IBM 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

-

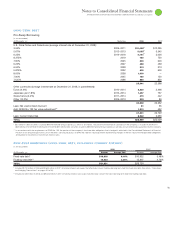

Pre-Swap Borrowing

($ )

At December : Maturities 2008 2007

U.S. Dollar Notes and Debentures (average interest rate at December 31, 2008):

3.55% 2009 – 2011 $10,496*$12,295

5.67% 2012 – 2013 5,053*3,545

6.25% 2014 – 2018 4,761*3,026

8.375% 2019 750 750

7.00% 2025 600 600

6.22% 2027 469 469

6.50% 2028 313 313

5.875% 2032 600 600

8.00% 2038 1,000 —

7.00% 2045 150 150

7.125% 2096 850 850

25,041 22,598

Other currencies (average interest rate at December 31, 2008, in parentheses):

Euros (4.4%) 2010 – 2014 3,330 2,466

Japanese yen (1.8%) 2010 – 2014 1,457 767

Swiss francs (3.4%) 2011 – 2014 470 442

Other (10.2%) 2009 – 2013 203 89

30,502 26,362

Less: Net unamortized discount 81 65

Add: SFAS No. 133 fair value adjustment** 1,210 432

31,631 26,729

Less: Current maturities 8,942 3,690

TOTAL $22,689 $23,039

* $8.1 billion in debt securities issued by IBM International Group Capital LLC, which is an indirect, 100 percent owned finance subsidiary of the company, is included in 2009-2011

($6.5 billion), 2012-2013 ($1.5 billion) and 2014-2018 ($0.1 billion). Debt securities issued by IBM International Group Capital LLC are fully and unconditionally guaranteed by the company.

** In accordance with the requirements of SFAS No. 133, the portion of the company’s fixed-rate debt obligations that is hedged is reflected in the Consolidated Statement of Financial

Position as an amount equal to the sum of the debt’s carrying value plus an SFAS No. 133 fair value adjustment representing changes in the fair value of the hedged debt obligations

attributable to movements in benchmark interest rates.

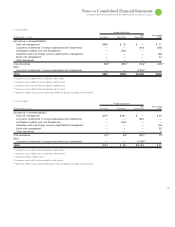

- (- , )

($ )

2008 2007

At December : Amount Average Rate Amount Average Rate

Fixed-rate debt* $16,608 6.16% $10,922 5.48%

Floating-rate debt** 15,023 3.35% 15,807 4.76%

TOTAL $31,631 $26,729

* Includes $1,700 million in 2008 and $2,600 million in 2007 of notional interest rate swaps that effectively convert floating-rate long-term debt into fixed-rate debt. (See note L, “Derivatives

and Hedging Transactions,” on pages 90 to 94).

** Includes $7,435 million in 2008 and $9,606 million in 2007 of notional interest rate swaps that effectively convert the fixed-rate long-term debt into floating-rate debt.