IBM 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Asia Pacific revenue increased . percent ( percent adjusted

for currency) year over year. Growth was led by strong performance

in the India, Greater China, Australia/New Zealand, ASEAN and

Korea regions, where the economies remain strong, with combined

revenue growth of . percent ( percent adjusted for currency).

Japan revenue, which represented percent of the Asia Pacific rev-

enue base, was flat (increased percent adjusted for currency) in

when compared to , reflecting a slower economy.

Across the geographies, the emerging BRIC countries of Brazil,

Russia, India, and China together grew . percent ( percent

adjusted for currency), reflecting the investments made to build

capabilities and capture opportunities in these countries. Brazil rev-

enue increased . percent ( percent adjusted for currency), Russia

grew . percent ( percent adjusted for currency), India increased

. percent ( percent adjusted for currency) and China increased

. percent ( percent adjusted for currency). In addition to the

BRIC markets, the company also had strong revenue growth in other

nations where there was strong demand for business and IT infra-

structure solutions.

Revenue growth rates, as reported, were impacted in as a

result of the divestiture of the printing business on June , .

Revenue, excluding the printing business in both years, increased as

follows compared to :

• Americas — .%

• EMEA — .%

• Asia Pacific — .%

• IBM Consolidated — .%

OEM revenue decreased . percent ( percent adjusted for cur-

rency) in when compared to , driven by a slowdown in

demand for game processors.

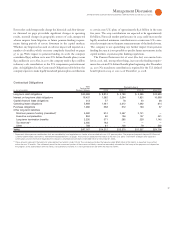

Total Expense and Other Income

Total expense and other income increased . percent ( percent

adjusted for currency) in versus . The increase was primarily

due to increased SG&A expense and interest expense. SG&A expense

increased primarily due to acquisition-related spending, as well as

increased investments in emerging countries and the software and

services businesses. Interest expense increased primarily due to higher

debt levels associated with the financing of the ASR agreements. The

expense-to-revenue ratio increased . points to . percent in ,

as revenue increased . percent and expense increased . percent in

versus .

Total SG&A expense of $, million increased . percent

( percent adjusted for currency) versus . The increase was pri-

marily driven by acquisition-related spending ( points), the effects

of currency ( points) and investments in the software and services

businesses, as well as emerging markets. In addition, bad debt expense

increased $ million primarily due to an increase in the provision for

doubtful accounts. The reserve coverage for receivables of . percent

was essentially flat versus year-end . Ongoing workforce reduc-

tions increased as a result of actions taken to address cost issues in

GTS, primarily in SO, during the second quarter of .

Other (income) and expense was income of $ million and

$ million in and , respectively. The decrease in income

was primarily due to higher losses on derivative instruments. The

company hedges its major cross-border cash flows to mitigate the

effect of currency volatility in the year-over-year results. The impact

of these hedging programs is primarily reflected in other (income) and

expense, as well as cost of goods sold. Losses from derivatives, as a

result of currency movements, resulted in $ million of year-to-year

impact to other (income) and expense. This decrease in income was

partially offset by a gain from the divestiture of the printing business

in the second quarter and sales of Lenovo stock in the first and sec-

ond quarters of .

RD&E expense of $, million increased . percent primarily

driven by acquisitions and investments to maintain technology leader-

ship across the product offerings. Software spending increased $

million partially offset by lower Systems and Technology spending of

$ million.

Intellectual property and custom development income of $ mil-

lion increased $ million or . percent versus . There were no

significant IP transactions in and .

Interest expense of $ million increased $ million, or .

percent in primarily due to the higher debt associated with the

financing of the ASR agreements.

Income Taxes

The provision for income taxes resulted in an effective tax rate of

. percent for , compared with the effective tax rate of

. percent. The . point decrease was primarily driven by the

absence of the one-time tax cost associated with the intercompany

transfer of certain intellectual property in the fourth quarter of

(. points) and the absence of the benefit from the settlement of the

U.S. federal income tax audit for the years through , also in

the fourth quarter of (. points). The company also benefited

in from a more favorable mix of income in lower tax rate juris-

dictions and increased capital loss and state credit benefits, offset by

a reduction in certain tax incentives.

Financial Position

Assets of $, million increased $, million ($, million

adjusted for currency) primarily due to increases in cash and cash

equivalents ($, million), prepaid pension assets ($, mil-

lion), total financing receivables ($, million) and goodwill

($, million). These increases were partially offset by decreases in

long-term deferred tax assets ($, million) and short-term mar-

ketable securities ($, million).

Liabilities of $, million increased $, million ($,

million adjusted for currency) driven primarily by increases in total

debt ($, million), tax liabilities ($, million) and total

deferred income ($, million).