjusted for currency). Adjusted for currency, Latin America was up

12 percent, Canada was up 6 percent and the U.S. was flat. EMEA

revenue decreased 12.2 percent (1 percent adjusted for currency) to

$9,468 million. Revenue performance in the major countries was

mixed when adjusted for currency, with Germany up 7 percent, the

U.K. up 4 percent, France grew 2 percent while Italy declined 8 per-

cent. Asia Pacific revenue decreased 0.7 percent (1 percent adjusted for

currency) to $5,469 million, with growth in the India, Australia/New

Zealand, and South Korea regions, being more than offset by declin-

ing revenue in Japan. The company has been investing heavily in the

emerging markets to capture opportunities to build out public and

private infrastructures. Additionally, these markets benefited in the

quarter from customer demand for cost saving offerings during the

current economic environment. Revenue from these markets repre-

sented 18 percent of the company’s geographic revenue in the quarter

and increased 6 percent, adjusted for currency. The BRIC countries,

a subset of the growth markets, together grew 1.6 percent (13 percent

adjusted for currency) led by double-digit growth in Brazil and India,

adjusted for currency. Russia revenue was significantly impacted by

credit limitations and declined 22 percent in the fourth quarter.

Revenue from the company’s industry sales units decreased

5.7 percent (flat adjusted for currency) in the fourth quarter of 2008.

Public sector revenue decreased 0.8 percent (increased 5 percent

adjusted for currency) with strength in government and with educa-

tion returning to growth, when adjusted for currency. In the growth

markets, clients are investing in education as a way to develop national

skill sets. Industrial sector revenue decreased 8.0 percent (5 percent

adjusted for currency) as concerns with the credit markets and mar-

gin pressures continued. Financial Services sector revenue declined

5.8 percent (1 percent adjusted for currency) and was in line with the

company’s overall performance for the fifth consecutive quarter. The

U.S. financial services sector revenue was up 4 percent and improved

significantly from the third quarter. Growth was driven by banking

and financial markets reflecting strong performance in software,

System z and POWER products. Partially offsetting the U.S. growth

was weakness in Japan and Europe as the economic climate worsened.

Revenue from small and medium business clients declined 8.6 percent

(3 percent adjusted for currency) although services signings in this

customer set increased 10 percent versus the fourth quarter of 2007.